Freelancing and consultancy have become popular career choices in India in recent years, especially with the rise of the gig economy. Being a freelancer or consultant comes with many benefits such as flexible work hours, independence, and control over one's career.

But it has its own set of challenges too such as absence of the office infrastructure, lack of visibility, etc. Also, freelancers and consultants face certain unique challenges when it comes to taxation.

That’s because they do not necessarily have a fixed source of income or a single employer to take care of their tax deducted at source (TDS) or other needs like regular salaried employees have. They need to handle everything on their own and, therefore, it is imperative for them to know how to keep their tax affairs in order.

As a freelancer, you have two options. One, to file your income tax return under the category of “Income from Business or Profession”. Two, to opt for the Presumptive Tax Scheme (PTS). Here is a lowdown on what these two options entail and other things to keep in mind.

Income From Business Or Profession

Here, the income is taxed based on the profits earned by the business or profession, rather than on a regular salary. This can result in complex tax situations and the need for proper record-keeping.

Aarti Raote, partner, Deloitte India, explains: “The income of individual freelancers or consultants would be taxable under the head ‘profits and gains from business and profession.’ Most of these would have professional income who offer income net of expenses to tax. The expenses should be those that are incurred in relation to the business such as rent, travel, employee costs, printing and stationery, etc."

Freelancers and consultants are required to maintain proper records of their income and expenses related to their business activities to be produced for income tax purposes. This includes keeping track of expenses such as rent, depreciation, travel expenses, professional fees, internet and phone expenses, and salary paid to employees. These expenses must be directly related to their business activities and supported by proper documentation such as invoices and receipts.

However, if a freelancer is operating from home without any specific office space, then only official expenses related with the profession are permitted. Common expenses such as rental, electricity, furniture, etc., should be prorated, according to information on the income tax website. The claim for expenses in the absence of a separate place of work has been a cause for litigation.

Presumptive Tax Scheme (PTS)

While large businesses may have the wherewithal to handle such details, it can become a challenge for individuals or small businesses. To ease the burden of record-keeping for those with an annual turnover or gross receipts of less than Rs 50 lakh, the government introduced the Presumptive Tax Scheme (PTS) in 1994 under Section 44AD of the Income-tax Act, 1961.

The scheme allows them to not maintain detailed accounts of their income and expenses.

Suneel Dasari, founder and CEO, EZTax.in, an online income tax filing portal, says: “Not all professions come under presumptive taxation. Legal, medical, engineering, or architectural, accountancy, technical consultancy, interior decoration or any other profession as notified by CBDT can opt for presumptive taxation under Section 44ADA. Presumptive taxation can be opted only if the gross receipts from profession does not exceed Rs 50 lakh until FY 2022-23. From FY 2023-24, this limit has been increased to Rs 75 lakh.”

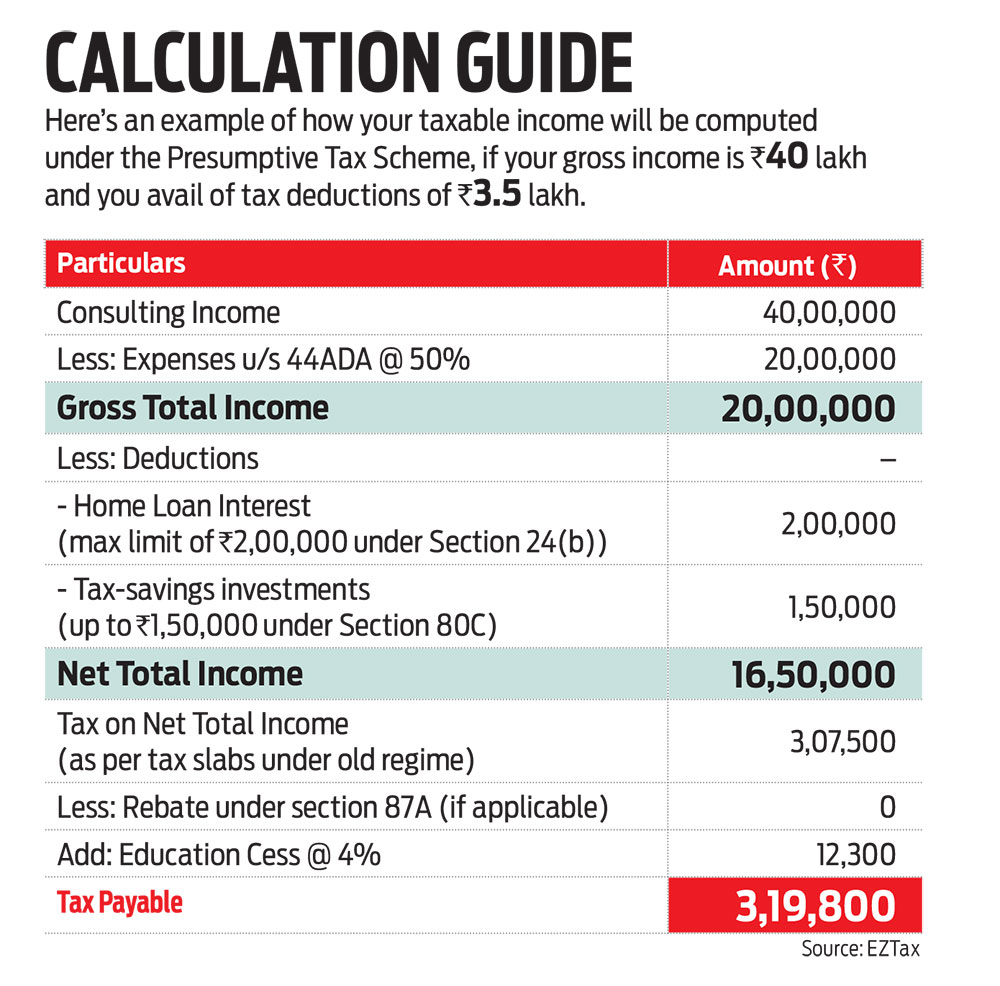

Under PTS, professionals are required to pay tax at a specified rate. They can declare income at 50 per cent of the gross receipts, subject to conditions under Section 44ADA, says Akhil Chandana, partner, Grant Thornton Bharat. The rest 50 per cent is deemed as business expenses.

Therefore, professionals who opt for PTS cannot claim any deductions or allowances for business expenses as they are already considered in the calculation of the taxable income.

Other benefits include simplification of tax compliance, reduction of tax burden on small businesses, and faster processing of tax returns.

Also, professionals who have opted for PTS in a particular financial year must continue to use the scheme for the next five financial years unless their gross receipts exceed the threshold limit.

Things To Keep In Mind

Under both the options, you can claim deductions under various Sections of the Income-tax Act, 1961, if you opt for the old tax regime. These include the Rs 1.5 lakh limit under Section 80C for investments in Public Provident Fund (PPF), life insurance premiums, equity-linked savings schemes etc., the deduction available on interest paid on home loans under Section 24(b) and others.

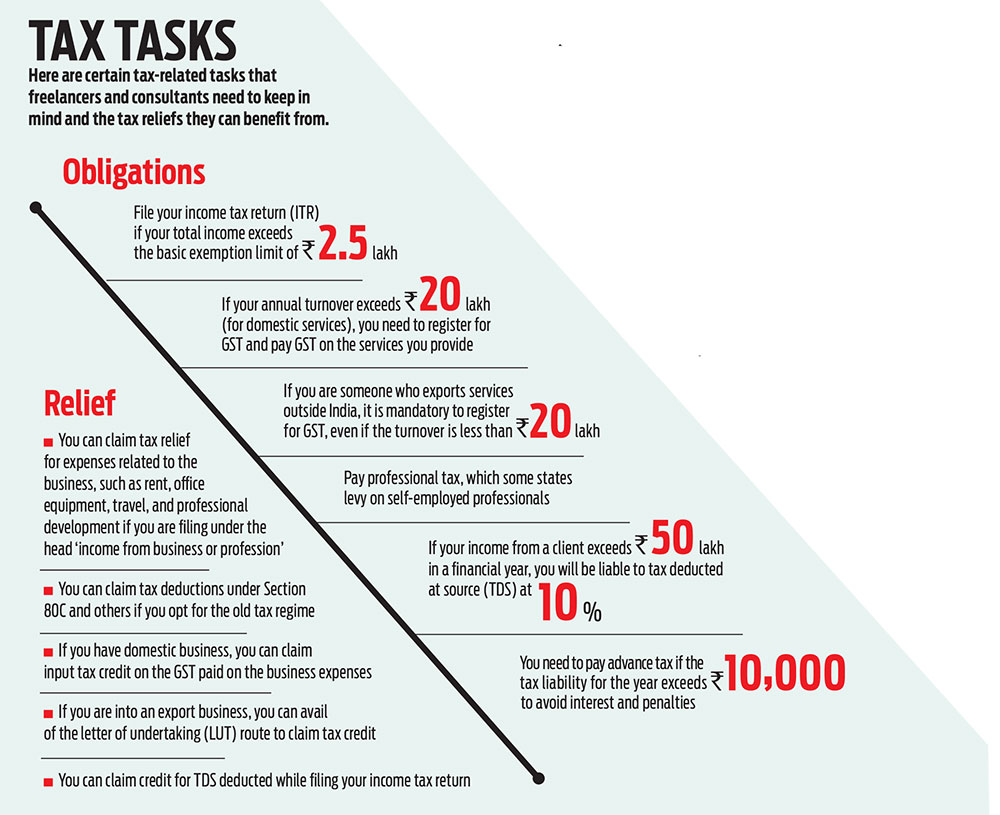

Also, since there is no employer to take care of TDS, freelancers need to pay advance tax on their own. Says Rajiv Bajaj, chairman and managing director, BajajCapital, “Freelancers are required to pay advance tax, which is the tax paid in instalments during the financial year based on the estimated income earned. Failure to pay advance tax may result in interest and penalties.” To read about other tax obligations you may have as a freelancer, read Tax Tasks.

To ensure compliance with tax laws and regulations, it is crucial for freelancers and consultants to seek professional advice. This can help them understand the tax rules and regulations governing their business activities, maintain proper records, and avoid any penalties or litigation.

meghna@outlookindia.com