Banking On Tailwinds For Profits

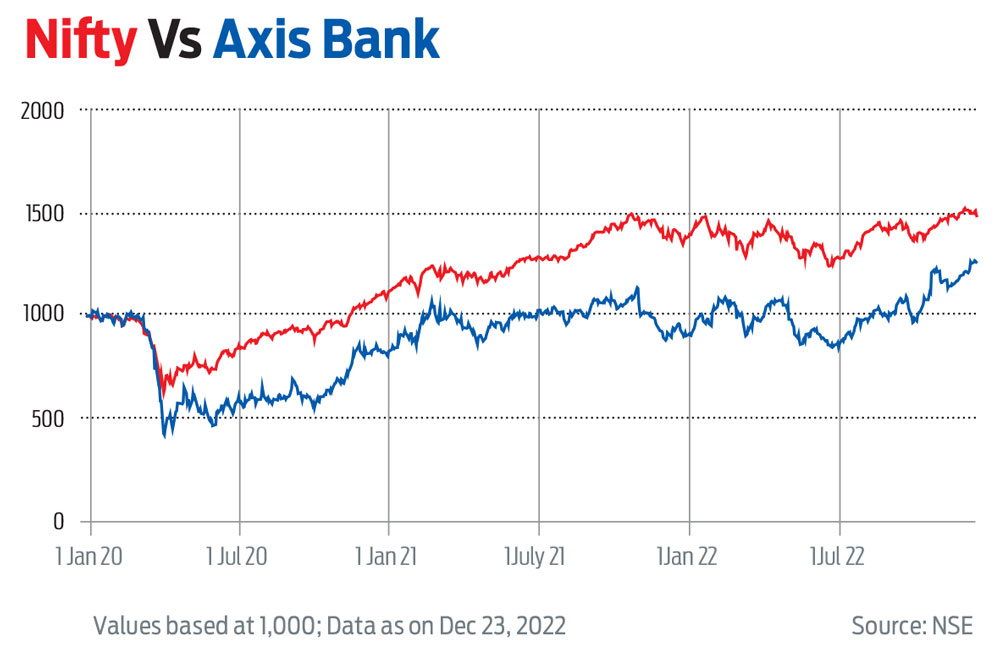

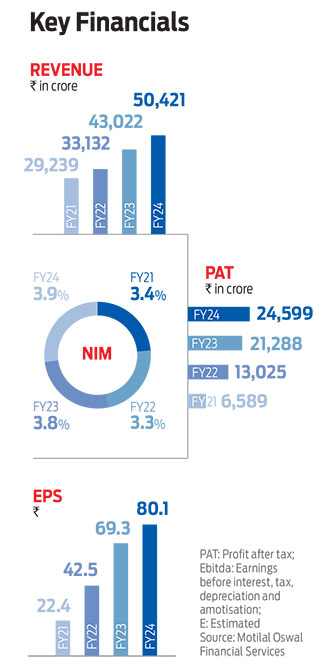

Company Name: Axis Bank

CMP: Rs 906

Market cap: Rs 2,78,704 crore

Over the past many years, the Indian banking sector saw low loan growth and high credit cost, which dented profitability. But now it is well set to deliver higher loan growth and lower credit cost. The economic environment also bodes well for delivering healthy performance.

Axis Bank is the third-largest private bank with a balance sheet size of Rs 11.8 trillion and total advances and deposits of Rs 7.3 trillion and Rs 8.1 trillion, respectively, as of September 2022. Over the past few years, its net profit declined from Rs 82.2 billion in FY16 to Rs 2.7 billion in FY18. It was further impacted by Covid in FY20 and it delivered a modest profit after tax (PAT) of Rs 16.3 billion.

In FY22, the bank's loan growth improved by 15 per cent, while its credit cost moderated to 0.8 per cent against 4.1 per cent in FY18. As a result, Axis Bank reported net profit of Rs 130 billion in FY22 and delivered return on assets (ROA) and return on equity (ROE) of 1.2 per cent and 12 per cent, respectively, versus 0.2 per cent and 2.1 per cent in FY20. Further, it reported a strong Q2FY23 performance with a sharp expansion in margins to about 4 per cent, while the ROA and ROE improved to 1.8 per cent and 18.5 per cent, respectively.

Axis Bank remains focused on building a stronger, consistent, and sustainable franchise. Loan growth is primarily driven by the retail book, which saw a compounded annual growth rate (CAGR) of 18 per cent over FY19-22, while small business banking and rural loans registered a robust CAGR of 49 per cent and 23 per cent, respectively. Its mix of high yielding retail loans also increased to 22.6 per cent in Q2FY23.

The loan growth is expected to sustain over the medium term at 16 per cent CAGR over FY22-24. On liabilities, the bank is focussed on building a granular franchise with ‘CASA + Retail TD’, which forms 82 per cent of the total deposits (TD). This has allowed the cost of deposits and cost of funds to moderate to 3.8 per cent and 4.1 per cent, respectively, which are comparable with peers. As 68 per cent of all its loans are floating, it can offset the rise in funding cost. Coupled with rising mix of high-yielding loans, this would support margins.

On the technology front, Axis Bank has been continuously investing in business and building digital capabilities to support growth. About 51 per cent of its incremental operating expenditure over the past one year has been towards investment in technology and business, as it added about 7,500 employees and 164 branches in FY22. The retail loan mix has increased to 58 per cent, which coupled with expansion in the credit cards business has resulted in elevated operating expenditure with cost to assets at about 2.2 per cent over FY22.

While the bank will continue with investments, revenues are likely to grow faster than opex, which coupled with improving efficiency, will result in gradual reduction in opex ratios. Thus, the bank expects to bring down the cost to assets to about 2 per cent by the end of FY25.

The stock price touched a new high of Rs 950 in December 2022. The bank has progressed well and has strengthened its balance sheet. It also achieved its aspiration of a consolidated ROE of 18 per cent in Q2FY23 and with sector tailwinds ahead, it remains well on track to deliver a sustainable ROE of 18 per cent over the medium term, and ROA and ROE of 1.8 per cent and 18.1 per cent, respectively, in FY24.

***

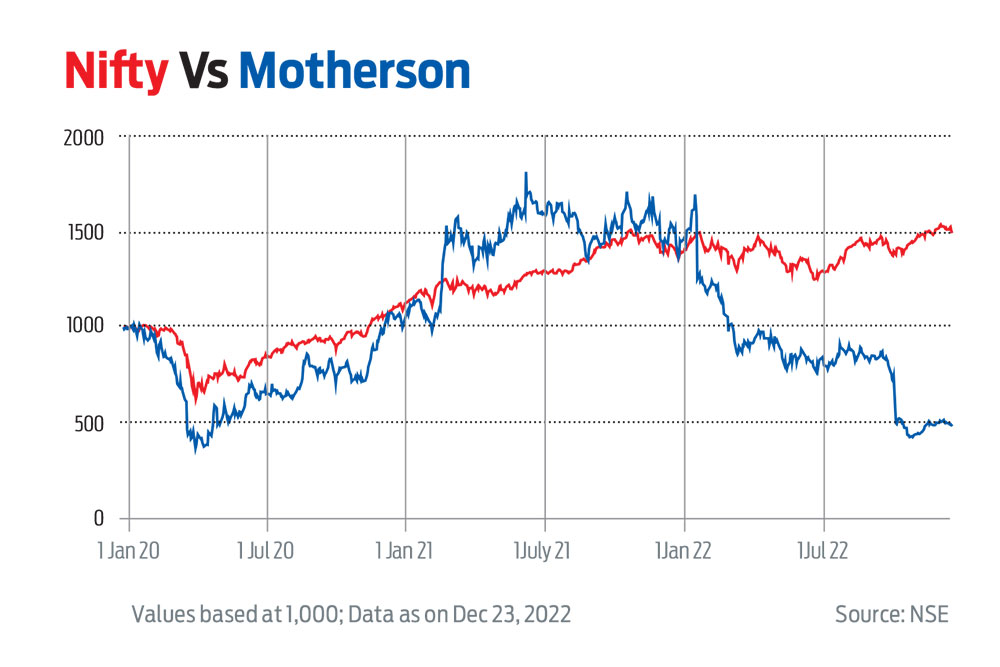

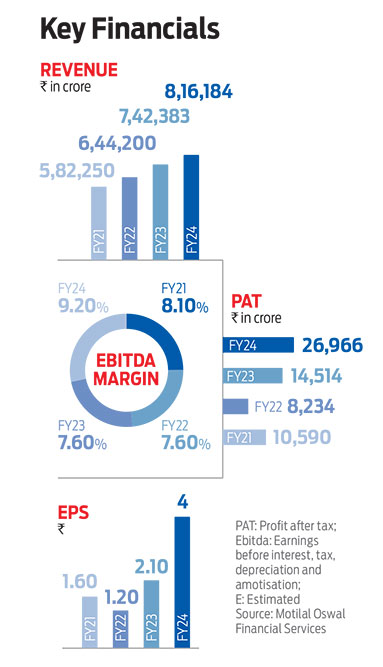

Steering On For Top Speed Run

Company Name: MOTHERSON

CMP: Rs 66

Market cap: Rs 45,333 crore

Samvardhana Motherson International (Motherson) is among the leading original equipment manufacturers (OEMs) to global auto majors. It came into being in 1986 through a joint venture (JV) with Sumitomo Wiring Systems and Sojitz Corporation of Japan as a single product (wiring harness) company. Since then, it has expanded into polymer products (through Samvardhana Motherson Peguform or SMP), automotive mirrors (Samvardhana Motherson Reflectec or SMR), wiring harness for commercial vehicles through PKC Group and elastomers. Other categories include precision metals and modules, technology and industrial solutions, logistics solutions, lighting and electronics, aerospace, health and medical and services. In 2020, it demerged its domestic wiring harness division into a new company—Motherson Sumi Wiring India Ltd (MSWIL). Motherson now holds 100 per cent stake of SMRP BV (which includes both SMR and SMP businesses) and 33.4 per cent stake in MSWIL.

India and the US contributed 18 per cent each of consolidated revenue in FY22, followed by Germany (16 per cent), China (13 per cent), Hungary (6 per cent) and others (more than 5 per cent each).

In the last few years, Motherson was adversely impacted by internal company issues, and tough operating environment. As a result, its stock underperformed the NSE Auto Index by 62 per cent and 72.5 per cent over one and three years, respectively.

Higher inflation, rate hikes by central banks, global supply chain disruption in the automotive industry due to semi-conductor shortages, Covid, and geo-political issues have impacted it. However, the global automotive supply chain is gradually regaining normalcy. Global passenger vehicles production grew 28 per cent year-on-year (y-o-y) and 11 per cent quarter-on-quarter (q-o-q), in Q2FY23.

Motherson’s operating performance is now expected to recover on the back of improving supply, stable costs, and increased demand. A substantially lower channel inventory also lends to medium-term visibility for demand. In fact, key global OEMs have indicated a healthy order book, especially in the premium vehicle category and Motherson is set to benefit from this global recovery, given that 76 per cent of its consolidated revenue comes from international business. The mega trends being witnessed in the global automotive industry are also expected to beneft the company, going forward.

Increase in the product line would be an important driver of growth for Motherson. This is likely to be driven by trends such as premiumisation (increase by 10 per cent to 200 per cent across businesses), rising SUV mix (increase by 50 per cent to 200 per cent increase), and electrification (increase by 40 per cent to over seven-fold increase). A strong order book and improved supply will cushion against macro headwinds and prevent sharp dip in volumes.

The global business, namely SMR (over 17 per cent CAGR over FY22-25), SMP (over 11 per cent CAGR), and PKC (over 5.6 per cent CAGR) is expected to show good growth, despite factoring in for the impact of commodity cost deflation. This recovery would be supported by the strong order book for SMRP BV. Motherson is well poised for a strong recovery, led by normalisation of production. With improvement in supply side issues (driving operating leverage) and correction in key commodity prices, it is expected there will be a sharp recovery in profitability for key businesses. At a consolidated level, net sales, earrnings before interest, tax, depreciation and amotisation (Ebitda) and profit after tax (PAT) are likely to register a 10 per cent, 21.5 per cent and 63 per cent CAGR, respectively, over FY22-25.

This would drive down net debt from about Rs 85.5 billion in Q2FY23 to marginal net cash by FY25. With high operating leverage, reasonable financial gearing and no risk of EVs, Motherson remains the preferred pick in the auto component industry.