Direct exposure to equity is affordable for investors with high-risk appetite. However, for investors with medium to low-risk bearing capacity, the same can be challenging. At the same time, a certain amount of equity exposure is necessary to generate wealth and beat the inflation mark. Mutual funds is one such asset class which provides adequate equity exposure with risk diversification. But, it carries a number of caveats like annual expense, total expense ratio, no quick redemptions across all funds, and occasional flexibility and transparency issue. Introducing smallcase - an alternative investment platform to mutual funds with exposure to equity and risk diversification.

“smallcase Technologies is in the business of developing digital investment platforms for retail investors to invest in portfolios of exchange-trade instruments like stocks and ETFs. These platforms are integrated with retail brokerages, so their clients can login, invest and track their investments seamlessly with their current trading and demat accounts,” said Vasanth Kamath, Founder and CEO, smallcase Technologies. The investments in smallcase happen through a portfolio of stocks or ETFs that is aligned to a specific theme, idea or a model. “We look for ideas and themes that are developing around us and try to understand if they make a strong investable case. Those are created with a long-term vision,” said Anugrah Shrivastava, Founder and Head of Investment Products, smallcase Technologies. Currently there are 63 smallcases and the themes include affordable housing - launched after government’s Pradhan Mantri Awas Yojana was introduced, GST opportunity – came after GST was rolled out, Smart Cities, Digital Inclusion, consumption shifts like Bringing the Bling (luxury products and services taking an uptick), Rising Rural Demand, The Great Indian Middle Class, Sharia Stocks as Halal Street and so on.

According to Rohan Gupta, Founder and Chief Technological Officer (CTO), smallcase Technologies, stock picking in these themes are based on proprietary algorithms. “We have several filters (beyond the criteria for the specific smallcases, like liquidity, valuation, etc.) in place that are used to pick stocks within each of the smallcases,” he added. Besides, the smallcase sector trackers also enable the investors to track the sectors they have invested in. “For instance, the smallcase Insurance Tracker allows investors to invest in and track insurance companies. There are no other indexes or ETFs that track the insurance sector,” further commented Kamath.

The minimum investment amount ranges from Rs2,500 to Rs45,000, subjective to every smallcase, and the total amount transacted so far is over Rs1,500 crore. Currently, there is only one smallcase that has fixed income exposure and all others are pure equity oriented.

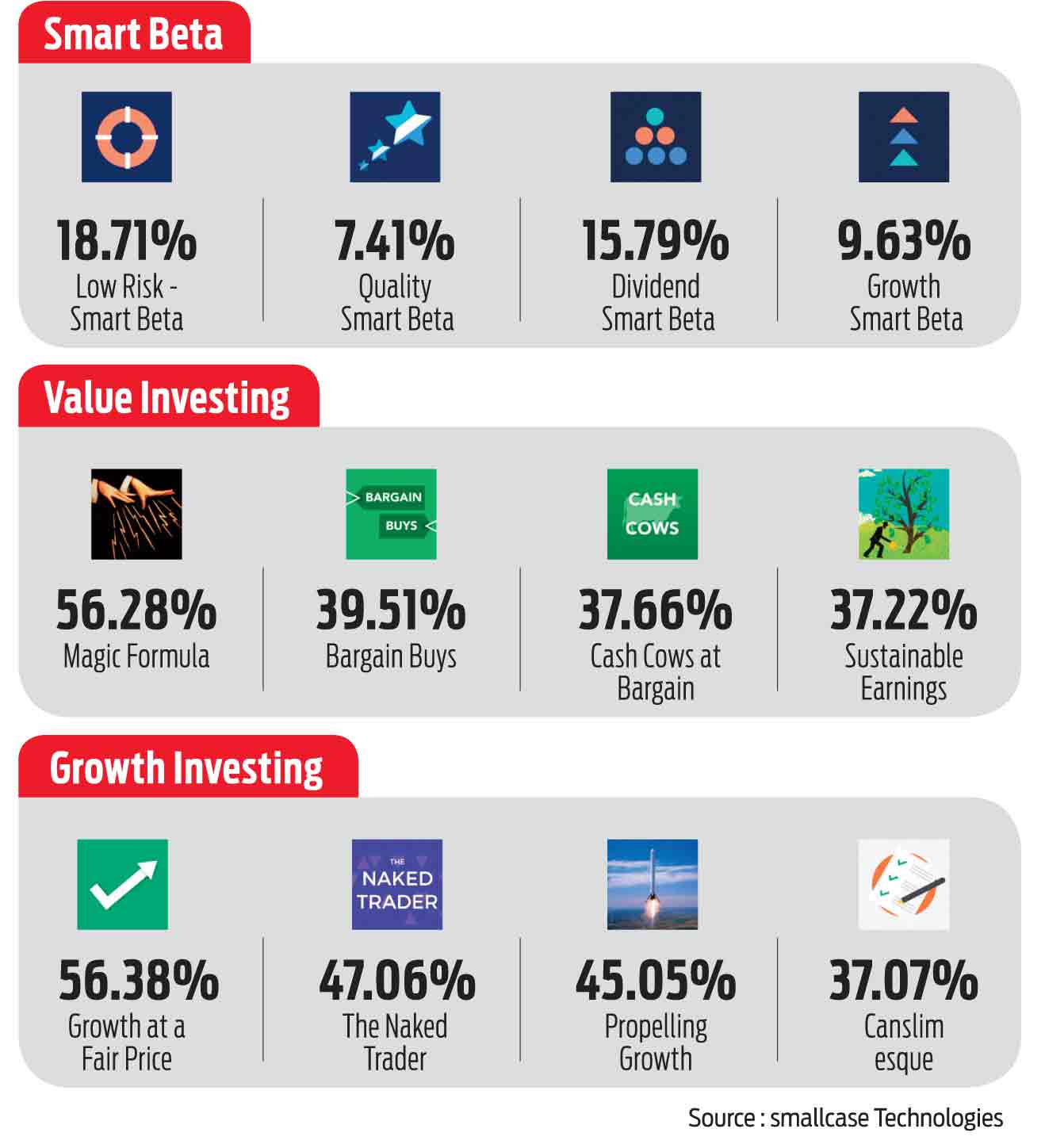

Furthermore, on expansion, Shrivastava said, mix of readymade smallcases has expanded beyond just thematic. “We now have smallcases that cater to different risk profiles, asset allocation (a portfolio that gives equity, fixed income and gold exposure via ETFs), smart beta strategies (large cap focused smallcases with an objective to beat the markets in the long-term), and also smallcases based on sectors and strategies like growth, value and momentum,” he informed. All the smallcases come with a risk label, so that the investors can buy as per their risk profile, he added.

Ayushi, 27, Product Manager, OLA, said that she is very happy with the investment experience at smallcase. “My investments are confined to ELSS - mutual funds - only for tax reasons. Since the last three years, I am preferring smallcase for wealth creation,” she said. Currently, her investment in smallcase is around Rs2.5 to Rs three lakh. Even Rohan, 32, multi-family officer at Mumbai, said that he has diverted major tranche of his savings from mutual funds to smallcase, as it `provides better returns.

On revenue model and in comparison with mutual funds, Gupta said that smallcase takes a flat fee on transactions from the brokerage. “The investor only pays when they transact - making it a lot more cost-efficient compared to paying a mutual fund a daily expense ratio,” he said. Furthermore, he said that benefits like flexible and transparent portfolios, fixed investment mandate, quick redemption and higher returns make this investment class much desired over mutual funds. Currently, there are more than two lakh investors.

suyash@outlookindia.com