Everyone likes something for nothing. Many of us can’t look away from the catchword ‘Free’. In this context, it is difficult to ignore the convenience of a credit card. It’s not only a safer option compared to cash transactions, but also offers benefits in the form of rewards or cash-back options. Mohali-based businessman Varinder Kumar is one such smart consumer who has managed to merge his banking account with his credit card spends in such a manner that he earns reward points not only when he spends but also when he saves.

Reward programmes let you stack up points every time you use your credit or debit card and now some banks let you earn reward points even on maintaining the minimum account balance. It’s their way of rewarding loyalty. Rahul Rana, managing director and CEO, Payback India, says: “Payback is a multi-partner rewards program, which gives it an edge over other loyalty cards. Several merchants can come together to reward the customers with Payback. It is for this reason that those who believe in cash-back on card usage are also inclined to move to Payback.”

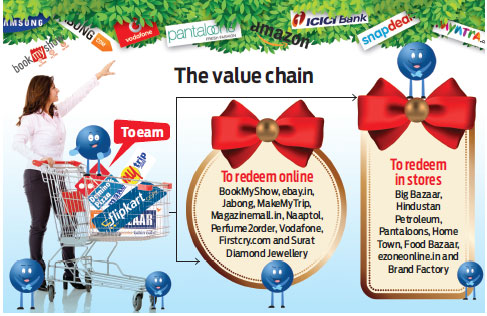

The range of utilities, services and platforms on which one can earn Payback reward points is astonishing. Over 50 partners, including affiliate brands and networks, allow members to earn reward points on shopping and redeem them for attractive rewards. “I have an ICICI Bank account that earns me reward points on transactions I make, and I have a credit card from them also which, when combined, is a great value for money,” says Kumar. Effectively, Payback offers a single benefit through multiple partners, thereby increasing the stickiness.

How cash-back stacks up

We are all hard-wired for immediate gratification—a reason for the popularity of cash-back system on card usage, where the benefit is almost immediate, unlike Payback where one needs to accumulate certain number of points to realise the benefits. You get a fixed percentage of the amount you have spent every time you swipe in case of a cashback system. This amount may vary for various banks and card issuers, who keep notifying changes in their offers from time to time. For instance, there is a different cash-back on spends on entertainment such as movie tickets versus those on utilities such as online bill payment.

Besides, most banks set a minimum transaction amount on their cards to qualify for the benefits and have a cap on the cash they return to the customer. For instance, the minimum transaction amount could be Rs.1, 000, with maximum cash-back of Rs.100 per transaction and Rs.500 for a month. Hence, picking up credit cards randomly can defeat the purpose of the benefits offered by them. It is, therefore, prudent to know the reward options and how you can make the most of them before you opt for one.

It is for this reason that the popularity of Payback over cash-back is worth noting. Another reason is the simplicity of Payback’s system. Over time, card issuers have put several limits, embargos and checks on how much one can earn as cash-back, which restricts the benefit that one can actually realise.

It is for this reason that the popularity of Payback over cash-back is worth noting. Another reason is the simplicity of Payback’s system. Over time, card issuers have put several limits, embargos and checks on how much one can earn as cash-back, which restricts the benefit that one can actually realise.

Explains Rana: “Payback allows its members to accumulate points at a faster rate irrespective of their payment mode like cash or card across enrolled partners.” Moreover, the choice to redeem the reward points gives consumers the power to use their rewards in a manner most suitable to them (See: The value chain). Users of Payback are also happy with the kind of deals and products they are able to redeem through the Payback channel. The points can also be used as a payment option at many Payback partners, which effectively works like the traditional barter system.

Consumer alert

Indians love a bargain and marketers love to show that they are giving one. But, do not try to game the system. One of the problems in doing so could result in expenses that are beyond one’s means, putting one in a debt trap. Remember to spend cards only on the items that you need and can afford to repay in time. Don’t forget, credit scores are partly based on the percentage of available credit you’re using—the lower the percentage, the better your score. Blindly chasing the reward points is a disaster waiting to happen. At the same time, prudent usage of cards to earn rewards can be a fruitful exercise, especially if you are a spender on several categories, where it could turn into a value for money experience.