Company Name: IndusInd Bank

CMP: Rs 1,147

Market cap: Rs 88,978 crore

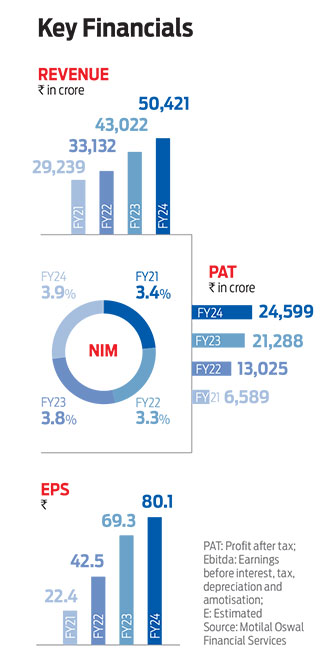

Banks are in a sweet spot as a multitude of factors are helping them improve the return on assets (RoAs). On the one hand, proactive recognition, bounded stress pool, reasonable buffer, and strong capital position place banks in a structurally better space. On the other, given cyclical tailwinds at play, improving loan growth, better net interest margin (NIM) and lower credit costs are helping banks deliver strong earnings growth with better RoAs.

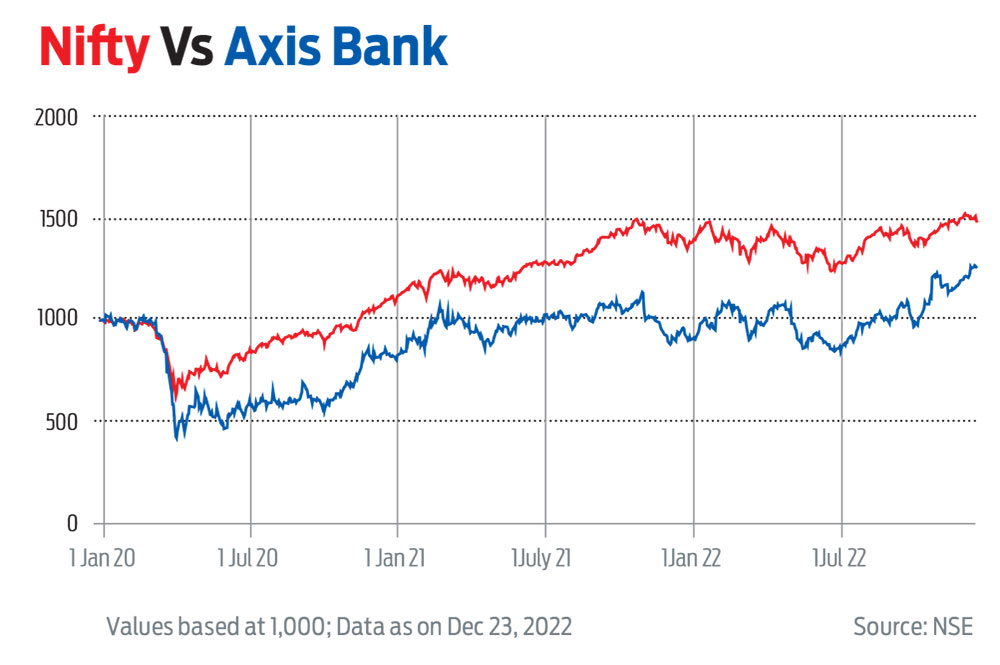

In this context, banks have seen some re-rating, which we expect to sustain as operational dominance rises. While most banks have already been re-rated, Induslnd is a little late to catch up. That's because it has underperformed the broader market (flat on a three-month basis) and still trades at more than 20 per cent discount to its five-year average multiples (in contrast to other top frontline private banks).

There are essentially three concerns here: a) impact of rising deposit cost on relatively weaker liability franchise leading to NIM pressure; b) the Reserve Bank of India (RBI) nod for management continuity; and c) impact of the promoter feud.

We believe these are likely to course correct in the near term for reasons listed below. This, along with strong earnings traction, will lead to its re-rating.

The first issue is the rising cost of deposits on relatively weaker liability franchise leading to pressure on NIMs. Given the liability orientation, we believe the incremental cost pressures will reflect in the near term. So, while other banks will surprise positively in the near term, IndusInd may deliver steady NIMs, leading to relative underperformance.

That said, with liability repricing likely by FY23, and winding down of the relative underperformance of NIMs, given higher fixed-rate-plus-MCLR book, we believe IndusInd will report better margins.

Note that the bank has not yet taken any hikes in the microfinance (MFI) book compared to other players who have taken a 150-200 basis points (bps) price hike. We expect it to go for rate hikes. Moreover, IndusInd still sits on a liquidity buffer, which is expected to unwind, and will be another positive bias for NIM delivery. Even structurally, it has come a long way in establishing a stable franchise with dependence on granular and stable funding avenues versus the last cycle (focus on more granular retail deposits) which is still underappreciated by the street.

The second issue is the management’s continuity. The bank has already received board approval for an extension of three years; we believe RBI’s nod will come closer to the date. Looking at recent experiences, RBI generally intervenes in case of any misalignment with the bank, with the expectation of course correcting those. We believe there have been no major interventions and, thus, the likelihood of RBI approval and continuity is higher.

The third concern is around the impact of promotor family feud, if any. With the promotor entity of IndusInd having 600-plus shareholders and the family dispute close to settling, as per media reports, we believe this concern will also abate in the near term.

Overall, while the concerns are genuine, they are stretched beyond our liking. We believe IndusInd has passed the consolidation phase seen in recent years and will continue to deliver on earnings. Besides structural changes, it is poised to capture on cyclical earnings tailwinds. It has built ample contingency buffer apart from over 70 per cent coverage, which will rein in credit cost.

Note that among the major frontline banks, IndusInd has scope for bettering credit cost (for others its already running below long-term averages), which apart from operation levers will provide a leg-up to the RoA and return on equity (RoE) delivery. In the last quarter, its RoE touched about 15 per cent with no one-offs, which gives confidence. We believe that scaling growth, improvement in liability and better return ratios would help a re-rating to buy. With favourable conditions in the financial market and strong credit growth, Induslnd may see bettter performance in the future.