Like anyone else his age, Kolkata-based Tanmoy Dey’s (31) life was active and fun. He had a good job, enjoyed his time with friends and explored the world around him, till tragedy struck in 2014. “In mid-May 2014, I started experiencing this weird sensation that aggravated and necessitated hospitalisation,” he narrates. He was diagnosed with acute spinal disc herniation, which in most cases can be treated using physiotherapy or medical prescription. “I was advised an immediate surgery as the prolapsed discs had protruded through the spinal nerve,” he recounts. He had a health insurance policy, but it did not help.

Like anyone else his age, Kolkata-based Tanmoy Dey’s (31) life was active and fun. He had a good job, enjoyed his time with friends and explored the world around him, till tragedy struck in 2014. “In mid-May 2014, I started experiencing this weird sensation that aggravated and necessitated hospitalisation,” he narrates. He was diagnosed with acute spinal disc herniation, which in most cases can be treated using physiotherapy or medical prescription. “I was advised an immediate surgery as the prolapsed discs had protruded through the spinal nerve,” he recounts. He had a health insurance policy, but it did not help.

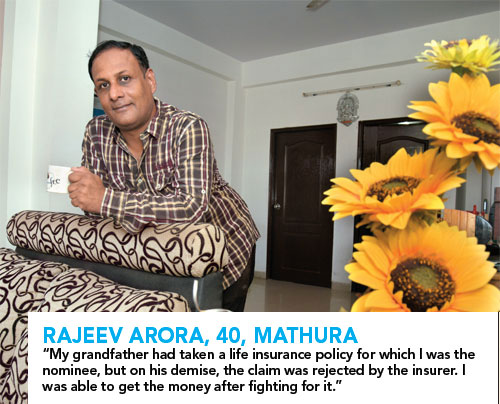

In faraway Mathura, 40-year-old Rajeev Arora was the nominee on a life insurance policy that his grandfather had taken from Birla Sun Life. “My grandfather died in June 2013 and the policy was for a Rs.2.5 lakh cover, but it took serious persuasion to get the policy proceeds,” he informs. Two distinctly different cases from two very different parts of the country, but the end results are more or less the same—getting a claim on your policy can be delayed and, in some cases, denied. As much as insurance offers protection against uncertainties, insurance companies also stick to their rules and regulations, which are rather strict and demanding.

Conditions apply

Most health insurance claims are held back due to one reason or the other. But, according to insurers, the primary cause of discord is incomplete sharing of information at the time of taking the policy. Says Mukesh Kumar, executive director, HDFC ERGO General Insurance: “You need to submit all bills, receipts, prescriptions, reports and other documents to the insurer in case of reimbursement claims.” Documentation aside, the problem stems from the long list of exclusions that are listed in a policy, which more often than not is not read or understood. There are other factors that can impact your claim as well. For instance, there are sub-limits and caps when it comes to health insurance policies. Sub-limits are what the policy will pay for, say, an ambulance service or room rents, and capping is the maximum it would pay for such facilities. Some insurers even have disease specific sub-limits and capping, and one should definitely read the policy before signing up for it. In fact, for these very reasons, never take an insurance policy only based on the premiums that you need to pay. While a policy may seem inexpensive on the face of it, you will land up paying a huge price at the time of a claim, which is when you really need the policy to work.

“But, the kind of exclusions mentioned cannot be internalised before going in for treatment,” says Delhi-based Vivek Bakshi. Bakshi’s wife Nalini was hospitalised few months back due to a medical emergency and the health insurance company rejected the claim. “Not staying in the  hospital for a full day was the basis on which the claim was refused,” he says. But, that is a fact. Health insurance claims come into effect only when the insured is hospitalised and spends at least a day in the hospital. The terms and conditions most often use jargon and technicalities that are not easy to understand and comprehend.

hospital for a full day was the basis on which the claim was refused,” he says. But, that is a fact. Health insurance claims come into effect only when the insured is hospitalised and spends at least a day in the hospital. The terms and conditions most often use jargon and technicalities that are not easy to understand and comprehend.

When it comes to health insurance, there are clauses that include waiting period for certain types of ailments. For instance, a hypertensive person may not get any reimbursement for a heart ailment in the waiting period, depending on the insurer and the type of policy. Says Dr S. Prakash, executive director, Star Health and Allied Insurance: “The maximum waiting period for coverage of pre-existing diseases is 48 months. There are products in the market with lesser waiting period.” There are also certain ailments against which the coverage kicks in after a shorter waiting period.

“I contested with HDFC ERGO because my case cannot be considered as a standard spinal disk herniation and hence, be excluded from the initial two years of waiting period,” narrates Dey. His case did not go through because it did not conform to the policy terms and conditions. In contrast, Arora was lucky when he took on the insurer. “My claim was rejected on grounds that according to the terms and conditions mentioned in the policy document, the policy was terminated on February 25, 2013, as the fund value dipped below Rs.10, 000 and was insufficient to recover the routine annual charges,” he narrates. He was lucky when he took the matter with the insurer directly who then paid him the claim amount of Rs.2.5 lakh.

Polishing act

To make insurance work for you, insurance regulator IRDAI and insurance companies have, over the years, come up with some good policyholder-friendly facilities. The cashless process in case of health and motor insurance is one such initiative. “In case of a cashless claim, one needs to fill the cashless pre-authorisation form available at the hospital’s insurance helpdesk with the mentioned details and we release the payment directly to the hospital,” explains Antony Jacob, CEO, Apollo Munich Health Insurance. Yes, most hospitals these days have an easy payment processing for people who have health insurance. All one actually needs is to furnish the health insurance policy card along with any reports and prescription to be treated without paying for it upfront.

In the case of motor insurance, cash- less claims have found favour, as most vehicle owners understand the process of a surveyor visit before the claims estimate is arrived at. “The concept of depreciation is understood and I know that some part of the claim will be borne by me,” states Mumbai-based Abhishek Sharma who had an accident claim on his i10 and had to part-pay for it. Yes, there are policies that insure even the depreciation, but these are not necessarily meant for everyone.

The exclusions with a health cover have necessitated the proliferation of several variants of health insurance plans like critical illness and top-ups. There are also health riders which you can attach to your life cover to enhance its scope. “Critical illness riders are optional covers available on payment of additional premium but cannot be taken without a base health cover. Such riders are available either on lump sum payment basis or on indemnity basis,” explains Prakash.

The exclusions with a health cover have necessitated the proliferation of several variants of health insurance plans like critical illness and top-ups. There are also health riders which you can attach to your life cover to enhance its scope. “Critical illness riders are optional covers available on payment of additional premium but cannot be taken without a base health cover. Such riders are available either on lump sum payment basis or on indemnity basis,” explains Prakash.

Critical illness insurance actually pays out the cover the moment the critical illness is diagnosed. The insurer does not even bother to check if the policy proceeds are being used towards treatment. Fine print is also there when it comes to renewing insurance policies, and in case of motor insurance states that if a claim is raised the insurer can increase future premium on the vehicle. Similarly, with health insurance, an insurer can increase the premium at the time of renewal in case a claim has been raised.

As a policyholder, it is in your interest to read the policy contract than blindly believe that you can claim for anything and everything. As soon as you get the policy document, immediately read the fine print where exclusions are spelled out. If you find anything that restricts the cover you had expected, you have the right to return the policy at no cost within 15 days of it reaching you. Do not be in haste; make sure the policy covers all that you were explained.