Indian equity markets have been volatile since February this year. Market has corrected over 10 per cent. Analysts are attributing this volatility to compulsions at international and domestic levels. However, there are certain regulatory measures, which too have added fuel to the fire.

SEBI in its October, 2017, circular had announced reclassification of mutual fund schemes. According to the circular, it has defined large, mid and small cap companies as per their market capitalisation. The mutual funds, according to SEBI, would have to rebalance (churning) their portfolios (if required) in line with the updated categories. The required changes were done in the first few months of Financial Year (FY) 2019 and accordingly, Asset Management Companies (AMC) have altered their schemes. It is to be noted that during this alteration, AMCs gave free exit load for withdrawal, which could otherwise be charged - if those exits would have occurred within the stipulated period. As per Association of Mutual Funds in India (Amfi) data, the net inflow during this period has reduced and there has been some withdrawal from the schemes. Refer to table 1 for net inflows in equity mutual funds.

Foreign Portfolio Investors (FPIs) have withdrawn left, right and centre in this period. The market is upheld by domestic investors and the reclassification, which was aimed at bringing clarity to the investors, might have just proved one of the many trigger points for escalating market volatility.

Referring to the SEBI move to reclassify the mutual fund schemes and redefine various categories by fixing the holding limits, CEO of a leading AMC, who did not wish to be identified, said, “More study (research) should be done on the subject. The question that should be asked is, whether the investors are aware of the changes that have been put in place. I doubt.” He further explained that the move has radically changed few funds but they are not explaining it to their investors. Before the reclassification came into force, there was no strict adherence to the holding limits with respect to small, medium and large stocks in the scheme. The definition of small, medium and large cap stocks used to differ from one fund manager of one AMC to that of another fund manager of a different AMC. This has drastically changed following the SEBI directive.

However, a senior official of a large distributing company said, “Even in the new set up, fund managers have the flexibility to decide on the holdings. For example, it is mandatory for them to invest 80 per cent of the corpus in the large cap stocks, but they still have the flexibility to invest balance 20 per cent either in mid or small cap or in a combination of two.” This distributor has a significance presence in retail resource mobilisation. According to him, the reclassification will make asset allocation orderly and will help the investors and their advisors in comparing apple with an apple, which was not the case earlier.

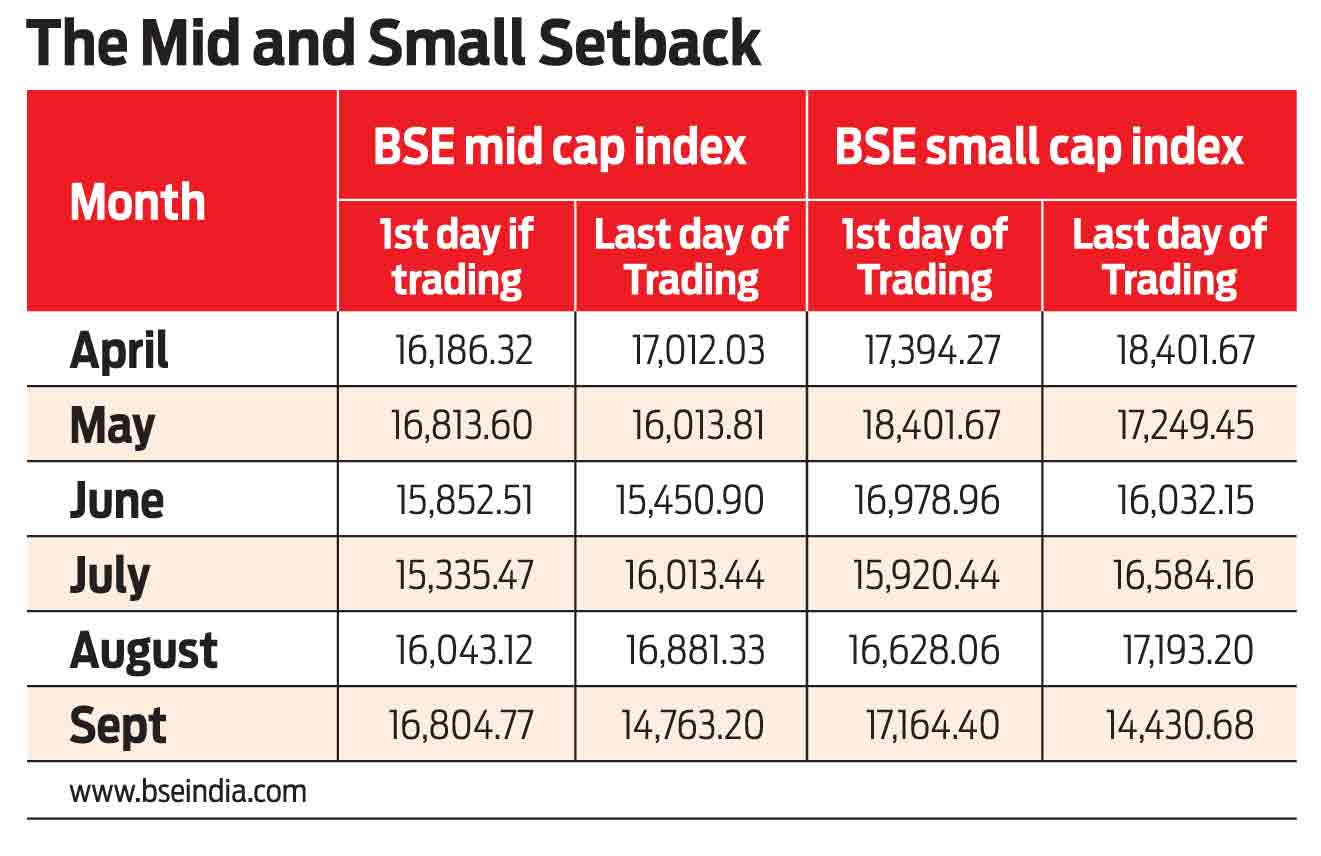

As the earlier regime was full of ambiguity, we witnessed buying across the board. This was the main reason for the buoyancy in the small and mid cap stocks during 2016-’17. The market regulator’s intent to bring order in the cap holding also shrunk the universe of stocks under each defined category. SEBI not only came out with the sub categories in equity, debt and hybrid categories, but it also defined scheme characteristics under each categories specifying holding ratios and also giving taxation treatment for each sub-category. Anticipating this ahead of time, the smarter fund managers began their gradual exit from the small and mid cap stocks, which have corrected significantly over the last 12 months.

suyash@outlookindia.com