The fear of recession still looms large over the developed nations, where inflation still remains beyond tolerance levels. After the collapse of some banks in the US and Europe, it has now become more challenging for banking regulators across the world to tame inflation without causing too much collateral damage to the economy.

On the domestic front though, inflation has started softening. It came down to 4.7 per cent in April 2023, closer to the tolerance band of 4 per cent set by the Reserve Bank of India (RBI). Experts believe that if inflation continues to soften, RBI may get room to ease interest rates.

Low inflation and falling interest rates are critical for sustainable growth, and those factors bode well for both equity and debt mutual funds.

But the market continues to remain volatile, and in this scenario, it is always better to keep a tab on your investment to ascertain if it’s on track or has deviated from the path you had expected it to take.

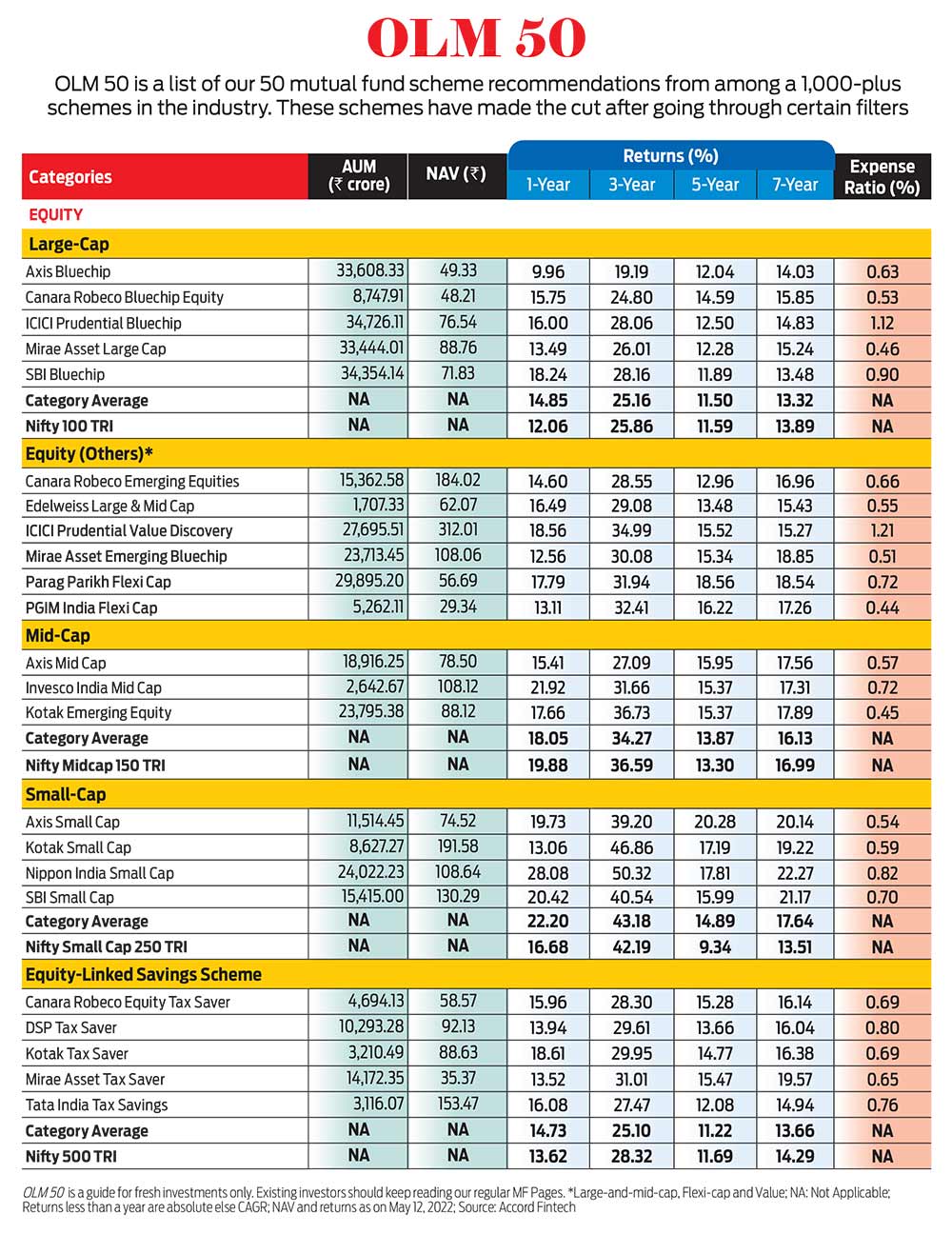

The OLM 50 basket of curated funds completed a year in May 2023. Last year, we re-launched it for the benefit of our readers, and it’s time now for its second half-yearly review.

To reiterate, the funds in the OLM 50 basket may not necessarily be the best performing. Our objective here is not to offer readers the hottest scheme of the year, but to choose a consistent performer across market cycles after applying relevant filters and parameters.

The Need For Review

There are times when you invest in the best performing funds, but they become laggards after a point due to multiple factors. This can affect the portfolio’s efficiency in reaching the financial goal for which you may have invested. So, reviewing the funds in your basket regularly is important.

According to experts, reviewing the performance of your champion mutual fund schemes should neither be done too frequently nor delayed for too long.

Striking the right balance in the frequency of performance reviews is the key to maintaining a well-managed investment portfolio. Frequent monitoring can cause unwarranted concern and even impulsive investment decisions based on short-term volatility. On the other hand, delaying performance reviews for an extended period can result in missed opportunities or the inability to address underperforming funds in a timely manner.

To ensure we don’t fall in either trap, we review OLM 50 after every six months, so that you know if the fund you have chosen from the list is still suitable or not.

Here is a report card on the various categories.

Equity

Large Cap: This category has been in the spotlight for a while now because of the underperformance of the funds in it. But despite market volatility and indications of underperformance, the majority of large-cap funds in OLM 50 have outperformed the broader index Nifty 100-TRI and the category average.

Out of the five schemes we have listed here, three have outperformed the benchmark—Canara Robeco Bluechip Equity, ICICI Prudential Bluechip and SBI Bluechip. Two others, however, have underperformed the Nifty 100-TRI index; these are Axis Bluechip and and Mirae Asset Large cap.

We found a wide gap in the performance of the benchmark and Axis Bluechip fund, but decided to keep it in the list, considering its past record of bounce-back and guidance of better performance in the future.

Says Jinesh Gopani, head of equities, Axis Mutual Fund, “In a typical 5-7-year market cycle, there are times when the value style of investing takes centrestage. At others, the growth style dominates. Growth style typically underperforms during high inflationary scenario like now and as a fund house, we follow the growth style of investing.”

“Our portfolio is aligned to the existing market opportunities and that can help investors take advantage.”

Other categories: The schemes in other equity sub-categories such as mid-cap, small-cap and equity-linked savings schemes (ELSS) are on track and performing well. We are, however, closely tracking a couple of other schemes in the large- and mid-cap space and ELSS category and may consider including them in the future.

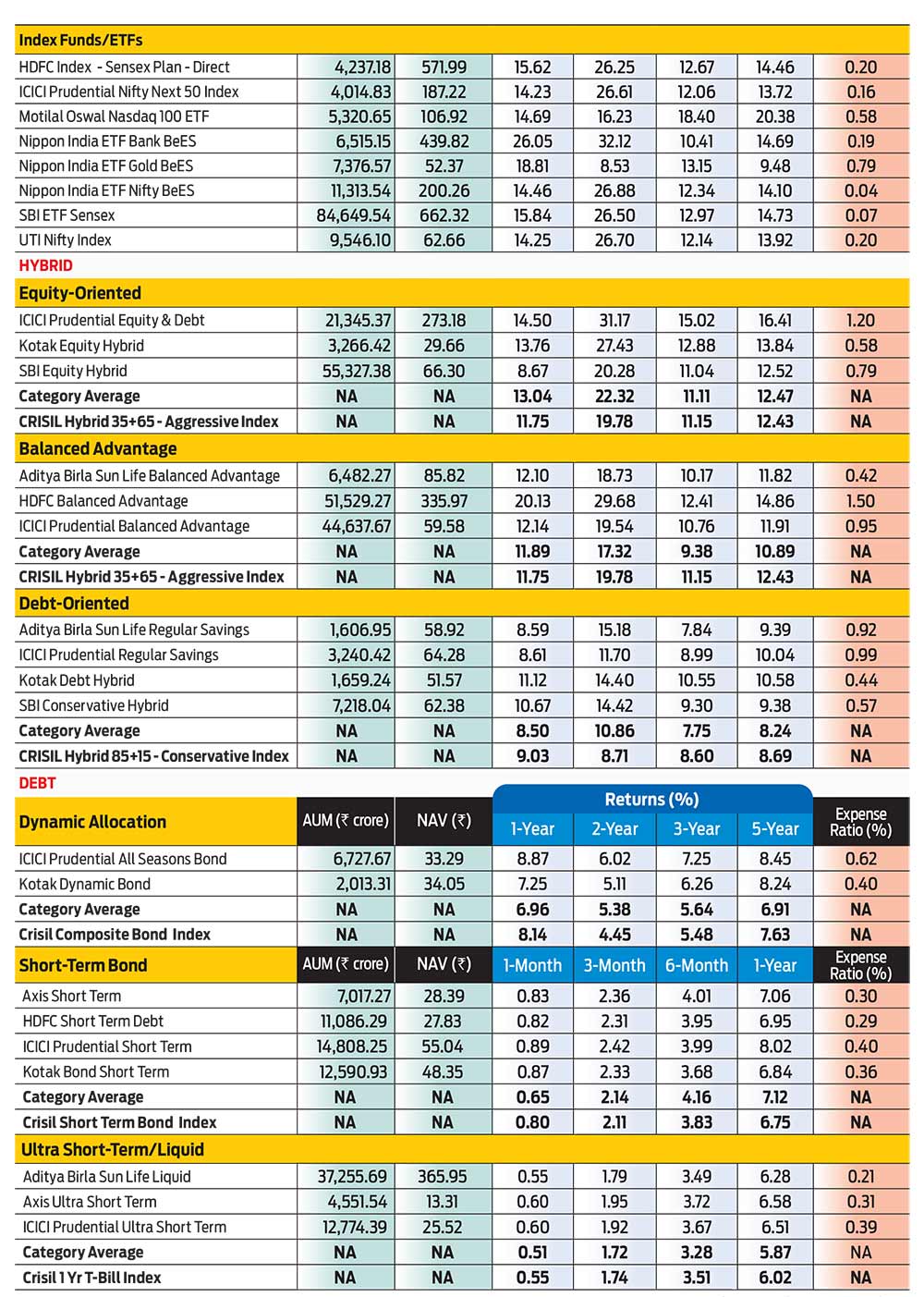

Debt and Hybrid

On the debt front, the market will closely watch out for RBI policy action in June. Experts believe that if the trend of falling inflation continues, RBI may cut interest rates, which may benefit debt funds. But debt funds now fall short in terms of the taxation benefit.

From April 1, 2023, the indexation benefit on long-term capital gains (LTCG) from debt funds has been withdrawn. There are no changes in debt funds in the OLM 50 list as all them still merit a place on the list.

As equity has turned volatile and the debt category offers better opportunities and given that we are closer to the peak of the interest rate hike, hybrid funds will offer better opportunities to tackle both volatility and take advantage of reversal in the interest rate cycle. Equity-oriented hybrid funds and balanced advantage funds are in the sweet spot now because of their ability to encash the market opportunity in both the equity and debt spaces.

If you are a new investor and are just being introduced to the OLM 50 list, rest assured. The list can help build a consistent portfolio as per your needs. Besides, you will also get a regular review every six months.

***

OLM 50 Methodology

The basket of 50 funds that is OLM 50 has been chosen after much care and deliberation. The cut-off date for our analysis was March 31, 2023, and we have considered categories defined by the capital markets regulator, the Securities and Exchange Board of India. We have only considered direct growth plans. Accord MF database was used for all the data and analysis.

Filters

We used two ?lters to reduce the number of funds. We have only taken schemes with assets under management (AUM) of at least 10 per cent of the respective category’s average corpus. For instance, if the category average AUM was Rs 1,000 crore, we did not consider schemes with an AUM size of less than Rs 100 crore in that category.

The other filter that we used is the number of years considered for the performance track record. We have only taken funds that have at least three years of track record.

Parameters

Equity Funds: Equity funds were evaluated on three key parameters: risk-adjusted returns, downside risk and the fund manager’s stock-picking acumen. We considered these parameters keeping in mind the retail investors’ risk-averseness as well as the fund manager’s ability to deliver returns.

We considered the fund managers’ track record with the respective schemes. For this, we evaluated other schemes managed by the fund manager to ensure consistency of performance and strategy. For managers who started managing funds only in the last one year, we evaluated the past track record with other funds.

Debt Funds: We evaluated all debt funds on risk-adjusted returns and their credit quality (the score of investments in sovereign plus AAA/P1+ rating was evaluated and given due weightage) for three years. These ratings stand for relatively high safety and less risk.

kundan@outlookindia.com