Personal care constitues

50% of the FMCG sector in India

Urban India contributed

65% to the overall FMCG sales in 2022

***

One sector on which you can rely on during a downturn or periods of high volatility is fast-moving consumer goods (FMCG). It is a defensive sector which is counted among the most resilient in the economy.

In India, the FMCG sector is the fourth largest, with three major segments. Household and personal care constitutes 50 per cent of the sector, healthcare covers 31 per cent, and food and drinks 19 per cent.

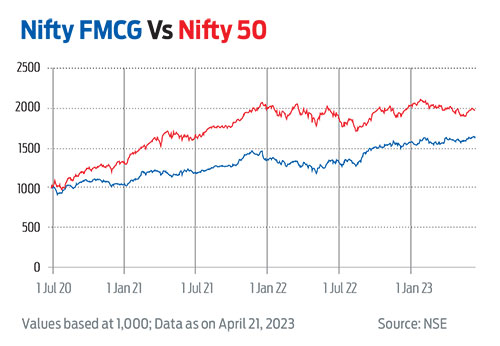

According to the Nifty FMCG data, other than in 2015, 2016 and 2019, the sector posted double-digit returns in the last 10 years. The exceptional performance of the sector can be attributed to several factors, including an increase in disposable income, growing young population, and heightened brand awareness among consumers.

According to the India Brand Equity Foundation (IBEF), “The FMCG market reached $56.8 billion as of December 2022. The total revenue of the FMCG market is expected to grow at a compounded annual growth rate (CAGR) of 27.9 per cent through 2021 to 2027, reaching nearly $615.87 billion. In 2022, the urban segment contributed 65 per cent, whereas rural India contributed more than 35 per cent to the overall annual FMCG sales.”

Of late, the sector saw a fall in demand on the back of a slowing economy and higher inflation, but that is likely to change soon.

Positive Signals

According to Saurav Basu, head, wealth management, Tata Capital, “Broad-based cyclical recovery in the economy along with moderation in the pace of inflation could be the key drivers of recovery in consumption.”

“Moreover, with government push for consumption through lower taxes and fall in commodity prices, it is expected that most companies may revert to pre-pandemic profitability levels in the coming quarters.”

Consumption seems to be back in urban centres as of now.

According to a report by HDFC Securities dated April 18, 2023, “Companies have started seeing a gradual recovery in demand. However, it still falls short of a full recovery. Urban markets returned to positive volume growth, while rural markets remained muted. Despite near-term consumption pressure, some green shoots are visible such as moderating inflation, improving consumer confidence and increase in government spending.”

The FMCG sector is highly sensitive to inflation as it is closely linked to the purchasing power of consumers. The fall in inflation coupled with lower crude oil prices would benefit these companies.

A significant number of FMCG companies in the Indian market have a substantial presence in the processed foods sector. In the past year, there has been a sharp decrease in the prices of agricultural inputs that are used in the production of processed foods, such as flour, edible oil, pulses, and cereals, primarily due to oversupply in the agricultural market. This has resulted in the reduction in input costs for FMCG companies operating in this space. Many key ingredients used by the sector are down by 25-35 per cent, according to reports.

“With softening of major commodity prices, FMCG companies have taken price cuts and grammage increases in the last six months. This is expected to result in volume uptick,” ICICI Securities wrote in a report dated April 10, 2023.

Analysts also believe that lower commodity prices will translate into higher margins for FMCG companies. “We continue to believe that margin recovery will be faster than revenue recovery. Most companies will be able to sustain expanding operating margins (assuming no macro challenges for the commodity basket exist). Thereby, near-term operating growth is expected to be healthy,” according to the HDFC Securities report.

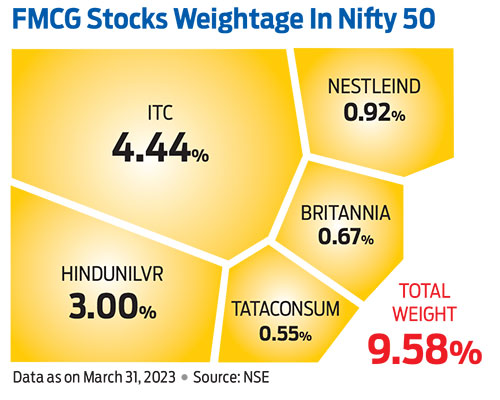

For almost four to six quarters, the sector was grappling with higher gross margin pressure quarter-on-quarter. “For some of the largest FMCG players like Hindustan Unilever, gross margins fell by 500-600 basis points, and in some cases, 900-1,000 basis points, largely because of rising input costs. A lot of those input cost factors are now reversed,” says Dhiraj Agarwal, co-head of institutional equities and head of equity sales, Ambit Capital.

He adds that there is a good tailwind for the FMCG sector. In the next 6-12 months, it is likely to do well. Over time, these companies have taken a lot of price hikes because of rising input cost. One would expect that some of that price hike would be reversed to pump up the volumes. Historically, we have seen that whenever FMCG companies come out of a margin compression cycle, for some time, they retain the previous price hikes to boost the margins back. This gives a huge amount of margin and pricing power to FMCG companies.

kundan@outlookindia.com