PRADIP, pradip.d@rediffmail.com, DURGAPUR: My present age is 50 and would like to invest in MF SIP @Rs.15000 per month for the coming 10 years. My expectation is around 14%-15% return. Which funds should I choose? How should I plan my portfolio?

Dear Sir,

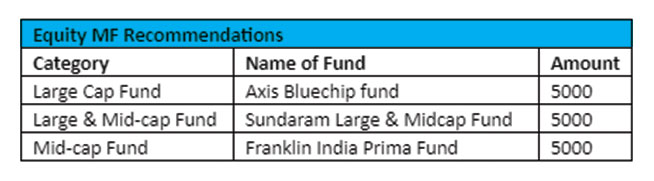

The first step in portfolio construction is asset allocation. Given that you have a time horizon of 10 years, which is a sufficiently long-term horizon, and return expectation of 14-15% per annum, we recommend the following combination of Equity MF portfolio. It is important to note that given the age, we would have considered some debt allocation as well, but in order to achieve the returns expected, we have considered a 100% Equity oriented portfolio. Accordingly, you may see some intermittent market linked volatility (like in the year 2018). In such a scenario you are advised to be patient and continue with your SIP for achieving your long-term goals. We recommend the following funds:

Amanjot Singh Jaggi, asjaggi9@gmail.com, NOIDA: I have made the below portfolio for myself to spend for more than coming 20 years- 1- Kotak Multicap Standard - 5000 per month 2- Tata India tax Saving Fund- 5000 per month 3- L&T Emerging Business fund- 5000 per month 4- Sbi small cap fund - 5000 per month 5-Mirae Asset emerging Bluechip fund- 5000 per month All funds are Direct with Growth option, Please let me know is this the right portfolio for me?

Dear Amanjot,

While investing and re-evaluating one’s portfolio, it is very crucial to keep in mind the goal which you want to fulfil at the end of your investment horizon. Goal based investing also helps in tracking the performance and re-balancing portfolio on a regular basis. With the information available I assume that your goal is wealth creation.

Age becomes an important criterion in deciding the asset allocation. With limited information and a long-time horizon of 20 years, initially you can have a higher exposure (80-100%) in equity related instruments. However, as you move closer to end of your investment horizon the same should be brought down by investing into debt / hybrid funds.

While most of the funds selected have steady long-term track record and are good to be part of the portfolio, a couple observations on the funds selected:

ELSS / Tax savings category funds come with a lock-in period of 3 years. This reduces the liquidity of your portfolio. Hence, only if there is a specific need for tax-saving, this fund should be considered.

We have observed that returns of SBI small cap fund have been more volatile, hence you may look at HDFC small cap fund within the same category which has given relatively stable returns.