There is something unnerving about tax planning, which causes the smartest of people to not make it work in the most optimum way for them. People tend to address tax savings in isolation instead of aligning it with their financial goals. By doing so, they miss out on extracting the maximum from the tax savings options available to them. However, this year things will be different given the many changes in tax rules that could help you plan your taxes than cut the chase to previous quarter.

New rules

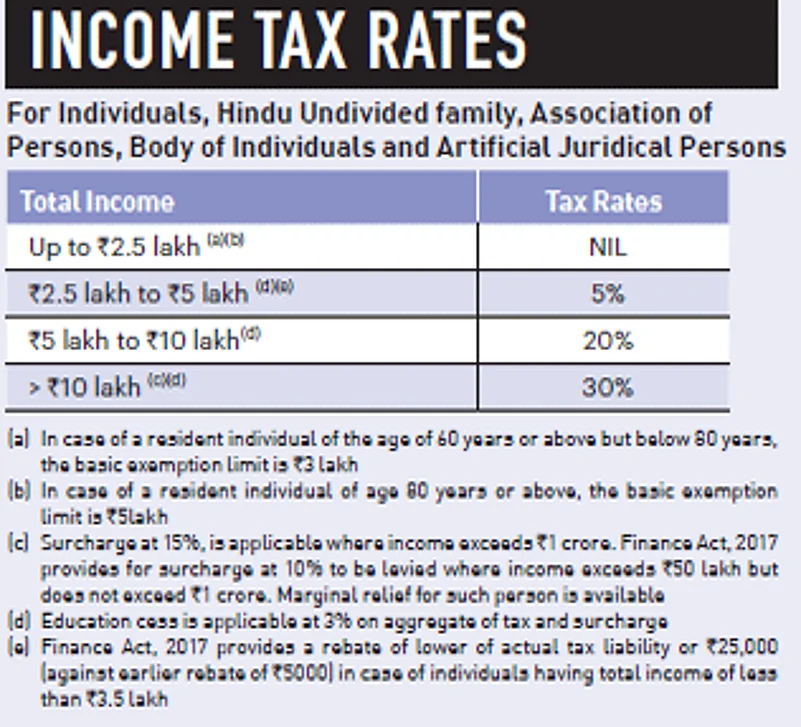

Before embarking on tax savings, understand the new tax slabs. First, the 10 per cent tax slab does not exist any longer. Henceforth, for those with income between Rs 2.5 lakh and Rs 5 lakh, the tax rate applicable will be 5 per cent. This will result in tax savings of up to Rs 12,500 per year for all tax payers. One hand takes what the other gives-the tax rebate has been reduced to Rs 2,500 from the earlier Rs 5,000 per year for taxpayers with income up to Rs 3.5 lakh. The combined effect of these changes in tax rate and rebate of taxpayers with taxable income up to Rs 3.5 lakh will now be Rs 2,575 instead of the earlier Rs 5,150.

Likewise, high value cash transacting will be nearly impossible and will have an impact on your personal taxations too. The limit for payment on expenses by cash (capital and revenue expenditure) has been reduced to Rs 10,000 per day from the earlier Rs 20,000 per day in aggregate per person. Also, there is a limit (Rs 2,000 in a year) on how much you can donate to claim deductions under Section 80G. More importantly, it is crucial to note that a limit has been set on payments using cash for everyone, as no person will be allowed to receive Rs 2 lakh or more in cash, except from their respective bank accounts.

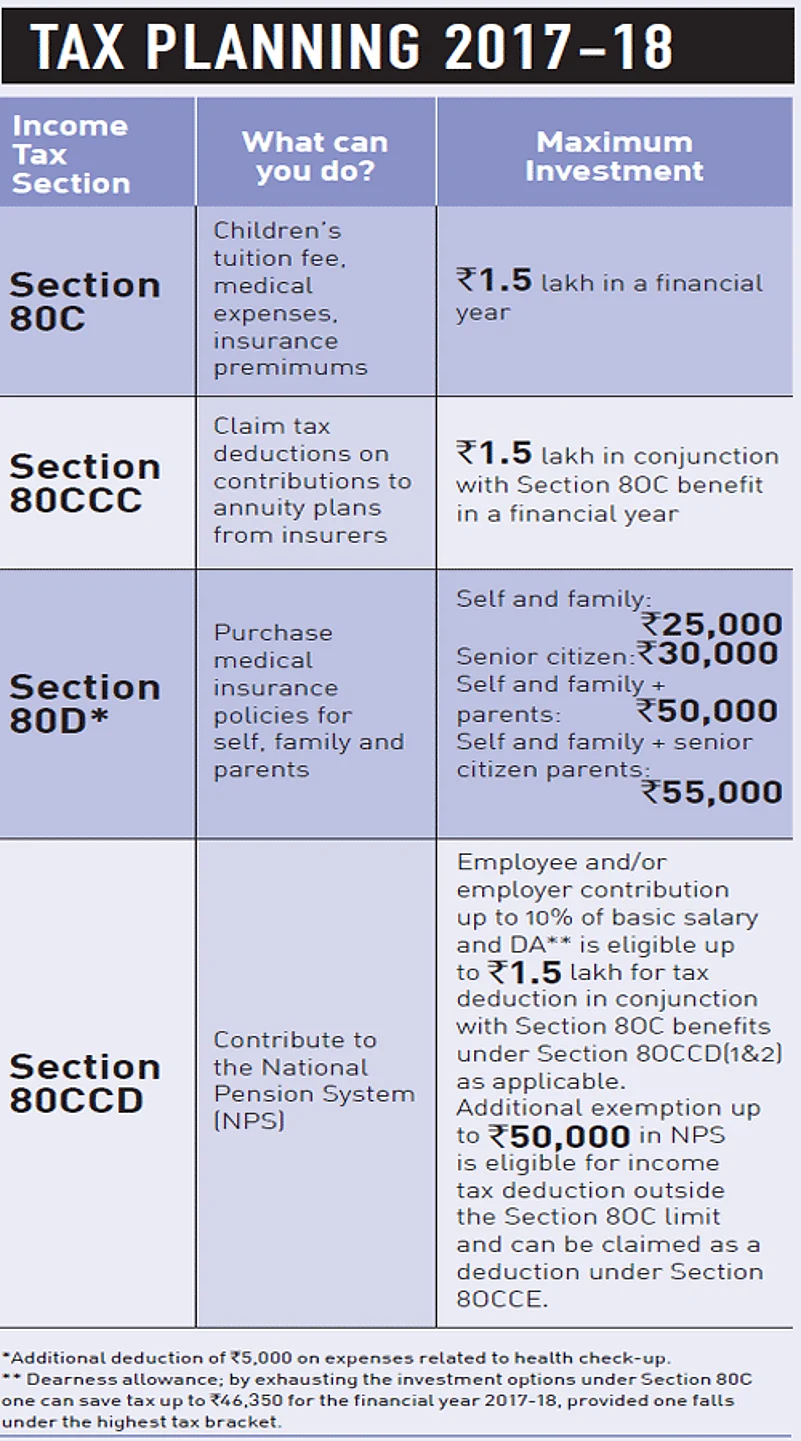

Saving taxes

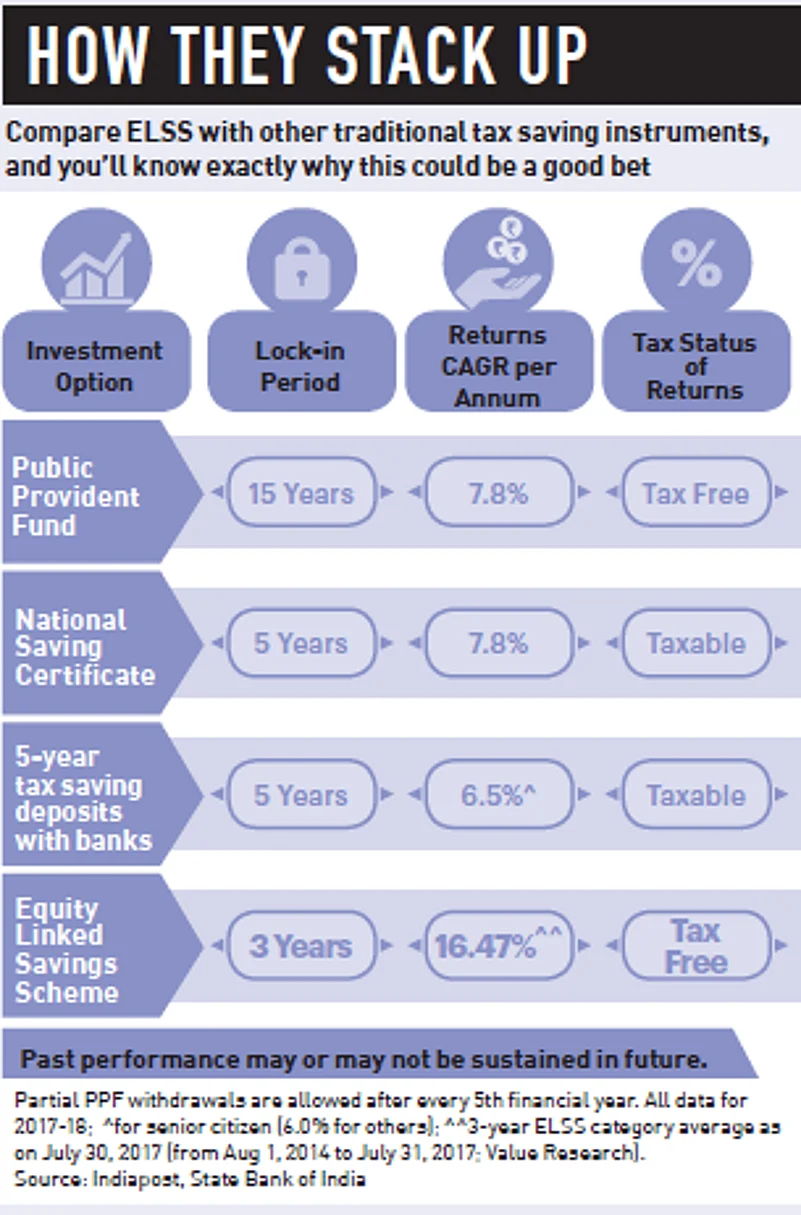

In general, people tend to have an inclination towards fixed return instruments, especially the ones who are within the tax saving basket. The savings options, which earn a fixed return, include contributions to the mandatory Provident Fund (PF), PPF, five-year post office term deposits, saving in five-year fixed deposits, National Savings Certificate (NSC), Sukanya Samriddhi Yojana and the Senior Citizen's Savings Scheme.

These tax saving options are so popular that taxpayers sometimes fail to see other options for both investing and tax saving, like equitylinked savings schemes (ELSS) or contribute in the National Pension System (NPS), which have investments in equities. The advantages of long-term investing cannot be emphasised more, which is where the ELSS scores. Just on account of lock-in, the ELSS scores over every other tax saving option with its three-year lock-in, which is the shortest, compared to other tax saving avenues.

The ELSS is an open-ended scheme that doesn't just help you save tax but it also helps your money grow. The three-year lock-in works to the advantage of both the taxpayer as well as the fund manager as both get the necessary time to counter market volatility. The taxpayer has the added advantage of being in a fund where other investors are only taxpayers, making them fairly homogenous in their construct. Further, the exposure to equities helps the investor to earn returns, which also have the potential to beat inflation.

For someone in their 20s, time is the biggest advantage. So, instead of putting money in fixed returns tax saving options, like NSC or the PPF, tax saving instruments like the ELSS or even the NPS, which has equity exposure could be the first choice. By opting for these over other fixed return investments, the potential benefits are two pronged-you gain from the long-term equity exposure and also from the power of compounding.

There is a thin line defining the optimum choice for your tax saving. To get the best of both worlds-tax saving and meeting financial goals-make sure you maximise the opportunity that comes your way towards meeting your long-term financial needs than get obsessed with utilising the Rs 1.5 lakh that you need to save from tax payment.

Smart tax savers make every rupee they pay as tax work for them without avoiding taxes at all. What is most important is that you patiently think of what your financial needs are and how to use tax savings as an accelerator to achieve them. This will not only give you tax benefits, it will also give you the double advantage of saving tax and realising financial goals. So, it's critically important to choose tax saving instruments that you understand than getting myopic, thinking of just saving tax.

A good way to make tax planning work in your favour is to check the available tax concessions and then identify which of these can be used favourably to go with your financial goals. In doing so, you would have ensured that not only do you reduce your tax liabilities, you also stay on the path of your financial goals in an efficient manner. For instance, go for a home loan if you need a house, instead of opting for a home loan because there is tax savings in doing so. As far as possible, make the tax planning exercise a year-long affair than just get into it when you hear about them from the accounts department in your office.