Large-cap equity funds are now in the spotlight because of their underperformance.

According to an S&P Dow Jones report, 87.5 per cent of active large-cap funds could not beat the 6 per cent gain of S&P BSE 100 in 2022. The underperformance rates were high in the three- and five-year periods at 96.7 per cent and 93.8 per cent, respectively.

According to the data available, only 13 per cent of these large-cap funds have outperformed their benchmarks.

In this scenario, therefore, the selection of the fund becomes crucial.

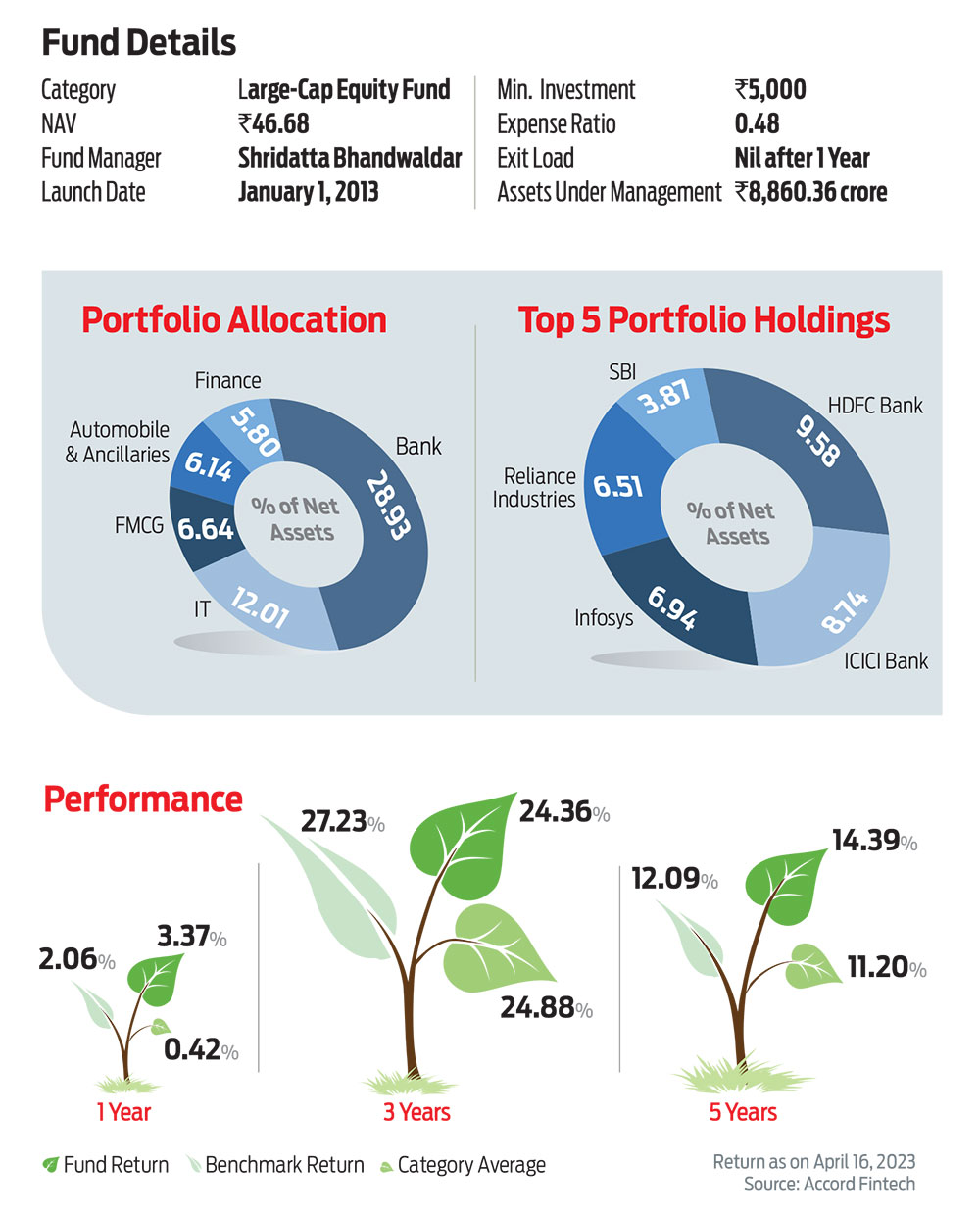

In this context, Canara Robeco Bluechip Equity fund is a decent choice for investors who wish to start their investment journey in equity mutual funds.

It has a long track record of superior performance and proven ability to protect downside better than its peers in times of market downturn. In fact, the fund is among the few in the equity mutual fund space that has consistently outperformed respective benchmarks continuously on a yearly basis in the last five years.

The best part about the fund is that it has managed to deliver steady returns since its inception. This consistency in performance also makes this fund suitable for an investor’s core portfolio. Also, focused exposure to large-cap stocks makes this fund best suited for investors in all market conditions.

The fund follows a concentrated portfolio strategy and, typically, holds 40-45 stocks in its portfolio, which seems right in terms of the fund size.

As on March 31, 2023, the fund is invested in 40 stocks.

As far as its investment strategy goes, the fund follows a focused strategy and invests in blue-chip companies and sectors that are expected to perform better than the general market.

The fund looks at the top-100 large-cap companies (blue-chip) based on market capitalisation while building its portfolio.

At present, the fund is exploiting the emerging opportunities from the banking space and is, therefore, heavily invested in the banking and financial sectors with exposure of around 33 per cent.

The fund also uses a proprietary quant model to identify winning stocks for its portfolio.

The fund manager’s ability to astutely pick stocks in line with its portfolio strategy has been the key to its consistent performance over

the years.

kundan@outlookindia.com