GDP growth at 8%

Sensex at 37,500

Nifty at 11,500

Earnings growth of 16%

Indian equities are in for another year of double-digit returns, as the benchmark indices are expected to climb higher over the next 12 months. If you thought 2017 was a stellar year for the Indian equity markets, 2018 could be better, provided earnings revive, consumption stays strong and credit growth returns.

After the Gujarat poll results, which saw fortunes swing wildly, elections have emerged as a potent addition to the mix of market-moving factors. With eight states set to go to polls in 2018, politics will be in focus. “While we see the economic/earnings cycle picking up, the election cycle is probably now upon us, and this will add to the swings in the market. It’s more ballots from here,” points out a note from Edelweiss Securities.

In addition, the heightened interest from domestic investors will also drive the markets this year. Pointing to the strong inflows of domestic funds into the Indian equity markets, Timothy Moe, co-head, macro research, Asia inflows and chief Asia-Pacific regional equity strategist at Goldman Sachs noted that domestic money was setting the price now. “Foreign institutional investors (FII) are no longer the price-setters,” he said. The firm’s

Nifty target for 2018 is 11,600. The SIP surge will continue to provide buying support to the market.

In order to get you a glimpse of what lies ahead, Outlook Money polled the country’s top 10 brokerages and the best equity strategists to get you the top 10 stocks and sectors that will fare well in the coming year.

The Hall of Fame

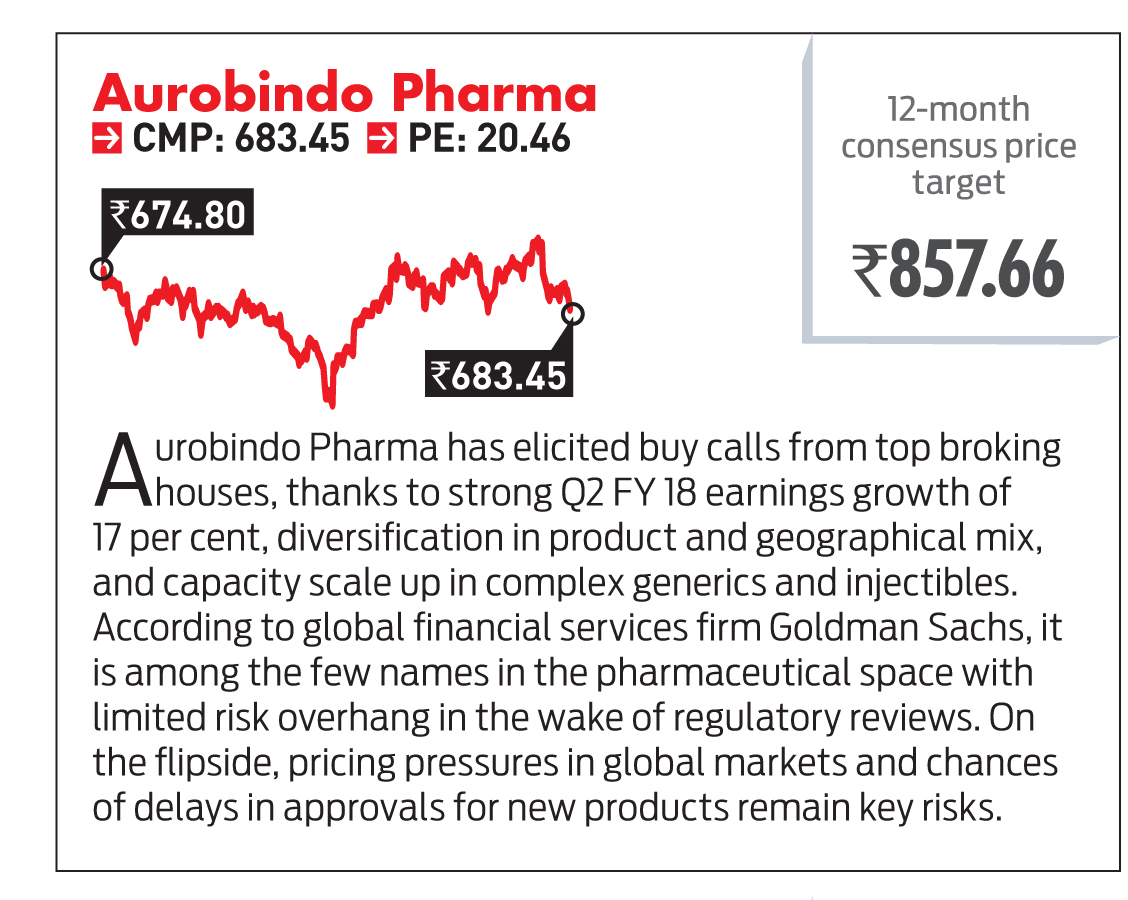

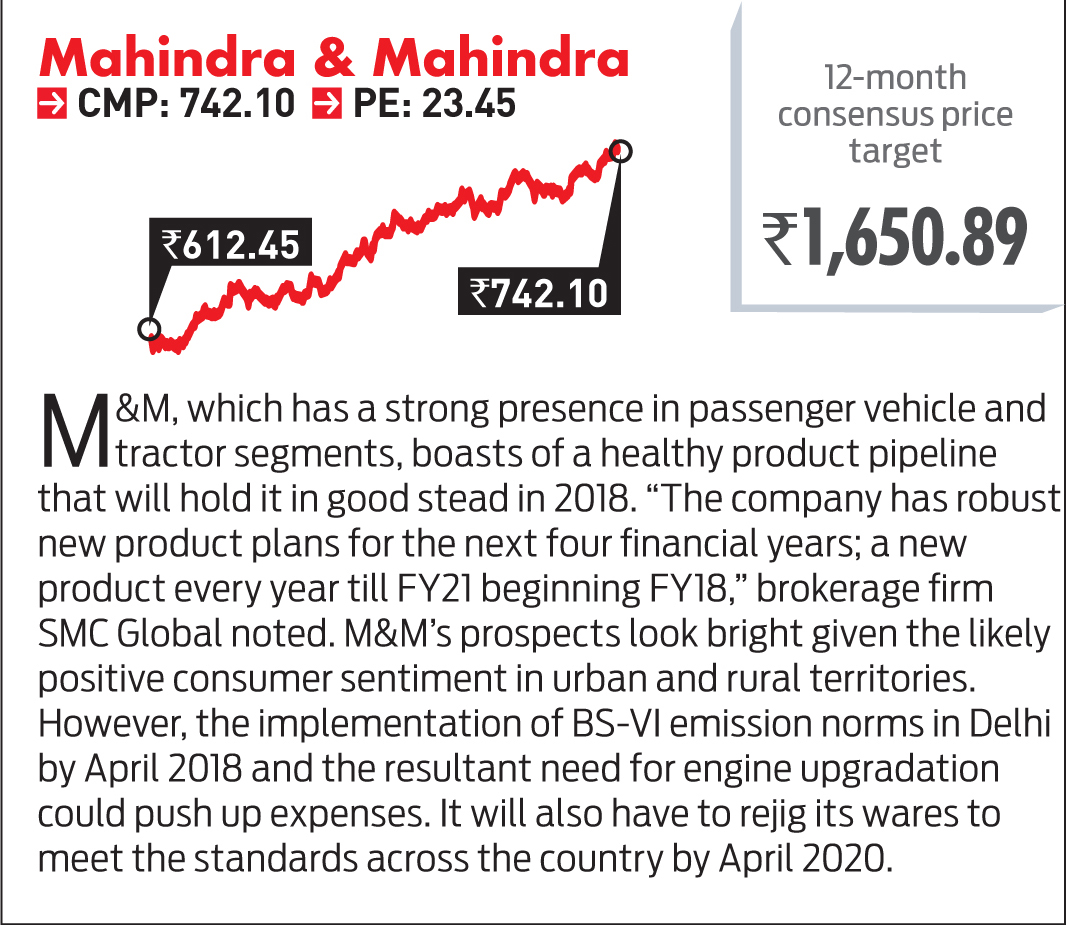

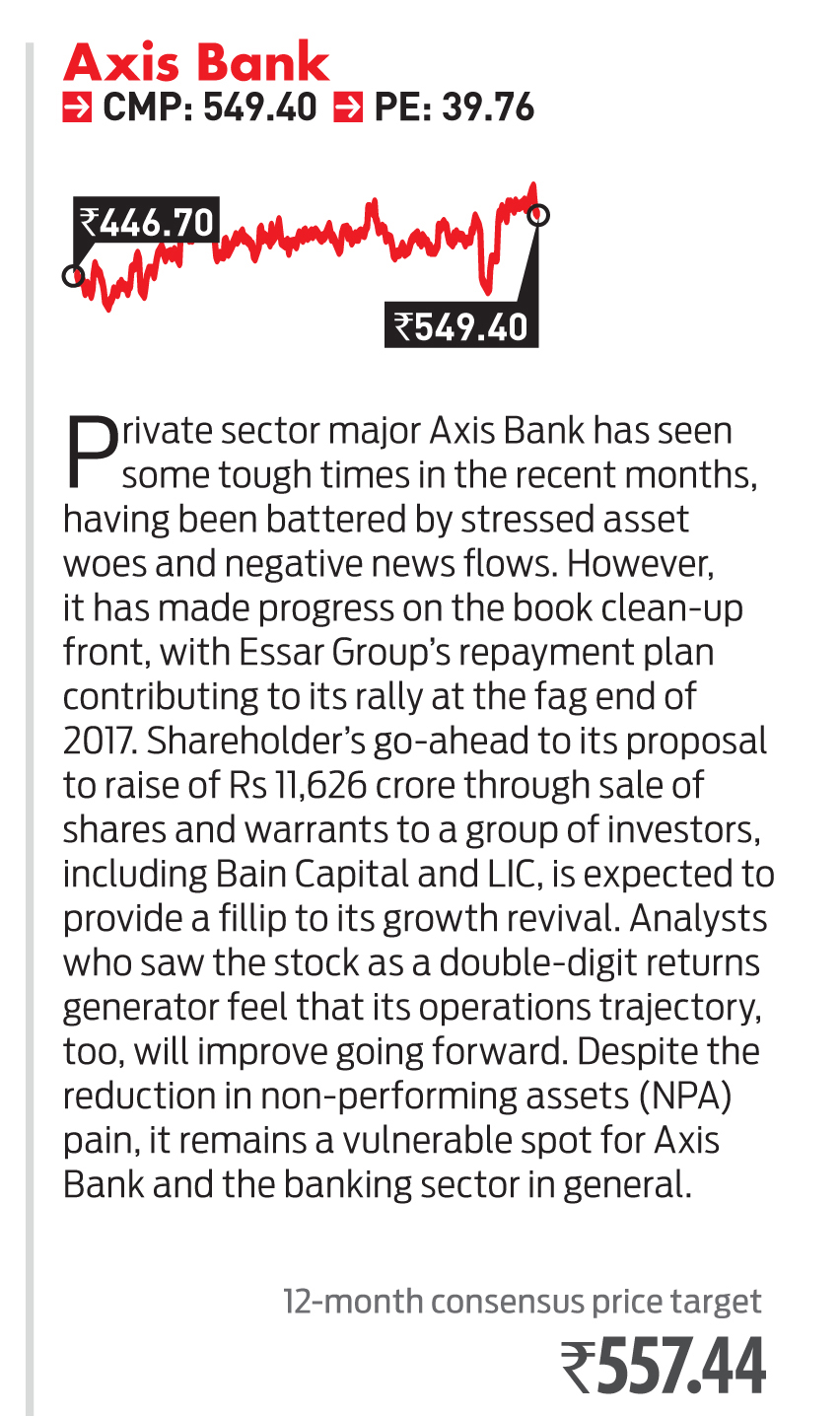

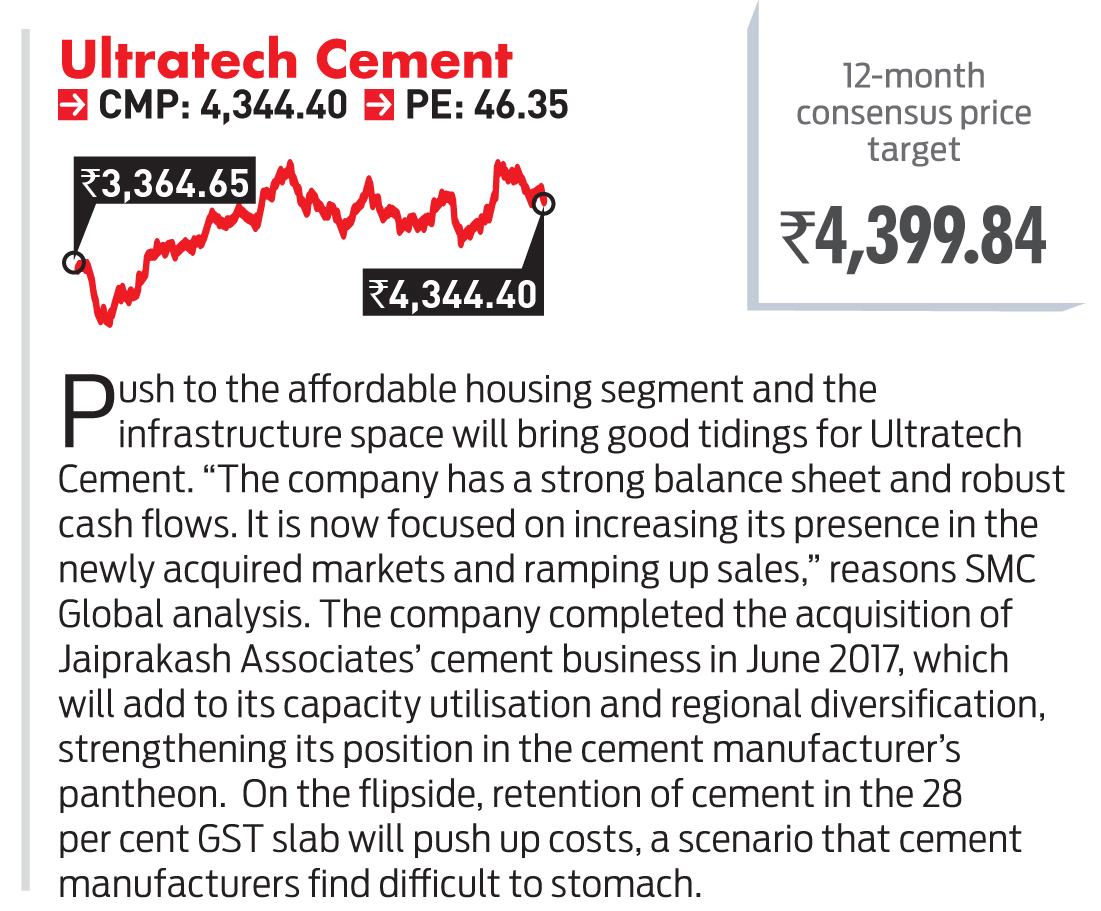

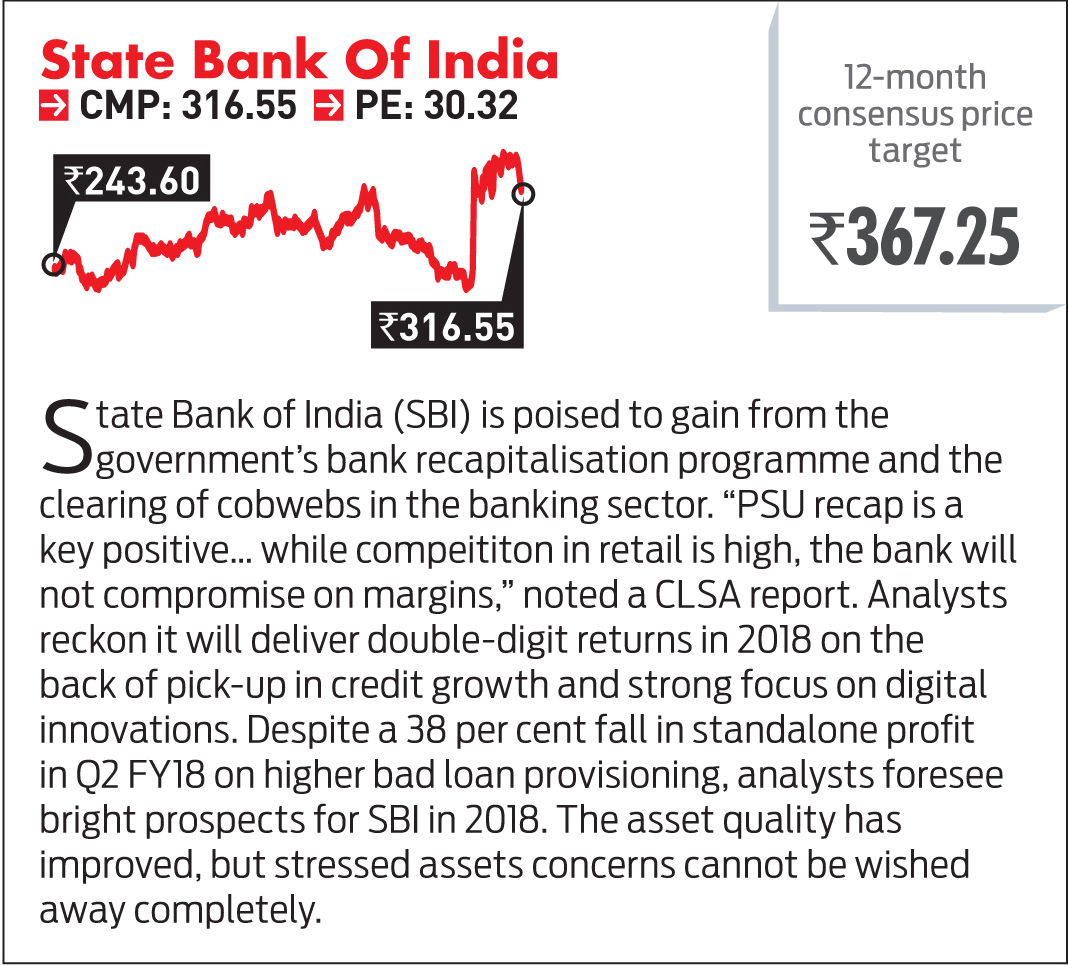

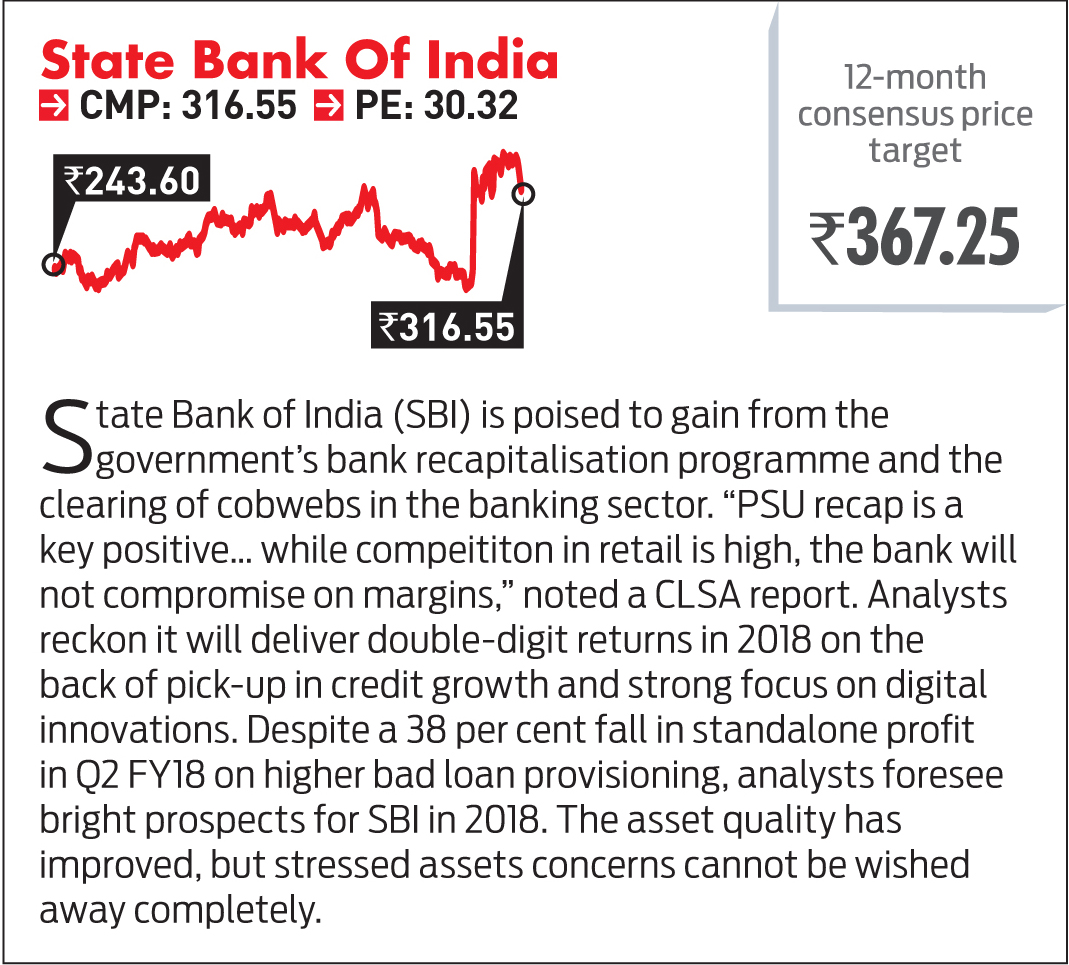

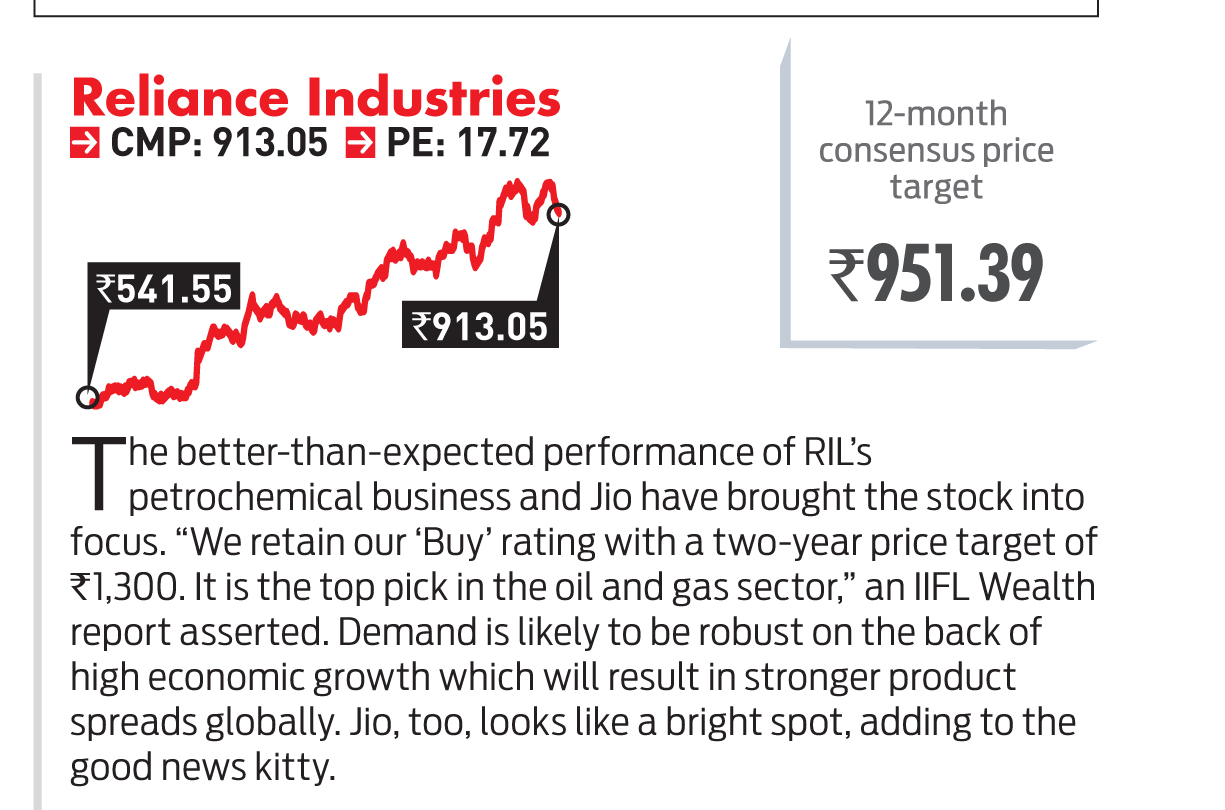

OLM’s incisive poll threw up a list of ten stocks (See poll results for the complete list) from varied sectors like banking, auto, oil and gas, pharma, infrastructure, and cement. Three banking stocks - State Bank of India, ICICI Bank and Axis Bank - made it to the top ten. The automobile sector emerged as a close second with Maruti Suzuki and Mahindra & Mahindra leading the sectoral picks. These are expected to deliver superior returns on the back of demand pick-up in the passenger vehicle segment and a possible rebound in the rural segment. Analysts are also bullish on the overall consumption theme next year. “We expect consumption to pick up - both urban and rural. Rural consumption has bottomed out and will pick up as we move forward. It can get an additional boost if CY18 budget has stimulus ahead of the general elections,” says Gautam Duggad, head, research, institutional equities, Motilal Oswal Financial Services.

Banking has emerged as the dark horse this year with the government

announcing its

`2 lakh-crore bank recapitalisation programme. The intense activity on the bankruptcy norms front, too, has reignited interest in this space, boosting prospects of both public and private sector banks. Some analysts believe that the worst may be behind for the banking sector. “With PSU bank recapitalisation and Insolvency Act, we expect the banking sector to start witnessing improvement in asset quality,” says Teena Virmani, vice-president, research, Kotak Securities.

Interestingly, technology is not the preferred theme this year and these stocks are conspicuous by their absence. Similarly, telecom stocks have not made the grade due to the high competitive intensity in the industry, though growing chorus around consolidation seems to have brightened the prospects of some of the bigger players.

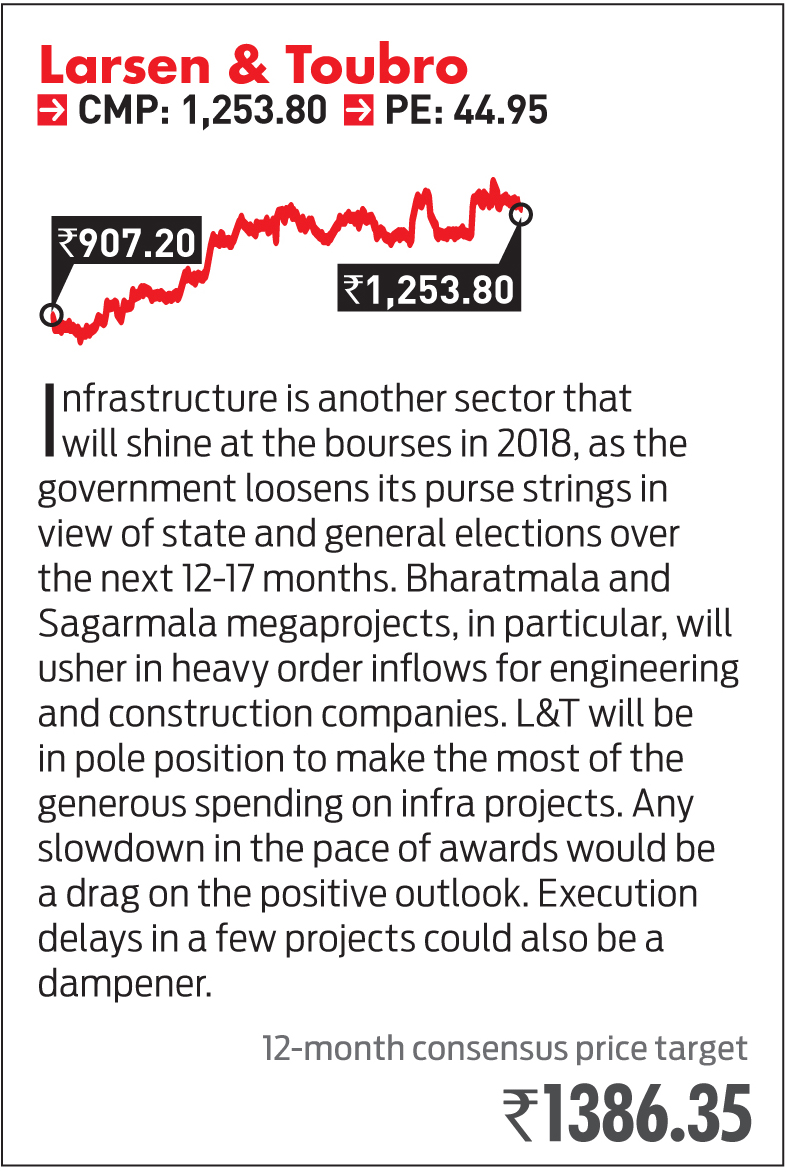

Another chart-topper is infrastructure, with Larsen & Toubro claiming its rightful spot in

the sun. The sector - road construction and port development, in particular, - may be direct beneficiary of the Bharatmala and Sagarmala projects, as new orders flow in. “NHAI is also likely to ramp up the award process in coming months. Building and urban infrastructure projects are also likely to see increased traction with affordable housing scheme as well as upcoming metro projects,” points out Virmani of Kotak Securities, who is particularly positive on EPC (engineering, procurement, and construction) companies.

In fact, most government sectors could deliver in 2018. “Order inflows have been picking up. Execution will pick up next year. Private fixed capital formation has bottomed out. Corporates would start investing in building fresh capacities as utilisation levels improve,” says Vikas Khemani, president and CEO, Edelweiss Securities

The Prime Drivers

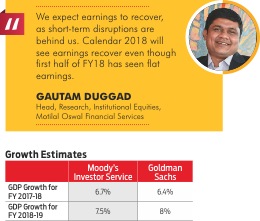

2018 is not likely to be an ordinary year. As it precedes the all-too-crucial 2019 general elections in the country, the year holds out much promise, but also poses risks for the stock markets. Moreover, it is the year, which many market-watchers believe, will witness a decisive revival in economic growth, putting India firmly on the path to recovery. “We expect India’s GDP growth to recover to 8 per cent in FY19 given the fading impact of previous shocks, and easier credit conditions,” said a report on annual market outlook from global financial services firm, Goldman Sachs, which is overweight on India.

ICICI Direct projects earnings recovery to be the major factor driving equity markets in 2018. “While interest benefits have largely played out in terms of market multiples re-rating, one must understand that we are moving into a benign economic setup led by the lower base of interest rate cycle, which should also kick-start capex and overall business recovery,” explains Pankaj Pandey, head, research, ICICI Direct. He expects corporate earnings to stage a smart recovery in the second half of the current fiscal year. “It will record 15 per cent CAGR over FY17-19E (22.5 per cent earnings growth in FY19E on a low base),” he forecasts.

There is a near-consensus on earnings revival in 2018. “We expect earnings to recover, as short-term disruptions are behind us. Calendar 2018 will see earnings recover even though first half of FY18 has seen flat earnings,” reasons Duggad. A host of factors are expected to come together to propel growth this year. “As growth recovers, capacity utilisation will improve and the operational leverage will bring about disproportionate growth in earnings,” says Dr VK Vijayakumar, chief investment strategist, Geojit Financial Services. The recovery in GDP growth and earnings cycle will boost corporate profits, while recapitalisation of PSU banks will aid recovery in credit growth. “Another factor that will boost earnings growth for 2018-19 would be the reduction in interest costs of companies due to decline in interest rates. This will be more pronounced in FY 2019,” he notes.

Fading away of negative impact from disruptive events like demonetisation and goods and services tax (GST) is also seen as a key contributor to growth next year. “Activity growth suffered for a couple of months, but our Current Activity Indicator is already beginning to show early signs of a sequential growth pick up,” noted the Goldman Sachs report. The firm expects earnings growth to touch 17 per cent in FY19.

Domestic broking firms too have pinned their encouraging earnings forecasts on an expected increase in demand due to the waning impact of demonetisation and GST. “Revival in consumption demand, good monsoon, low interest rates, and growth-boosting policies of the government are expected to drive the earnings growth,” reckons DK Aggarwal, chairman and managing director, SMC Investments & Advisors. Firming up of commodity prices will add to topline growth. “Consumer companies are already showing a volume growth of 9-10 per cent. The only piece not doing well is exports. If that picks up, all engines of the economy will be firing in 2018,” says Khemani.

Tread with Caution

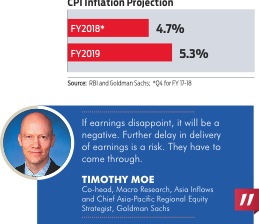

The rush of good news augurs well for the markets, but prudent investors should keep an eye on the risks too. The opportunity - earnings recovery - can also metamorphose into a threat to the equity story, if it fails to take shape in line with expectations. The consensus earnings estimate for FY18 and FY19 are 18 per cent and 16 per cent, respectively. Any slipup on this front poses a threat to the overall positive outlook. “If earnings disappoint, it will be a negative. Further delay in delivery of earnings is a risk. They have to come through,” says Moe of Goldman Sachs. The firm’s chief Asia economist, Andrew Tilton, also counted inflation and vagaries of weather amongst the risk factors, apart from geopolitical risks.

Despite the near-unanimous positive commentary on market performance next year, several voices have also advised caution. “2018 is unlikely to be like 2017 and one should expect modest returns from the market,” says JK Jain, head, equity research, Karvy Stock Broking. He foresees scope for market to correct in 2018. Smart investors who have missed the 2017 bus could use this as an opportunity to stock up on equities.

“Since the market has run up too high and too fast and the valuations are stretched, it would be realistic to expect modest returns, say 15 per cent in 2018,” cautions VK Vijaykumar, who expects correction in the small caps space.

This year, retail investors would do well to keep it simple: Invest in quality large-cap stocks, think long term, capitalise on opportunities and prevent greed from influencing your decisions. Welcome 2018 with these resolutions in mind to ensure that you are not left with regrets by the end of year.

Happy Investing!

preeti.kulkarni@outlookindia.com

BSE’s Big Bet: Beyond Equities

From its traditional role of trading, the country’s premier stock exchange is taking a giant leap into financial products like mutual funds and bonds

Capital markets traditionally deal with long-term funds. These funds are easily transacted in well-entrenched exchanges. Speculation plays an important role here. It raises debt, equity or hybrid funds, yet, the actual fund raising activity is quite low.

Also, one does not see Initial Public Offering (IPOs) in primary markets every day. Given its low frequency and the effort involved in making a prospectus and marketing an issue, raising capital or IPO is not perceived as an exciting activity. In contrast, secondary markets are gaining momentum due to high frequency trading and day-to-day price movements.

Once known as the ‘Satta Bazar’, the secondary market allows issued debt and equity for trading. And like in the capital market, it involves speculation. In the good old days, trading took place on the physical floor. It was called the ‘ring’ after the shape of the circular enclosure. All this changed in 1995, when high-octane trading was replaced by screen- based trading.

In the last 25 years, automation has also helped boost trading. What took a few minutes earlier could now be done in 150,000th of a second. Speed, algorithm trading and co-location facilities have boosted trading.

Leveraged trading such as futures and options have also increased trading volume. The Indian stock market volume rose 5,000 times between 1992-2017.

However, the number of investors in the secondary market did not grow correspondingly during this period. This despite the growth in gross domestic product and a rising Indian middle class.

What went wrong? For one, the markets meant for investments got converted into trading markets. Similar movements took place in the developed world, where investors opted for derivatives and speculative trading. About 25-50 per cent of the population participated in it.

By contrast, India did not see investor base growth beyond 2 per cent during the same period. However, Indian market capitalisation of listed firms is expected to grow from the current $2.3 trillion to $10 trillion in the next 15 years. Therefore, building trust among new investors in long-term financial products is essential.

With this aim, BSE has been focusing on financial products for investments over speculation and trading. A nation’s wealth cannot be built on speculative or short-term trading. As the economy grows, it will also have to harness its savings into productive capital. To this end, BSE has developed several innovative frameworks.

The ‘BSE Electronic Bond’ platform is already preferred by companies seeking to raise debt. Since 1st April, 2016, it has helped raise more than `2.5 lakh crore.

On the other hand, the ‘BSE SME’ platform enables Small Medium Enterprises (SME) to raise funds with a post issue face value capital of as low as $100,000. It has already raised `1,757 crore for some 213 companies whose market capitalisation has touched `20,493 crore. This accounts for more than 75 per cent of listed SME companies. BSE’s Bond and SME platforms control 70 per cent of market-share.

Similarly, the ‘BSE STAR-MF’ platform is India’s largest digital platform for mutual funds. With 80 per cent market share among exchange distributed funds, it accounts for more than 50 per cent of all new retail funds. The BSE STAR-MF platform has a wide distribution network, covering 3.000 cities and 2,00,000 solution providers.

In two years, it saw one crore transactions totalling a value of `75,000 crore, up 500 per cent in the first nine months of the fiscal. Its ‘Offer For Sale’ (OFS) and ‘Offer To Buy’ (OTB) options are leading with a near 90 per cent market-share. Since 2012, BSE has been the designated exchange for 170 OFS and 173 OTB issues. Its market-share is 86 per cent and 96 per cent, respectively, in both categories.

In essence, BSE has positioned itself as the ‘Investment Exchange of India’, ready to roll out its insurance initiatives.

India’s financial distribution system is changing rapidly. Rather than a speculative entity, BSE has now truly become a catalyst for capital formation in the country.

“Catch Them Young, Watch Them Grow”

As India grows, wealth creation opportunities presented by mid and small caps in relatively lesser discovered sectors could be humongous

With every bull market run, investors start scouting for the next multibaggers. These multibaggers are more often found not only in beaten down sectors and stocks but more so amongst the smaller companies listed on the exchanges. A peep into the history tells us that in the last bull cycle of 2003-2008, market value of Sensex increased by 6x, but BSE 500, a more broad based index, grew by almost 9x. This was not just because of valuation rerating happening in the markets, but also because earnings growth of smaller companies was playing out more vigorously. Mid and small-cap companies witnessed earnings expansion almost twice that of earnings of Sensex companies. A combination of earnings growth and expansion in valuation becomes a strong inducement for smart investors to focus on mid and small-caps during bull markets

There is another interesting aspect of why mid-caps enthuse smart money. Warren Buffett puts it beautifully: “You can’t win by being where the ball is, but where it is going to be.” Hence, the possibility that large caps of today become mega caps of tomorrow is much lower than small caps of today becoming large caps of tomorrow. To buttress the point, let’s look at the historical composition of S&P 500. The average lifespan of a company in the S&P 500 has decreased from 90 years in 1935 to 18 years today. At the current churn rate, 75 per cent of S&P 500 companies will not be present in S&P 500 index by 2027. Coming closer home, 21 out of 30 companies have been replaced in Sensex in last 10 years. So, the place to look for next multibagger is not large-cap indexes but amongst the smaller companies.

Historically, it has also been observed that small and mid-caps are bigger wealth creators. To put things in perspective, in 2003, the market capitalisation of Sensex was `6 lakh crore while that of Maruti Suzuki (MSIL) was `11,000 crore and that of Motherson Sumi was `1083 crore. As of today, Sensex’s market capitalisation is `57 lakh crore (9x growth), MSIL’s market capitalisation stands at `2.3 lakh crore (20x growth) while Motherson Sumi’s market cap has gone up to `78,000 crore (78x growth). So, the ability of a good small-cap to generate wealth is far greater than that of even a well-performing large-cap.

More interesting insights come to fore when we look at relatively lesser discovered stocks and sectors in the market. Let’s take a peep into the milk industry in India. India and Europe produce close to 150 million tonne and 160 million tonne of milk every year, with 18 per cent and 20 per cent global market share, respectively. But, the size of the dairy industry in India is `6 lakh crore whereas that of Europe is `21 lakh crore, 3.5x India’s size. This is mainly because large quantity of milk in Europe gets processed into higher value products like cheese, butter, chocolates etc, a path on which Indian milk industry is beginning to venture on.

More interestingly, the total market capitalisation of all listed companies in India in this space is just `30,000 crore, while the top two companies in Europe boast of a market value of `5 lakh crore. As India grows to become a $5 trillion economy, wealth creation opportunities that could be presented by mid and small-caps in sectors such as these could be humongous.

Politics Could Make Markets Jittery

Sensex likely to broadly remain in line with the currently prevailing value, says Saurabh Mukherjea in an interview with Malini Bhupta

Saurabh Mukherjea

CEO, Institutional Equities,

Ambit Capital

How is 2018 expected to be for equities?

We see the market as being fully valued. Hence, we find it hard to see the index as a whole giving meaningful return in 2018. While it is likely that FY19 will become the first year to achieve double-digit EPS growth for the Sensex after a gap of four years, we do not share consensus’ current optimism regarding 25 per cent EPS growth in FY19. Our estimate of EPS growth in FY19 is a more conservative 15 per cent. Retaining our 19x trailing multiple and multiplying this by the FY19 EPS estimate of `1,700 gives us our March 2019 Sensex target of 32,300, broadly in-line with the currently prevailing value of the Sensex.

Do you expect markets to sustain at these levels?

Across the world, equities, bonds, and other risky assets such as bitcoins have become overvalued. Indian equities are no exception to this rule, much as we would like to believe that some home-grown miracle has pushed the Indian stock market to the current levels.

What are the factors that will drive markets next year?

The NDA government is making a determined effort to reflate the economy through a big GST rollback (which I reckon will result in GST collections falling by around one per cent of GDP), through the PSU bank recapitalisation, which will result in lending being directed at credit starved sectors, and through the Bharatmala road-building program. This should help GDP growth recover modestly next year and hence, help drive a long-awaited pick-up in EPS growth.

How many times will the US Federal Reserve hike rates in 2018?

We are not experts on US interest rates, but if the Upper House in the US approves Trump’s tax cuts then the Fed would have to hike by more than anyone has expected.

Will crude oil spoil the rally in 2018?

Crude oil and copper account for 40 per cent of India’s balance of trade (BOT). If the Western economies continue recovering, these factors could increase India’s current account deficit and budget deficit (because the government will have to cut excise rates in order to buffer the public from the rise in oil prices).

These in turn could lead to monetary policy tightening and put pressure on the market and the economy.

Do you see domestic factors playing spoilsport?

The main domestic factor I worry about is politics. We have assembly elections almost every month between now and the 2019 general elections. If the NDA suffers reverses in these assembly polls, the stock market will get jittery.

How To Make `100 Cr In The Market

Raamdeo Agrawal of Motilal Oswal Asset Management, a self-confessed bhakt of Warren Buffett, tells Malini Bhupta how investors can create serious wealth by investing in equities for a long period

Most people dream of making big money in the stock market, but few go on to become billionaires. In India, the average investor stays invested in equity funds for no more than one year, which is abysmally low to create even a reasonable amount of wealth. Raamdeo Agrawal, chairman, Motilal Oswal AMC, shares four principles that will help an investor make `100 crore over 50 years.

Power of compounding

It is important to understand the power of compounding, which works like magic, but only over a long period of time. Even if you start with a tiny amount of capital, but if your investment were to earn a steady return of 20 per cent every year, then `1 lakh would become `100 crore over 50 years. Agrawal recalls buying HDFC Bank shares at `40 and selling them at `52. The shares are trading at a significantly higher price now. “If I had just stood with those six lakh shares then this building would have had another 12 floors on this tower,” he says talking about the firm’s swanky headquarters in central Mumbai. The way to make big wealth is to compound returns. At 20.22 per cent CAGR, `1 lakh will become `100 crore over 50 years.

Start early and stay invested

Any person can cherish the dream of becoming a multi-millionaire or a crorepati several times over only if one has time on hand. When you start from the age of 22 years, you have the full runway of 40 years to create wealth, says Agrawal. But for that you must have a game plan and ability to identify stocks that can compound money for the next 50-60 years. Warren Buffett, who created huge wealth over a long period of time and not one or two years, had read all the books on investing at the Omaha Public Library by the age of 11. The stock market is meant for long-term wealth creation. Market returns are positive, provided investors stay invested for the log-term. “Every 25 years, India’s stock market goes up 100 times,” he says. Now, 3 per cent of investors exit from their mutual fund scheme every month. So every three years, a fund has a totally new base of customers. This is not the way to make money, which is bad.

Good and clean stocks that grow at 20%

If `1 lakh has to become ` 100 crore, investors would need to buy stocks that will generate returns of 20 per cent consistently for several decades. For such returns, a portfolio needs to be built that will last 20-30 years. Just as people keep their homes clean, investors should buy top quality businesses and management. There are three types of businesses—great, good, and gruesome. To reach financial goal of `100 crore, investors must sit in a fast car and not a bullock cart. Agrawal says: “We buy companies that can deliver these returns. If the underlying economics of the business will change, then the company won’t deliver such returns. The best businesses are those that make money without deploying money. There are some consumer businesses which make money without any investment. In India, Hindustan Unilever or Asian Paints make money without any incremental investment. Stocks are friends of good businesses. Investors must ask themselves if they are sitting in a vehicle like Kingfisher Airlines or HDFC Bank.

Growth over value

It is not just how long you hold on to a stock that matters, it is equally important that the stock you own generates 20 per cent returns consistently over several decades. The right stocks that will deliver such returns are identified using two investment philosophies: value or growth. Value investing is about buying good companies that are selling at beaten down prices as there are business challenges. Growth investing, on the other hand, identifies businesses that will deliver consistently over long periods. Agrawal, a strong proponent of growth investing, says it is hard to figure out companies that will grow robustly over several decades. He says, it is best to look out for a good fund manager who can do this for you.

Equities Could Take A Breather In 2018

Valuations in 2018 could moderate, though earnings growth can be upwards of 30% over FY19-20, says Nilesh Shah in conversation with Malini Bhupta

Nilesh Shah

MD, Kotak Mahindra Asset Management

How will 2018 be for equities?

This year will be different from the perspective of returns generation. In 2017, earnings didn’t grow, but valuations did. Hence, market delivered good returns. This year, valuations can moderate even though earnings will grow. Ahead of the 2019 elections, market can turn cautious, if there are uncertainties regarding the outcome.

What will drive markets in 2018?

Currently, domestic liquidity is supporting prices. But, there is a difference between the liquidity drive rally of 1991 and 2017. In 1991, the markets were rising on a greater fool theory; on the basis that some other party would buy at elevated levels. The current liquidity is driven by hope.

What factors do you think are driving this hope rally?

There are four factors that are driving the current rally. First, real interest rates are higher than historical average, hurting corporate profitability. When real interest rates normalise, corporates will benefit. Second, our over-valued currency is hurting exports and resulting in an increase in Chinese imports. The Street expects currency to moderate in 2018.

Third, the short-term disruptions led by GST and demonetisation have abated. Businesses will normalise and reap the benefits in 2019. Capacity utilisation will increase, which was down to 73 per cent in 2017 from 80 per cent in 2012, and the margins will improve. This will further result in new investments being made.

So far, the consumption part of the economy has been reflected well in corporate earnings. It is the investment part which has been lagging. Once that starts, all engines of the economy will start firing.

And finally, employee cost has increased from 8 per cent of sales in 2012 to 11.5 per cent in 2017. No employer will keep employees at the cost of profits. Businesses are expecting activities to pick up and profits to rise.

What about earnings?

Over FY19-20, earnings growth can be above 30 per cent, combined for both the years. This would be on a lower base, as earnings have stagnated for three years.

How should retail investors look at 2018 from an investment point of view?

Investors must remember that risk management is important. If you are coming to a mutual fund, come with an SIP or STP route to average yourself in and with a long-term time horizon. One also needs to embrace risk at lower level of valuation. Other things being equal, if the market goes to 33,000, it is better for retail investors to invest in a monthly income plan, which has about 15 per cent exposure to equities. If the market goes to 30,000, then one can switch to balance advantage fund with about 40 per cent exposure to equities. And, if the market goes to 27,000 level, then investors could switch to balance funds, with about 70 per cent exposure to equity, and if market goes to 25,000 then one can move to large-cap equity fund. If investors can embrace risks when appropriate then they would earn better returns than bank FDs.

Indian Equities: Outlook For 2018

Sustained domestic flows into equities can be expected in 2018, but with sober return expectations of 13-15%

The year 2017 could not have been a better year for the Indian markets. Several key economic parameters are in place: Fiscal and trade deficit is in control, inflation is not going up, the rupee is doing well, and good monsoons, all augured well for the Indian economy. The only wish one could ask for would be higher capital expenditure for the year. No wonder the markets returned 24 per cent returns year to date(YTD) till December.

The year 2018 could be a year of sober returns for equity investors as compared to 2017. The returns in 2018 could be front-ended, as the second half could see some kind of consolidation. We expect Indian markets to react positively in the first half due to surge in earnings (on account of the low YoY base) and better visibility of tax inflows (on account of GST). Today, Nifty at 10,128 is trading at 17.3x FY19E. Assuming 17.5 per cent earnings CAGR for FY19-20E and valuations at 17-18x, we could see Nifty at 11,600 by end of 2018.

Key positives in 2018 will be the upgraded rating of the country, higher tax collection, and recovery in earnings. Sustenance of domestic flows is a given for the markets to remain at higher valuations. We expect domestic flows to sustain in 2018, in the absence of any other alternative asset class.

Risks, if any, could emanate from possible rise in global bond yields on the back of higher inflation and rising interest rates. The other major worry would be crude oil prices. Indian macros could deteriorate if crude prices sustain or go above $65/bbl.

Within the macros, broader variables like fiscal deficit and current account deficit could be under threat. Fiscal deficit has gone up sharply due to GST implementation and short-term mismatch between front loading of government expenditure and slower tax collection. Current account deficit is going up due to rise in crude oil prices. However, we expect both these broader variables to normalise in 2018, as tax collection is expected to rise after the implementation of e-way bill and crude oil prices could stabilise post winter.

Heavy capital expenditure on roads and railways should lead to upswings in order book of infrastructure companies. Further, higher spending in defence, water and irrigation projects should help in reviving the economy. The announcement of PSU bank recapitalisation should improve the banks’ ability to lend and increase credit offtake in the system. Faster resolution of cases in NCLT would be another trigger for cleaning up the NPA situation in the banking sector. These steps could lead to a sharp reversal in the earnings of PSU banks in FY19E and FY20E.

Emerging markets have received $60 billion of equity flows YTD as compared to marginal outflows seen in 2016. Within emerging markets, India has a healthy overweight position in terms of flows. Considering the strong GDP growth of 7 per cent envisaged in FY19E, India could remain one of the preferred destinations for foreign institutional investors in 2018. Only caveat to flows could be the risk of rising bond yields in developed markets. Assuming 3-4 per cent of incremental household savings going into equities would mean annual domestic flow of $15-16 billion into equities. Even though markets are close to new highs, equity investment, as a percentage of total household savings in India, is still 4 per cent as compared to real estate, which accounts for 57 per cent. Given this background, we could see sustained domestic flows into equities in 2018.

Hopefully, 2018 should see the reversal in earnings trajectory. Consensus is building on 20 per cent earnings CAGR for the next two years. In FY19E, the market is slightly expensive at 17.3x, but nowhere near the bubble zone of 22-23x forward PE. Considering India’s economic growth, earnings recovery, strong local flows and improvement in return ratios, valuations could remain on the higher side. 2018 could also be another good year for Indian equities but with sober returns expectation of 13-15 per cent.

Disclaimer: The views expressed in the article are personal and do not reflect the views of Kotak Securities Ltd.

No Big Gains For Gold In 2018

Global and domestic factors likely to stifle demand, says Himali Patel

Over the last two years, gold has gone through testing times. World Gold Council (WGC) data showed that global physical gold demand slumped in the first nine months of 2017 by 12 per cent to 915 tonnes compared to 2016. Further, the demonetisation exercise and introduction of the three per cent Goods and Services Tax (GST) in July 2017 contributed towards slowing down the demand for gold. The government bringing the gems and jewellery industry under the ambit of Prevention of Money Laundering Act in August also added to the industry’s woes

The global scenario:

The shape of global economy plays a crucial role in deciding the fate of gold demand and prices, especially the US dollar, which is one of the biggest drivers. Therefore, the Federal Reserve’s monetary policy actions would be crucial for gold. The Federal Reserve had raised rates twice in 2017 and market has already factored in a December hike with few more hikes in the coming year. Says Veeresh Hiremath, head, research, commodities at Karvy Stock Broking:

“Gold has survived couple of rate hikes in the years 2016 and 2017, a factor that hampers gold, and going forward the narrowing yield curve in the US treasuries can actually support gold prices.”

Muted returns

In India, demand for gold has also been impacted as domestic equity markets have been recording new highs. “The foremost aim of any investment is to generate returns. Nifty has jumped 22 per cent since 2015 while gold has delivered around 10 per cent,” points out Motilal Oswal in its metals report.

Further, the market has witnessed a structural change, as the curb on cash has diverted the savings into other financial assets like equities and mutual

funds. “We may see buying at lower levels and returns will be capped at 10 per cent, which is similar to that in 2017 or 2016. The expected price range for 2018 would be `27,000 to `30,000 per 10 grams,” says Aurobinda Prasad Gayan, vice-president, Kotak Commodity.

Not so bright

Several factors are likely to impact gold prices, like global trade policies, geo-political events, currency fluctuations, and equity market performance. While the returns would remain moderate, gold will continue to remain attractive. Says Kishore Narne, head commodities and currencies, Motilal Oswal Commodities: “We believe that gold will remain attractive as considerable uncertainties still exist globally. The downsides in gold could be limited towards $1,200-1,225 in international markets and `28,250-28,500 in domestic markets.”

There has been another development that deserves a mention. Market watchdog SEBI has given approval to India INX and MCX to launch gold trading options in 2017. The move is aimed at creating more participation in the commodities market. Though it has witnessed a slow start, more participation is expected to be seen in 2018. Market experts, thus, foresee moderate returns on gold for investors in 2018. The yellow metal is not expected to shine any brighter.

No Better Time To Buy A Home

With supply in abundance, real estate is expected to be a buyer’s market, says Anagh Pal

For residential real estate developers 2017 was a bad year, due to a slew of big regulatory changes. From re-aligning their business to factor in GST to changing their business model to comply with RERA and facing an investment crunch post-demonetisation, the challenges were many. According to data shared by ANAROCK Property Consultants, new housing project launches were severely impacted in 2017. Only 94,000 units were added in top seven cities of India between January-September 2017, which is a drop of more than 50 per cent from the same period in 2016. But, one can say for certain that the residential real estate market is on its way to recovery. In October and November 2017, some 18,000 units were launched, which is around 90 per cent of the new launches in the quarter. Here’s what home buyers can expect in 2018:

More power to the buyer

In 2017, due to low demand, there was an increased availability of unsold properties. “Overall, 2018 will be a year of market recovery defined by restricted new launches, gradually improving sales and declining unsold units. Home buyer confidence is reviving, and more fence-sitters will spring into action in 2018,” says Anuj Puri, chairman, ANAROCK Property Consultants. “With supply in abundance, it is now a buyers’ market

and buyers can move into ready-to-move in properties with no delay risk. From an end-users’ perspective, this is the best time to get the proverbial ‘bang-for-the-buck’,” says Sudhir Pai, CEO, Magicbricks.com. With several options to choose from, buyers will be able to negotiate hard on the price.

Focus on affordable housing

With a massive focus now on affordable housing, this segment will be the poster boy of 2018. “The government’s ambitious ‘Housing for All by 2022’ mission also received a major thrust in 2017, with the granting of the vital infrastructure status to affordable housing. In addition, the definition of affordable housing and houses classified under middle income group (MIG) underwent a series of tweaks to cover a larger buyer base and help developers offload their budget homes inventory,” says Puri.

Positive note

“Implementation of major reforms such as RERA, GST, the Benami Property Act and demonetisation promise to make the Indian residential real estate sector more transparent than ever before,” says Ramesh Nair , CEO and country head, JLL India. Concurring with this, Ashwin Sheth, chairman and managing director, Sheth Group says: “Post the implementation of RERA, there has been increased transparency and accountability in the sector, which has further reinforced investor confidence.”

The New Year, however, should be positive for both the real estate industry as well as the home buyer. If you are looking to buy a house this year, this could just be the right time. Evaluate a range of options, negotiate hard and in case you are looking for a budget home, make the most of the plethora of incentives on offer.

Rate Cycle Could Turn In 2018

Retail fixed income investors have been used to a benign interest rate scenario in 2017, but 2018 could see rates inching up, saysPreeti Kulkarni

If 2017 was about softer interest rates, 2018 could see the interest rate cycle turning. Experts believe that the Reserve Bank of India (RBI) could raise policy rates this year. The changed circumstances will call for a revised strategy for retail investors.

The road ahead

With inflation and crude oil prices on the rise, and fiscal deficit concerns looming large, interest rates will feel the upward pressure. Interest rates in the global market will also influence their trajectory.

“There is a talk in the market of a

policy rate hike in February. Interest rates could go up by 30-60 basis points (a basis point is 0.01 percentage point) due to a cocktail of factors, including global interest rates and Federal Reserve action,” says Mahendra Jajoo, head, fixed income, Mirae Asset AMC.

The next three months could see the ten-year gilt benchmark yield trade in a range of 6.8-7.5 per cent. “The trajectory of interest rates will depend on residual central and state government borrowing for FY18 and the fiscal targets and borrowing plan as outlined in Union Budget for FY19,” says Bekxy Kuriakose, head, fixed income, Principal PNB AMC. Inflation is expected to hover between 4.5 and 5.75 per cent over the next six months. “As banking system liquidity turns to neutral mode in the next three months, we may see short-term rates inching up by 15-25 basis points,” she adds.

While the CPI-based (consumer price index) inflation is headed upwards, rates could remain stable in case it remains within RBI’s target range. “RBI may continue to maintain a neutral stance on policy rates till the time rise in inflation doesn’t look to play spoilsport,” says Lakshmi Iyer, CIO (debt) and head, products, Kotak Mutual Fund.

Granting of higher house rent allowances to central government employees is also seen as a factor contributing to higher inflation. “Firming up of housing inflation is of bigger concern,” says Jiju Vidyadharan, senior director, funds and fixed income, CRISIL Research, who also sees farm loan waiver as a factor that could push up inflation.

The strategy for 2018

Retail fixed income investors would be better off investing in instruments carrying shorter tenures this year. “Investors could look to invest in liquid, ultra-short, and short-term debt funds, which are likely to offer better carry on these products and lower price risk due to lower duration,” suggests Vidyadharan.

However, those with the capacity to stomach higher risks could also consider dynamic schemes. “It is advisable to do balanced allocation to ultra short-term and short-term funds with tactical allocation to dynamic funds post clarity on the Union Budget,” says Kuriakose.

Investors could also keep it simple and just stick to asset allocation strategy. “A combination of short-term and/or corporate bond-based accrual strategies could form part of core fixed income allocations,” says Iyer.

If you are an investor with a longer horizon, you need not overhaul your strategy. “You should not worry too much about rate rise as trends change quickly. In August, we were discussing rate cuts and the cycle has turned now. Adhere to your investment strategy, objective and, horizon,” says Jajoo. If you are looking at a short-term horizon, stick to short-term or liquid funds and wait for more clarity to emerge.