The Union Budget for 2018-19 was a much anticipated event because the salaried class was expecting the government to give away tax sops. But instead of putting more money in the hands of urban Indians, Budget 2019 is all set to pinch their pockets in ways more than one. Be prepared to shell out more for not just diamonds but even food, consumer goods, mobile phones, personal care products and perfumes. Not surprising then that urban India has not taken kindly to these measures. Hours after the Budget speech was over, a WhatsApp message started doing rounds on the standard deduction of `40,000 replacing existing reimbursements, a measure that would put an extra `150 in the hands of a salaried person with an income of `10 lakh (See Table on Page 40). The message to middle income households is that there is another India the government needs to take care of, which is not an unfair ask. While there is no doubt that social equity should be the focus of any government, the current Budget has several measures which will result in higher cost of living for most Indians. Outlook Money’s Budget package will tell you how the Budget will impact your finances and investments.

Given that this is a pre-election year, the government has had to do a fine balancing act between rural and urban India’s expectations So for starters, there is no change in personal income tax slabs. But if you are in the highest income bracket, then you have to pay a higher education and health cess.

Budget 2019 will also inflate household budgets, thanks to the expected increase in prices of food products. With minimum support prices of the Kharif crop pegged at 1.5 times of production cost, there is a likelihood that prices of food products will also increase, resulting in a spike in consumer price index (CPI). Experts anticipate agricultural products to become expensive by 47 per cent. Cereals, pulses and edible oils make up 15.6 per cent of the CPI basket and if prices of these products go up by nearly 50 per cent in the next fiscal, it will also impact the homemaker’s budget. Higher customs duty on perfumes, silk fabrics, tyres, footwear, sports goods, mobile phones and television parts will also lead to higher prices.

But the worst blow has come in the form of long-term capital gains tax, which has made a comeback after 13 years. Gains from equity investments over `1,00,000 will now be taxed at 10 per cent. And mutual fund investments will also come with a 10 per cent distribution tax (Refer to Page 45 for details).

On the upside, the government has taken measures to ease the pain of senior citizens. For senior citizens, exemption of interest income on bank deposits has been raised to `50,000, which has come as a big relief as interest rates have been steadily declining.

While there is no doubt that Budget 2019 is inflationary for most part, perhaps the government’s hope is that the sacrifice is not too much to ask when one sees the benefit it seeks to pass on to the lesser privileged households.

Impact on Sectors

Measures announced in Budget 2018-19 have brightened the prospects of several sectors and stocks, while adversely affecting a few

Union Budget Hits Equity Investors Hard

Finance Minister Arun Jaitley left investors dejected with his tax proposals, explains Rakesh Bhargava

The Finance Minister presented his last full Union Budget for the fiscal year 2018-19 on February 1. As general elections will be held next year in 2019, the Union Budget to be presented in the month of February 2019 shall be an interim Budget and the full Budget for the year 2019 shall be presented by the newly-elected government.

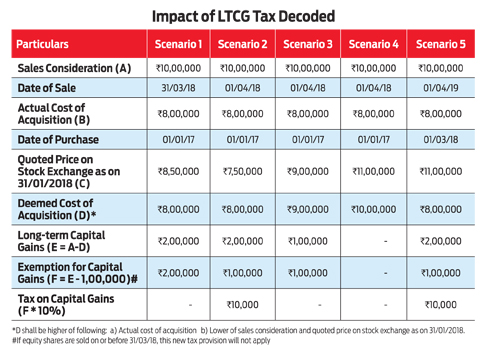

All investors were eagerly expecting big announcements in this budget. However, finance minister Arun Jaitley has disappointed both retail and institutional investors. The biggest jolt given by the Budget is the withdrawal of exemption for long-term capital gains from listed equity shares under Section 10(38) and introduction of tax on such gains at a flat rate of 10 per cent without giving the benefit of indexation.

In capital gains, three provisions are worth talking about. Two of them are not in investors’ favour and one provides mild relief to owners of immovable properties.

No more exemption for capital gains

Currently, long-term capital gains arising from transfer of listed equity shares, units of equity-oriented mutual funds or units of business trusts are exempt from tax under Section 10(38) of the Income Tax Act. In order to minimise the economic disruptions and curb erosion of tax base, the finance minister proposes to withdraw this exemption and introduce a new Section 112A in the Act.

As per the proposed Section 112A, long-term capital gains arising from transfer of an equity share, a unit of an equity-oriented scheme or a unit of a business trust shall be taxed at 10 per cent of such capital gains. Such capital gains tax shall be levied in excess of `1 lakh. This concessional rate of 10 per cent will be applicable if securities transaction tax (STT) has been paid on both acquisition and transfer of such capital assets in case of equity shares, and paid at the time of transfer in case of unit of equity-oriented fund or a unit of a business trust.

Though the tax rate has been kept at 10 per cent, it shall be charged on the capital gains as computed without giving the benefit of indexation to the investor. Indexation is a process meant to increase the cost of acquisition, which nullifies the impact of inflation. The indexation process takes into account inflation from the time the tax-payer buys the asset to the time he sells it. Indexation increases the cost of acquisition of the asset. The indexation benefit is generally allowed in case of transfer of a long-term capital asset. However, such benefit shall not be allowed in case of transfer of listed equity shares.

This new provision to tax long-term capital gains arising from transfer of listed equity shares shall be applicable for all those share trades that are done on or after April 1, 2018. However, an interim relief has been provided to the investors wherein an option is given to the investor to assume a different purchase price of the shares held by them.

In case of listed equity shares acquired by an investor before February 1, 2018, he can assume that the purchase price of such equity shares shall be higher of following:

a) The actual purchase price of such equity shares; or

b) Fair market value of such equity shares or the actual sales consideration, whichever is lower.

The fair market value of listed equity shares shall mean its highest price quoted on the stock exchange on January 31, 2018. In case of units which are not listed on recognised stock exchanges, the net asset value of such units as on January 31, 2018 shall be deemed to be its fair market value.

This capital gain has been kept out of the purview of Chapter VIA deductions and relief under Section 87A. It means a taxpayer cannot claim any deduction under Sections 80C to 80U or relief under Section 87A from the gross total income to the extent of such capital gains. If an investor has only made long-term capital gains of `2,00,000 from the sale of listed equity shares, he shall be liable to pay tax of `10,400 (`10,000 tax on capital gains plus `400 as health and education cess).

Variation from stamp value now accepted

Currently, under Income Tax Act provisions, there is a concept of inflating the sale consideration for the purpose of calculating capital gains tax by taking stamp value into consideration. If the sales consideration received by an investor from the transfer of an immovable property is lower than the stamp value fixed by the stamp authorities, then the stamp value is deemed as the actual sales consideration. Due to this reason, the amount of capital gains seems higher even if the seller has not gained anything and the tax becomes due because of such higher stamp valuation. Further, the difference in the stamp value and the actual consideration disclosed by the parties is also taxed in the hands of the buyer.

The actual sales consideration even for similar properties in the same area may vary because of a variety of factors, including shape of the plot or the location. Therefore, this deeming provision of considering stamp duty valuation as the actual sales consideration creates undue hardship. In order to minimise hardship in the case of genuine transactions in the real estate sector, the Budget has proposed that no adjustments will be made if the variation between stamp duty value and the sales consideration is not more than five per cent of the sales consideration. These amendments will be applicable for all transactions that occur on or after April 1, 2018.

Exemption for immovable properties

Currently, an investor can claim an exemption of up to `50 lakh if any long-term capital gain arises from the sale of any long-term asset and this profit is invested in the specified bonds of NHAI and RECL within a period of six months from the date of such transfer. Such bonds come with a lock-in period of three years.

The Finance Bill has significantly curtailed the scope of this exemption. As per the proposed amendment, this exemption under Section 54EC shall be allowed only if long-term capital gains arising from transfer of immovable properties (land or building, or both) are invested in the specified bonds. Other long-term assets will no longer be eligible for this concession. Additionally, the lock-in period of such bonds has also been increased to five years.

The Author is a Director of Taxmann

A budget for Senior Citizens

Elderly tax-payers have emerged as the chief beneficiaries of Finance Minister Arun Jaitley’s personal tax proposals.

- Suresh Sadagopan, Founder, Ladder7 Financial Advisories

We need not have waited for this Budget with bated breath or misplaced notion that the middle class was going to benefit from the Budget.

It has something for everyone, but the ones benefitting the most are the farmers, certain underprivileged groups, rural population and poorer sections of the society. The middle class has quite mercilessly been cut out. The salaried class has been given a standard deduction of `40,000 in lieu of the transportation and medical allowance, which collectively make up `34,200 currently. Hence, the effective deduction benefit stands at just `5,800. This effective benefit will depend on the tax brackets one falls into. Moreover, even this saving will evaporate if we consider the increase in the education cess from 3 per cent to 4 per cent.

Long-term capital gains (LTCG) tax has been introduced on equity-oriented assets at 10 per cent (without indexation) for gains exceeding `1 lakh in a year. The customs duty also goes up as social welfare surcharge of 10 per cent has been introduced in place of the education cess of 3 per cent, effectively making imports costlier. Customs duty on mobile phones has been increased from 15 per cent to 20 per cent, and some parts and accessories of television sets and mobile handsets are now going to be charged at 15 per cent.

So, the question is, who benefits from the Budget announcements? If I were to look for one category that has benefited the most, it would be senior citizens. Let us see how.

The exemption on interest income from fixed deposits and post office schemes has been increased to `50,000 a year, from the previous `10,000 a year. This is a useful benefit that can result in a saving potential of `8,000 on taxes if the person falls under the 20 per cent tax bracket. It is safe to say that majority of senior citizens are big investors in fixed return-generating instruments like fixed deposits and post office schemes, hence they will benefit from this exemption.

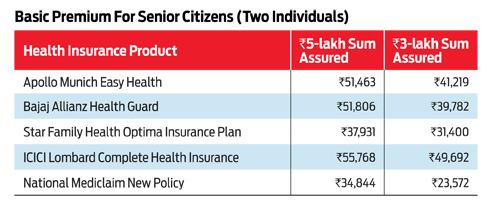

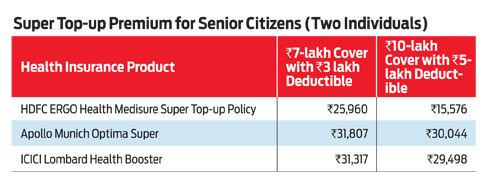

The next important benefit is the deduction (under Section 80D) available for medical insurance/medical expenditure, which has been increased from `30,000 to `50,000. This is a useful and timely increase as medical insurance premium for a senior citizen couple comes close to the `50,000-mark for a cover of `5 lakh. Now is the time for senior citizens with low health insurance covers to review and increase their sums assured. This will be a prudent thing to do. If they feel the need for a higher insurance cover, they can opt for a super top-up cover on their existing basic cover.

For instance, if they have a basic cover of `3 lakh each under a medical insurance policy, they may opt for a super top up cover of `7 lakh with a deductible of `3 lakh. This will effectively cover them for `10 lakh. Now, the premium will exceed `50,000 per annum, but they will also be covered for `10 lakh each. This could be a good point to review, and they can increase their medical insurance cover as per their requirements.

In times of low interest rates, senior citizens, essentially those who depend on interest from bank fixed deposits and similar investments for their sustenance, have been in a fix. The Pradhan Mantri Vaya Vandana Yojana ( PMVVY ), which was introduced for senior citizens last year, sought to address this to an extent. This scheme offers 8 per cent interest to senior citizens, which is better than many options available otherwise. But the limitation was that one could only invest up to `7.5 lakh. In this Budget, the limit has been doubled to `15 lakh, which comes as a major relief for the elderly investors. So, a senior citizen couple can now invest up to `30 lakh in PMVVY, which looks like a good idea in the current interest rate scenario.

Then, there is the benefit of a standard deduction in lieu of transportation and medical allowance. Till now there was no such benefit available for senior citizens, unlike salaried employees. Hence, for senior citizens, the entire standard deduction benefit of `40,000 is now available. But the limitation here is that it is available only to the pensioners. This is unfortunate and it should have been made available to everyone, irrespective of whether they worked in government sector, private sector or were self-employed before their retirement. This clause favours government employees, as they have a regular mode of income in the form of pensions.

There is a concession available to those senior citizens who are either disabled themselves or have disabled family members, in the form of `60,000 for senior citizens and `80,000 for super senior citizens (individuals over 80 years of age). Now, this benefit has been increased to `1 lakh for both the categories. However, this clause may not apply to everyone. But if it does, the amounts have been increased and will certainly prove to be helpful in reducing their tax liability.

This Budget has been benevolent to senior citizens. They should take full advantage of the provisions, especially the medical insurance part and put a robust protection net in place. PMVVY is another scheme that they should go for, considering the low risk involved and the relatively good interest they can earn.

Count thy blessings, seniors. You have worked all your lives, and the years to relax and live a peaceful life just got a bit easier with this Budget!

The Author is a Certified Financial Planner

Also read the PwC's column on Union Budget 2018-19 here - https://www.outlookindia.com/outlookmoney/personal-finance-news/budget-focuses-on-farmers-and-poor-2577