More Than

200 Accounts of large borrowers were identified as NPAs

There are now

42 Banks in total listed on the stock exchange

***

The banking sector has a symbiotic relationship with the economy. As banks expand, the economy gets a boost, and as the economy flourishes, the banks expand further.

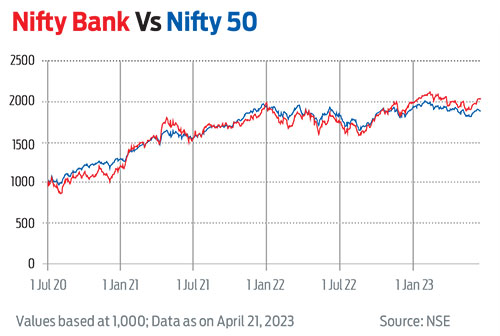

For instance, in the previous economic cycle, which saw robust growth, the banking sector exhibited remarkable performance. During 2002-07, the Nifty Bank index outperformed not only the Nifty index but also all other sector indices by a significant margin.

But there have been exceptions as well. After a prolonged tough period, the sector has regained momentum in the last two years even amid challenging conditions.

The sector extended huge loans to the infrastructure sector on the back of growth in the mid-2000s. Most of these turned into bad loans when the economy suffered. In RBI’s Asset Quality Review for 2015-16, over 200 accounts of large borrowers were identified as non-performing assets (NPAs), resulting in massive losses to the banks. In 2018, the NPA book grew further when the IL&FS crisis blew up. NPAs reached their highest level of 11.2 per cent of gross advances in 2017-2018. Now, after several rounds of government support and recapitalisation of Rs 2.33 lakh crore between 2015 and 2021, the sector seems to have turned around.

Many banks have demonstrated strong performance in the last one year and the sector appears to be a promising outperformer in the medium to long term. Let’s understand why.

Improving Metrics

The banking sector seems to be in a good position for decent growth in the future, supported by factors such as improving credit growth, well-capitalised balance sheets and significant decline in bad loans.

“The space appears well-poised for multi-growth years on strong balance sheet, improving asset quality and pick-up in credit growth,” says Sailesh Raj Bhan, chief investment officer, equity, Nippon Mutual Fund.

Clean Book: According to the Economic Survey 2022-2023, “The gross NPAs of banks, a key indicator of asset quality, was down to seven-year low as of September 2022.”

“The balance sheet clean-up over the last few years has enhanced the lending ability of financial institutions—seen in double-digit growth of non-food credit offtake by scheduled commercial banks (SCBs) since April 2022,” the survey said.

There could be further improvement in asset quality. “The gross NPAs (are expected) to fall further to decadal low of sub 4 per cent by March 2024, riding on post-pandemic economic recovery and high credit growth,” Crisil said in its report dated March 2023, Rider In The Storm. The report adds that the asset quality of the banking sector will also benefit from the proposed sell-off of NPAs to the National Asset Reconstruction Company.

Credit Growth: Credit quality is at its best in many years with no incremental risks foreseen in any of the major segments, including corporate, retail, housing, or infrastructure. With the economy growing along with rising credit penetration, bank credit can potentially grow at a faster pace than nominal GDP growth.

The sector has witnessed significant credit growth over the past few years. According to data released by RBI on March 31, 2023, non-food bank credit registered a year-on-year (y-o-y) growth of 15.9 per cent in February 2023, up from 9.2 per cent in the previous year. This growth is attributed to both corporate and personal segments.

In the corporate sector, credit to industry grew by 7 per cent y-o-y in February 2023, compared to 6.7 per cent in February 2022. Large industries accounted for the majority of the growth. In retail, loans reached 20.4 per cent y-o-y in February 2023, up from 12.5 per cent in the previous year. Housing loans were a major driver of this growth, and this trend is expected to continue.

Strong Balance Sheet: The balance sheets of banks have strengthened due to an increase in both capital and provisioning levels. “Healthy credit growth and rising interest rate regime has led to improving net interest margins (NIMs) and low credit costs (good asset quality performance) has led to strong ROA/ROE (return on assets/return on equity) performance,” adds Bhan.

Deposits: The main concern in the future for the banking sector is the collection of deposits. “For banks, deposits are the raw material,” says Sunil Singhania, founder, Abakkus Asset manager LLP. When raw material cost is higher, there is pressure on a company’s margin. The same is true for banks, and smaller players are facing some difficulties.

However, the recent announcement of doing away with the indexation benefit on long-term capital gains of debt mutual funds, is being seen as a positive for bank fixed deposits (FDs). “The recent changes in taxation of other investment products have provided a respite to the banking sector, particularly to private banks, in terms of deposit growth,” says Madanagopal Ramu, head, equity, Sundaram Alternate Assets.

Where Should You Invest?

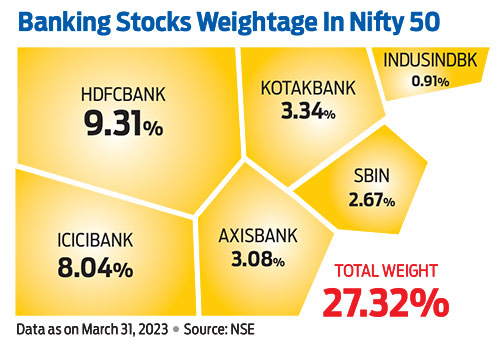

With the amalgamation of 10 public sector banks into four big banks from April 1, 2022, there are now 12 public sector banks and 30 private banks on the stock exchange.

So, should you invest in PSU or private banks? “Instead of focusing on PSU or private banks, we should focus on good franchises, as opportunity exists in both the segments,” says Singhania.

“In the PSU space, there are two-three banks which have great brands and are comparable with the best private banks in terms of maintaining their CASA ratio,” he adds. In fact, some PSU banks have given outstanding performance in the last one year with double-digit returns. For instance, Union Bank of India has delivered 75.80 per cent, while Bank of Baroda has given 58.3 per cent in the last one year, as on April 21, 2023.

On a price-to-earning (PE) basis, experts are bullish on private banks “because of their strong balance sheet, improving loan growth prospects, and attractive valuation,” according to Pratik Gupta, CEO and co-head, Kotak Institutional Equity.

The Indian banking sector’s outlook is positive, and the sector is expected to witness sustainable growth in the coming years.

However, it requires careful analysis and research to identify the winning stocks. As such, investors should focus on analysing the banks’ balance sheet, valuation, regulatory environment, and growth prospects.

kundan@outlookindia.com