When the equity market is highly volatile and debt is offering better returns, which is the case now, investors feel perplexed about choosing investment options.

If you find yourself in a similar dilemma, you could consider investing in hybrid equity funds. Equity-oriented hybrid funds invest in both equity and debt, thus providing the advantages of both worlds.

Equity provides higher growth, while debt acts as a shock absorber in the portfolio. The other advantage of investing in these equity-oriented hybrid funds relates to taxation.

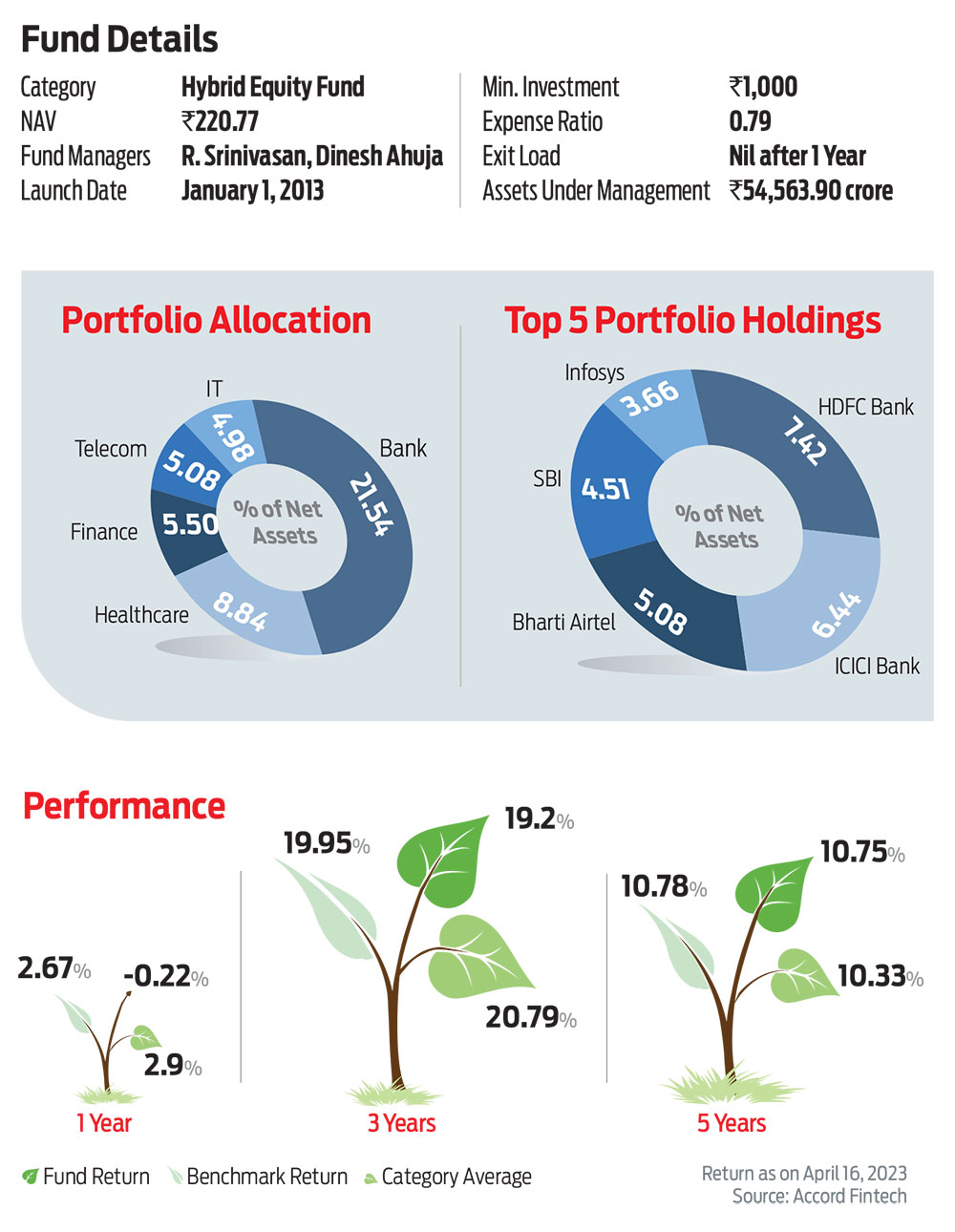

Despite having a debt component in its portfolio, SBI Equity Hybrid Fund, is taxed like equity funds. Gains from investments after one year are eligible for long-term capital gain tax, which is nil up to `1 lakh.

Performance-wise, this fund has been among the consistent ones in the equity-oriented hybrid space. The fund follows a 75:25 allocation ratio for equity and debt.

Within equity, the fund prefers to invest 50 per cent in large-cap stocks, which provides stability in volatile times. The remaining 50 per cent is allocated in mid- and small-cap stocks which helps in boosting the overall return.

Considering the higher volatility in the market, the fund is following a conservative approach by tilting the equity portfolio towards large-cap stocks. As on March 31, 2023, the fund has deployed around 62 per cent of its equity portfolio in large caps.

The fund has also minimised its small-cap exposure to 1.38 per cent. Typically, small-cap stocks are considered more volatile. At present, the fund holds 38 stocks in 23 sectors, with the highest in banking and finance, which come to a little over 27 per cent.

In terms of debt allocation, the fund managers prefer to stick with high-quality papers. Of the total debt allocation, the fund invests 50 per cent of its corpus in high-yield papers with rating grade above A- (A negative).

The remaining debt component is deployed in government securities and other highly-rated papers according to the market and the prevailing interest rate scenario. At present, the fund is holding 10.28 per cent in government bonds while the remaining debt portfolio comprises certificate of deposits, non-convertible debentures and treasury bills.

This strategy has worked in its favour in delivering consistent, if not superior returns. Investors who want to play safe in volatile times can consider investing in this fund.

kundan@outlookindia.com