Nifty IT Index gave

61% return in 2021 against 25.26 per cent by Nifty

Sector is down by

15% and many companies are available at decent prices

***

The Information Technology (IT) sector has seen many ups and downs, but every time, it has come back stronger. After a stellar run in the 1990s came the Y2K crisis, but the sector managed to reinvent itself. Eight years later, in 2008, it again received a drubbing during the Lehman Brothers crisis, but raised itself again. Once again, after a bumper run in the Covid period, the sector has hit a roadblock, but it is expected to re-emerge.

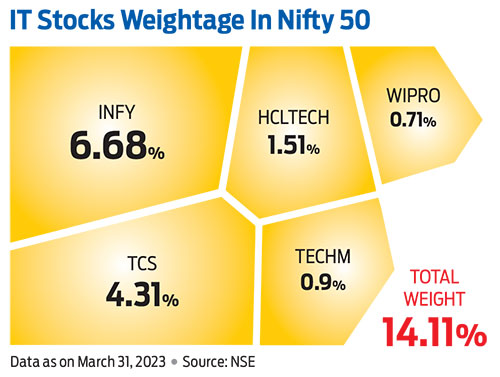

IT is among India’s most vital sector—it employs millions and hauls in precious foreign exchange. In fact, the tech companies have been the cornerstone of India’s economic growth.

Recent Roadblocks

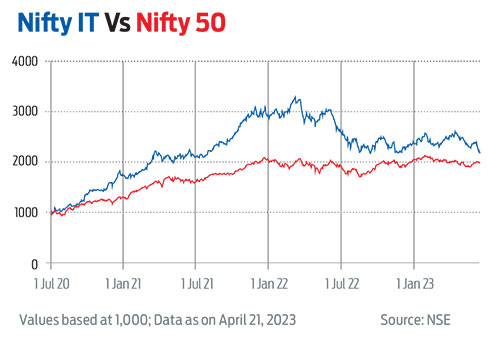

The Nifty IT index gave a stellar performance in 2020 and 2021, clocking 57.30 per cent and 60.98 per cent, respectively, compared to 16 per cent and 25.26 per cent by the broader Nifty.

However, in 2022, the Nifty IT index underperformed all major indices and fell by 25.27 per cent following fears that the developed economies would slip into recession and lower their spending on IT.

Recently, the poor performance and lower guidance by two major IT companies, Tata Consultancy Services (TCS) and Infosys, dragged the index down. Infosys surprised the market yet again with another patchy performance and a weak outlook in Q4 FY2023, though analysts believe that the annual guidance is not as bad as it seems. “We were expecting 5-8 per cent guidance (against the guidance of 4-7 per cent). What’s more important is the implied growth rate between quarters is a strong 2.3 per cent CQGR (compounded quarterly growth rate) which is similar to its last 15-year average,” HDFC Securities wrote in a report released in March 2023.

Future Outlook

The sector has been struggling with growth for some time now, on the back of a lower order book. But experts believe that once the cloud of uncertainty clears, the sector will shine again.

“The second half of 2023 would see the global economy reviving and all the headwinds will become tailwinds, including lower inflation and lower interest rates. China is coming back on steam and even growth in the global economy, which was looking like it was slipping into a recessionary kind of an environment, is coming back to some extent. I think there’s a possibility that sentiments might change. What we need to remember is that in IT companies, the profits are completely cash converters. In that respect also, I think it’s a great sector,” says Sunil Singhania, founder, Abakkus Assets LLP.

Other experts are also optimistic about the sector. “Increasing technology intensity across verticals will continue to drive strong demand for the IT sector. The US recession and any global banking crisis could impact sector performance in the near term, but the long-term story for the sector remains intact,” says Saurav Basu, head, wealth management, Tata Capital.

What To Watch Out For?

Adaptability: Investors would need to watch out how companies change their business strategies and win deals without compromising on pricing and margins. A weak rupee could keep the IT sector competitive, but strong execution capabilities and the companies’ ability to ramp up their verticals are key to future profits and sustainability.

Digital Transformation: One factor driving the demand for IT services is the rise of digital transformation initiatives across various industries. As businesses seek to streamline their operations and improve their customer experience, they are turning to technology solutions, such as cloud computing, artificial intelligence, and the Internet of Things (IoT). This is another catalyst for growth.

“We see digital transformation as a multi-year growth driver for the industry even as clients of some mid-cap Indian IT services have been under pressure,” Macquarie said in a report in January 2023. The report adds: “A long growth runway is likely while consensus worries about growth rates is halving. We think Covid-19 ushered in a new regime in which IT spending will be more resilient. We also think demand for digital transformation has a long growth runway.”

Why Should You Invest?

The sector is down by a little over 15 per cent in the last one year to April 21, 2023, which means many good companies are available at better valuation. This could be a good entry point for investors. “IT sector valuations have seen a major downshift in the last 12 months, making them reasonably priced. However, the single-digit growth outlook for earnings in the sector is likely to continue until the US economic outlook stabilises. Indian companies have strong balance sheets and high cash generation and will be able to weather these near-term challenges,” says Sailesh Raj Bhan, chief investment officer, equity, Nippon Mutual Fund.

kundan@outlookindia.com