One of the biggest challenges with equity investing is the involved risks - that is why many Indians even equate it to gambling. These risks are especially highlighted during periods of market stress and heightened volatility; like the ones we are currently in the middle of.

Such events leave many stock market investors vulnerable and even scares away quite a few from equity investing altogether. Which is not ideal in the long run, since academic research and data show that investing in equities is the best way to grow wealth over the long-term. To ensure that investors stay invested in equities, we realised there is a need for an investment product that ensures investors stay anchored to a core portfolio.

That is what motivated us to create the All-Weather Investing smallcase. The core philosophy behind this investment strategy is building a portfolio that cannot only offer downside protection during market turmoil but also provide equity-like returns over the long-run. It is a portfolio for all types of market conditions, and is hence all weather.

Identifying the constituents

The All-Weather Investing smallcase significantly minimises the damage that a sudden market fall or a prolonged recession can have on the portfolio. It accomplishes this by allocating capital across a mix of three asset classes - equities, gold, and fixed income.

While exposure to equities generates returns in a rising market, gold provides the much-needed protection against the decrease in the value of equities in a down market. On the other hand, fixed income provides a stable and positive return consistently. Since these asset-classes have a low correlation with each other, a combination of the three provides investors with the much needed inherent diversification. This helps them not only preserve their wealth but also grow it in a much safer (i.e. less volatile) manner over the long-term.

We decided to use Exchange-Traded Funds (ETFs) to get exposure to these asset classes. ETFs are like mutual funds, but investors can buy and sell them on exchanges like stocks. Every ETF tracks an underlying, which could be the Nifty-50 index, price of gold, and many more. Thanks to their low-cost and tradability on exchanges (amongst other benefits), ETFs have become one of the most popular instruments in the world.

The Asset Allocation Algorithm

While a mix of gold, equity, and fixed income reduces portfolio risk, it is important to get the exact allocation right - one that maximises returns with minimal risk and which accounts for dynamic market conditions.

To build a truly all-weather investment product, we studied many algorithms like Maximum Diversification, Inverse Volatility, Equal Risk Contribution, Minimum Volatility. Each has its pros and cons, and ultimately an algorithm that maximized the Sharpe Ratio of the portfolio was selected.

The algorithm follows the Sharpe maximisation principle, which aims to maximise the excess returns of the portfolio for each unit of risk. If two investment products have the same returns but one has a higher Sharpe ratio and the other has a lower Sharpe ratio, the one with a higher Sharpe ratio means that it generates more returns than the other for the same level of risk.

Back testing for all market conditions

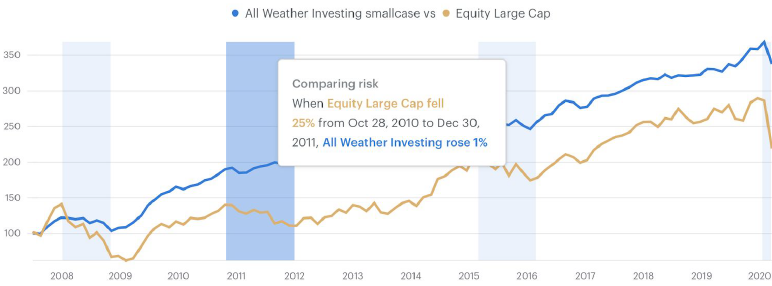

Once we had the strategy ready, the next step was to test the performance of the same under different economic and market cycles. For this, we selected a period starting from 2007, so that the robustness of the strategy could be tested in one of the worst stock market crashes in recent history (until the ongoing one). It also included other stressful times for Indian markets like the Greek or Euro Debt Crisis of 2012 and 2016 demonetization in India. The chart below shows the performance of the strategy in various periods when the Indian markets crashed:

Live Performance

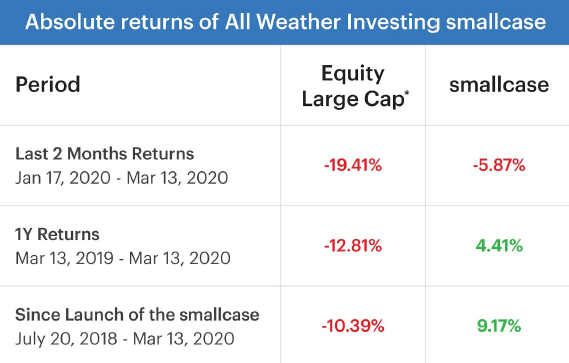

After these rigorous back tests, we launched the All-Weather Investing small case in July 2018. Since launch, the live performance of the All-Weather Investing smallcase has validated our thesis - it has not only provided returns that are better than that of the Nifty-100, but it has done so with far less portfolio volatility.

Is this for you?

We believe that the All-Weather Investing smallcase suitable for every investor. It is designed to be the cornerstone portfolio for every investor. While different investors might want to have different percentages of allocations towards their core portfolio depending on their risk profile, we certainly believe it’s important for everyone. Such times of market crisis serve as a good reminder of why this asset allocation approach is especially important. Of course, investors should always consult their financial advisors when in doubt. They can help one understand their risk-taking capabilities and determine the exposure required in a particular investment product.

Lastly, please note that there is no guaranteed return with the All-Weather Investing smallcase. To be honest, no product that has equity or gold in it can truly offer it. But the founders of smallcase (and many smallcase employees) are heavily invested in the All-Weather Investing smallcase. In our opinion, that is not only a very necessary disclosure but also the ultimate vote of confidence one can offer!

The author is the Co-founder and CIO at Smallcase Technologies.