India accounts for

20% of the global supply of generic medicines

CAGR rose by

30% in the last bull run between 2009 and 2016

***

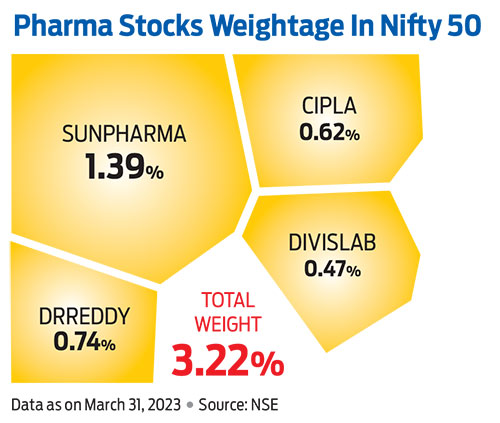

One sector that was heavily mauled in the recent sell-off is pharma. Hence, the stocks in this space appear attractively priced. Pharma is considered a defensive sector and could be a perfect pill to ride the volatile markets.

India’s pharmaceutical industry ranks third globally in terms of production volume. According to the annual report released in 2023 by the Department of Pharmaceuticals, which falls under the Ministry of Chemicals and Fertilisers, the total annual turnover of pharmaceuticals in the fiscal year 2021-22 was Rs 3,44,125 crore.

Moreover, the country is the largest producer of generic medicines. It manufactures about 60,000 different generic brands across 60 therapeutic categories and accounts for 20 per cent of the global supply of generics.

No wonder, during its last bull run between 2009 and 2016, the S&P BSE Healthcare Index jumped nearly six-fold, resulting in an impressive compounded annual growth rate (CAGR) of nearly 30 per cent over the course of seven years.

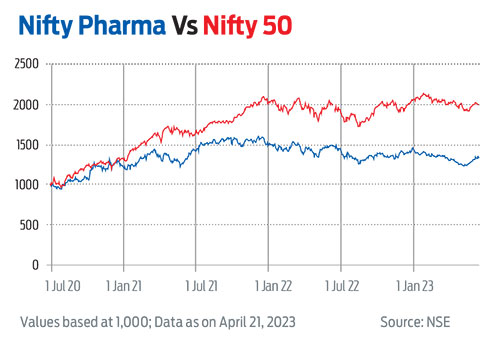

After 2014, the US market that once laid golden eggs for the Indian pharma sector became the source of intense regulatory scrutiny. After that, the sector underperformed for the next five years before the Covid pandemic hit in 2020. In that year, Nifty Pharma stole the show by delivering 61.62 per cent return. This show did not last long though, and it underperformed all major indices in 2021 and 2022.

But the tables may turn once again in the future on the back of several factors.

Focus On Domestic Growth

Pharma companies are now focusing more on domestic growth and markets rather than the US. Experts believe that the domestic market offers immense opportunity for the pharma sector. “Pharma is a long-term growth story given that India is the second-largest country when it comes to the elderly population in the world,” says Sailesh Raj Bhan, chief investment officer, equity, Nippon Mutual Fund.

A report by India Brand Equity Foundation, released in April 2023, suggests that India’s medical spending is expected to increase by 9-12 per cent, placing it among the top 10 nations worldwide. The ability of companies to orient their product portfolio towards chronic therapies for diseases like cardiovascular, anti-diabetes, anti-depressants, and anti-cancers, which are on the rise, will play a role in domestic sales growth in the future.

Speedy introduction of generic drugs into the market has been in focus and is expected to benefit the Indian pharma companies. With the dramatic increase in lifestyle-related diseases in India, the segment is likely to help the sector grow.

Currency Depreciation

Export-oriented sectors like pharma tend to gain from currency depreciation, as their major export revenue comes in dollars. “The pharma sector is expected to benefit from positive attributes, such as currency depreciation, fall in raw material prices, low crude prices, and correction in shipping prices, which would aid in revenue growth and improvement in gross margins,” says Ankush Mahajan, analyst, Axis Securities.

“On the US front, a favourable currency movement is likely to play out during the quarter as the rupee has depreciated 9.3 per cent vis-à-vis the dollar on a year-on-year (y-o-y) basis. Besides currency movement, we expect growth to be driven by new launches, traction from specialty business, and volume gains. We expect the US portfolio to grow at 16 per cent y-o-y to Rs 14,747 crore and the European portfolio to grow at 10 per cent y-o-y to Rs 3,021 crore,” according to a report dated April 13, 2023, by ICICI Direct Research.

Government Support

According to Union Budget 2022-23, Rs 37,000 crore has been allocated to the National Health Mission and Rs 83,000 crore for the Ministry of Health and Family Welfare. These announcements are likely to act as boosters for the sector.

Niti Aayog, in its healthcare report, has said that “India has the opportunity to boost domestic manufacturing, supported by recent government schemes with performance-linked incentives, as part of the Aatmanirbhar Bharat initiative. Further, between 2018 and 2024, patents worth $251 billion are expected to expire globally, presenting a lucrative opportunity for the country’s pharma sector and the patents market.”

Better Valuation

Experts believe that there is investment opportunity in pharma as valuations are reasonable. “Branded business share in profit is rising and accounts for 30-90 per cent of the net profit for many companies. Earnings are expected to rebound in the next 12 months, and valuations are reasonable after consolidation. There is a strong long-term market structure for companies with an increase in domestic profits, and their earnings are sustainable and attractive,” says Bhan.

kundan@outlookindia.com