There are two major strategies that are usually employed when investing in equities—the top-down and the bottom-up approaches. The top-down approach starts with a macro perspective and then analyses the micros. The bottom-up approach focuses on the stock itself. However, there is no definitive answer on which one is better. Each approach has its advantages in specific situations and the skill of the stock picker lies in knowing when to apply each method.

Typically, the top-down strategy works better in volatile times, like in the current situation, when external factors have a greater bearing on the performance of one’s portfolio. This strategy works on the economy-industry-company model. When one approaches the market with the top-down strategy, one analyses the economy and then moves to the industry or sectors which will get impacted.

To give investors a perspective about which sectors hold promise in the current scenario, we got in touch with 10 market experts to get their perspectives on sectors and industries which hold opportunities for investors. Based on their inputs, we zeroed down on the top five broad sectors which are major constituents of the broad-based NSE Nifty index.

We also kept in mind the emerging market scenario, when the Reserve Bank of India (RBI) has paused the interest rate hike, and export-oriented sectors are giving moderate guidance on future earnings as the fear of recession is looming over the developed economies, and crude and commodities are falling.

The sectors we chose are auto, banking, fast-moving consumer goods (FMCG), information technology (IT) and pharma. Investments can be made in these either through direct stocks or through diversified mutual funds.

Sector Perspectives

Apart from the five sectors we chose, several other sectors came up during discussions. One of these was the oil and gas sector. But we did not include it because out of the total 12.14 per cent of the total weightage in the Nifty index, Reliance Industries Ltd alone commands 10.34 per cent. Other sectors that may hold promise include capital goods, defense and chemicals, but we have not covered these separately.

Krishna Sanghavi, chief investment officer, equity, Mahindra Manulife Mutual Fund, believes that some sectors offer both earnings growth and also provide the potential for re-rating.

“We currently favour sectors like utilities, capital goods and industrial manufacturing. We are looking for earnings resilience in the current economic scenario amid market volatility, and/or reasonable visibility of earning growth over the medium term. Some of the companies in these sectors offer a combination of earnings growth as well as the potential for re-rating,” says Sanghavi.

Devina Mehra, chairperson, managing director and founder, First Global, believes that the fall in crude price augurs well for many sectors. “Crude prices are down nearly 35 per cent from their peak, and that would help a whole lot of industries, including FMCG, chemicals and textiles, and to some extent, cement, too. Companies can take a call on whether to use that to improve margins or to pass it on and, therefore, boost demand, because demand has been a concern for a variety of industries.”

Mehra sees opportunities in capital goods and industrial machinery. “They have been great performers for us; stocks have gone up to three times. We’ve even booked some profits. We don’t hold as much as we used to, but still, relative to the index, that would be the biggest overweight,” she says.

Market analyst Ambareesh Baliga believes that banking has posted a good show, and now the valuation has gone up. “There’s no reason to sell off. But then I don’t see a major reason to go out and start buying banks at this point of time. When I look at my portfolio, some of the public sector banks are now two-times from the levels at which they were bought. So, I will not really be buying afresh as such,” he says.

He sees an opportunity elsewhere. “If you look at the budgetary allocation for infrastructure and railways, it is several multiples of what the government was spending about 8-10 years ago. So, I think there’s a huge opportunity there. In addition, there’s the defence sector as well. I think that’s clearly a focus area for the government. We have seen the sector performing to a decent extent, but I still see them doing well even in the foreseeable 2-3 years,” says Baliga.

Dhiraj Agarwal, co-head of institutional equities and head of equity sales, Ambit Capital, has his faith in the banking sector, as earnings have rebounded and there’s no pressure of non-performing assets (NPAs) on banks.

“The quality and the health of the banking system is pretty good. In the near term, we’ll probably see some amount of margin pressure coming in on the banking sector, but it still looks attractive,” he says.

Sunil Singhania, founder, Abakkus Asset Manager LLP, feels that the second half of 2023 would see the global economy reviving and all the headwinds will become tailwinds, including lower inflation and lower interest rates. “China is coming back on steam and even the growth in the global economy, which was looking like it was slipping into a recessionary kind of an environment, is coming back to some extent. I think there’s a possibility that sentiments might change. What we need to remember is that in IT companies, the profits are completely cash converters. In that respect also, I think it’s a great sector,” says Singhania.

The Risks

There are a lot of opportunities in different sectors, but the big question for the retail investor is should they consider sector investing?

The equity market is a dynamic and ever-changing space. It is influenced by various global, domestic and geopolitical factors that can have a significant impact on its performance. In such a varied market scenario, different sectors react differently, and “no themes run forever, no geography, sectors, no asset class,” says Mehra.

But despite the opportunities, the risks cannot be ignored. Time and again, investors have burnt their fingers following fads of sector investing.

In 2000, the technology sector was rocking the market. When the stocks fell out of favour, the agony of seeing their investments being reduced to a fraction within the space of a few months led many investors to spurn the sector forever. In 2007, the infrastructure sector was at its peak, but it ran into rough weather in 2008. Recently, in 2020-21, many investors gyrated towards the IT sector when it was at its peak, but the recent drubbing has robbed many of those gains.

In the above examples, many conservative investors got lured by the expectation of high returns to invest in a particular sector, but sector investing needs a certain understanding, which retail investors may lack, for want of time, knowledge or both.

More often than not, it’s a mismatch that causes disillusionment among investors. But for every such embittered investor, there are many others who are happy investing in the stock market in a diversified way, in tune with their risk profiles and investment objectives.

Therefore, sector investing is a strategy that needs to be approached with utmost caution.

A single sector does not perform forever. Most sectors do go through alternate phases of growth, stagnation and, sometimes, even negative growth. “What is my view today on a sector may not be the same when you ask after a year,” says Singhania.

The trick to making money through sector investing is to predict growth cycles and take positions accordingly.

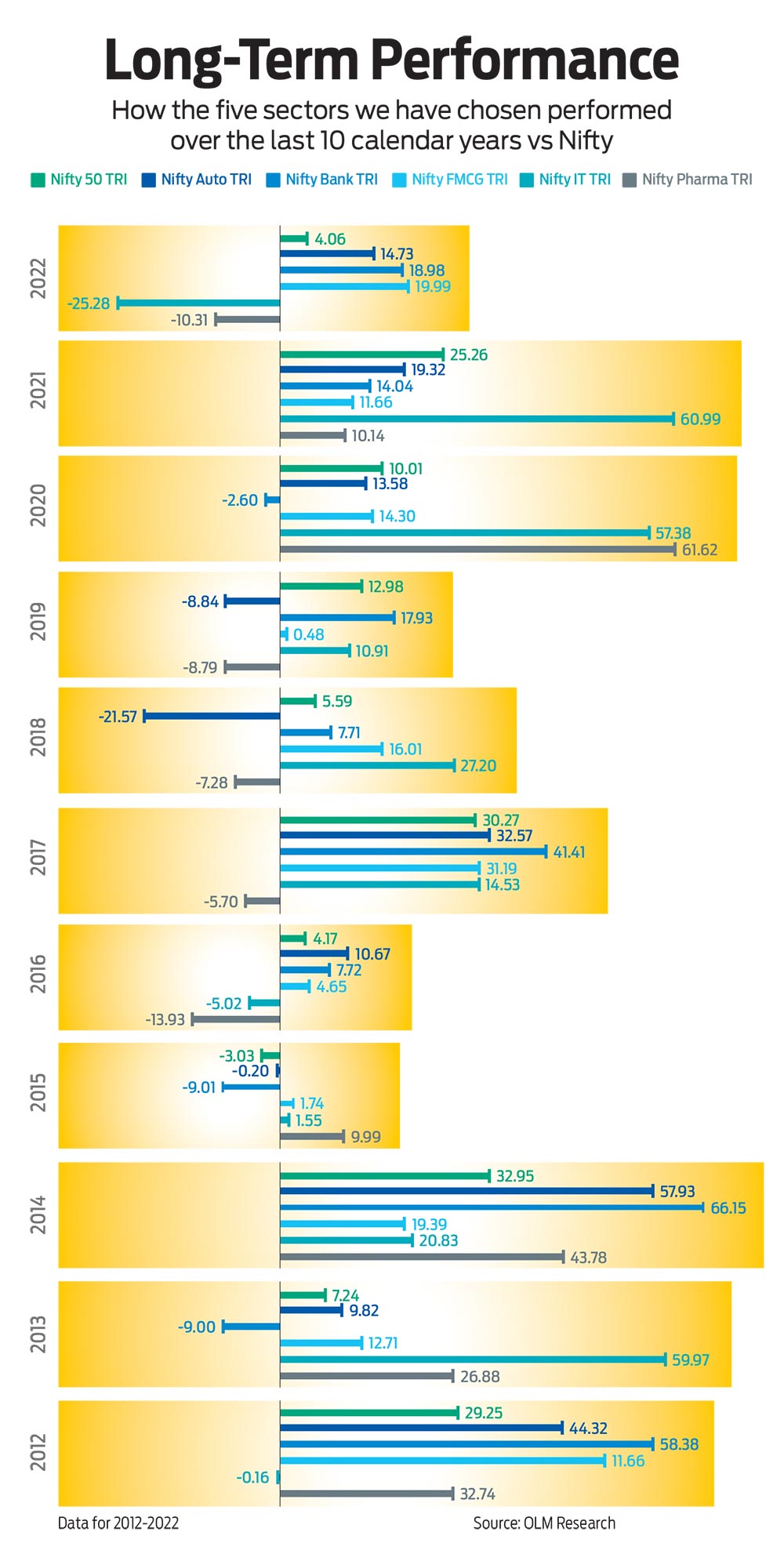

Data points also prove this maxim. The performance data of 15 sectors over the last 10 years shows that none of them have performed consistently. For instance, in 2012, Nifty Bank was the best performer among the 15 sectors we chose, with 58.04 per cent returns. But, next year, in 2013, it fell by 9 per cent. Similarly, pharma performed well from 2012 till 2015, but between 2016 and 2019, it remained in the negative zone.

If we look at Nifty Metal, it gave 19 per cent in 2012, but fell 14 per cent the very next year. In 2014, it went up by 8 per cent in 2015, but fell by 30 per cent in 2016.

What Should You Do?

The risks that sector investing entails, compared with the comfort that a diversified portfolio provides, does not necessarily mean you stay away from it. Instead approach it with some amount of caution and awareness.

It is not a bad idea to take advantage when there are opportunities. For instance, you could be a strong votary of long-term investing, but you might be inclined to use part of your savings to capitalise on short-term market movements. Say, you see an opportunity in the battered IT space. To get adequate exposure, you will have to invest in the companies of that sector. Investing in just Nifty may not help, as the broad index has only 18.4 per cent weight in the IT sector.

One of the main factors that affect the performance of a sector is the economic cycle. Different sectors perform differently during different phases of the economic cycle. For instance, during a period of economic expansion, sectors such as technology, consumer discretionary, and industrials tend to perform well. On the other hand, during a period of economic contraction, defensive sectors, such as healthcare and consumer staples tend to perform better. As such, it is crucial to have a clear understanding of the prevailing economic conditions before investing in a particular sector.

If doing all this sounds complicated, simply stick to an asset allocation that suits your needs and goals. In fact, you should ensure that the investments you make even within sectors is aligned with your goals.

“We all look for mutibaggers, but first you need to get your asset allocation right. First of all, you should know what your correct asset allocation is, which surprisingly very few people know,” says Mehra.

Sector investing has the potential to deliver better returns compared to investing in individual stocks or in the broader market. But it also comes with a higher degree of risk due to concentrated exposure to a specific sector. Therefore, it is important to diversify the portfolio across multiple sectors to minimise the risk.

ALSO READ

kundan@outlookindia.com