What is your view on the Indian pension landscape? What is its future?

The pension coverage in India is quite low, partly because more than 90 per cent of the workforce is in the informal and unorganized sector, where people are not entitled to workplace-related pension.

There are different players in the market who are providing pension, such as annuity from insurance companies and some retirement solutions from mutual funds. Now, we have NPS and Atal Pension Yojana (APY), too.

Because of these two—NPS and APY—pension is now accessible to even people in the unorganized sector, and anybody can afford to have a pension.

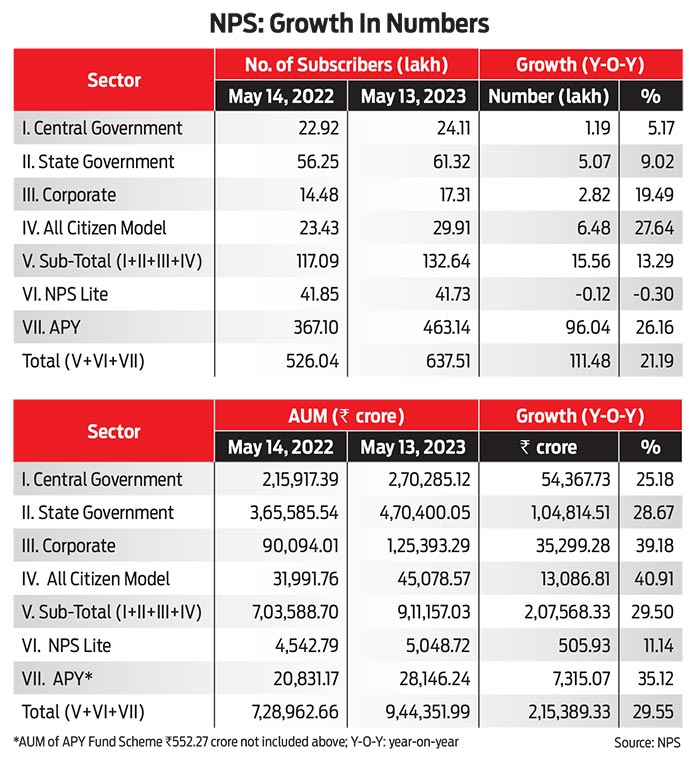

This is being primarily driven by APY, which has about 46.3 million subscribers; there are 13.2 million subscribers in NPS. But there is more potential, so the aspiration is to ensure that everybody gets a pension.

Do you think NPS has a large role to play in providing pension to the unorganized sector?

Absolutely. NPS has a flexible design and it’s a good scheme. Earlier, only those in government services had access to pension. Though NPS was also meant for only the government sector initially, it was extended to individuals later and then to the corporates. Now, anybody can be a part of NPS and can access similar schemes, depending on the risk tolerance. So, yes, NPS has a much larger role to play.

You have recently taken over as PFRDA chairman. Are there any changes that we’ll see during your tenure in the NPS?

I would say it’s a continuity, but there are a whole lot of things that need to be done. We will have a sharper focus on certain aspects.

There will be higher emphasis on pension literacy through focused initiatives and by roping in multiple stakeholders.

Though a lot of corporates have taken up NPS, the uptake of the scheme by employees is still low. We will reach out to the corporates through trade bodies—we’ve already been doing that, but we will scale it up. We will also scale up through our intermediaries, such as the points of presence. We also have retirement planners who can spread pension literacy. Pension entities can also employ agents, who can then spread the word.

Another important aspect is digital content. We are trying to disseminate information as widely as feasible on the digital side. And it’s a much better way to reach out to the youngsters.

What's your view on the debate between NPS and OPS? Some states have already reverted to OPS. Will it affect the uptake of NPS?

I don't think it will affect the uptake of NPS. Despite the debate and discussions on NPS versus OPS, the number of NPS subscribers is increasing in states, and even the corpus is going up.

When we talk about the nature of the schemes, the distinguishing factor is that NPS is self-funded, unlike OPS, and NPS came into being because that kind of scheme (OPS) is not sustainable. Even, globally, countries that have defined benefit schemes are struggling.

At the end of the day, OPS seems more attractive because people don’t have to pay anything from their own pockets. So, how does the system plan to convince people about the unsustainability of OPS and change the narrative?

Recently, a committee has been set up under the finance secretary that will deliberate on some of these aspects and come up with some additional thoughts as well. One could look at how NPS can be improved for the public sector and the government employees.

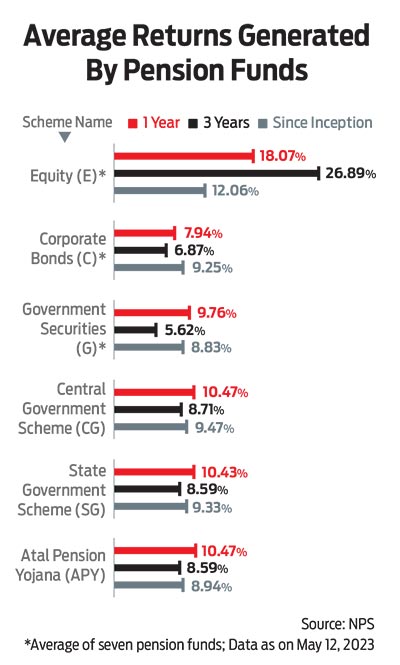

There are two-three things to work with. One is the amount paid after retirement. For that, awareness about how the scheme is performing in terms of returns needs to be spread, as the returns are quite good. If we look at the equity scheme, it has given about 12 per cent returns since inception. Overall returns have been upwards of 9 per cent, which are quite good and can be optimised by applying some reasonable assumptions.

OPS gives about 50 per cent of the last salary as pension. With reasonable assumptions, such as a fairly long period of working like 30 years, and assuming full contribution in NPS is annuitised, the payout may be equal to 50 per cent of the last salary even in NPS. Those things need to be highlighted.

Two, the concern about assured returns needs to be addressed because NPS is market-linked. This, too, is a question of awareness.

People need to be made aware that if you can ride the market cycles, which is normally five to seven years, you can expect better returns. And, effectively, if you can wait out the market cycles, the returns could be called stable. The same thing happens with systematic investment plans (SIPs) of mutual funds if you remain invested for a reasonable period of time.

But this concern is quite legitimate, as people think that they’re taking too much risk and there’s no certainty.

Last year, PFRDA had said it was looking at a minimum assured return scheme. Is that still work in progress? How will such a product address the concerns of equity-linked returns?

The minimum guaranteed scheme is very much under consideration, and we are looking at its various aspects. Obviously, the challenge would be to give a reasonable return that is attractive, while also managing the risk in the whole process.

The pension product is a low-cost-high-return one, compared to other similar products, but if you are giving assurance, risk management becomes important.

For assurance, one will have to get into government securities and bonds, and there will be issues of interest rate risks, too.

Pension funds, which are pass-through vehicles and thinly capitalised, would need to bring in additional capital layers so that there is solvency capital.

This will ensure the risk doesn't seep into other aspects. An appropriate capital requirement needs to be fixed, depending on the investment choice that the pension fund is making.

All that needs to be balanced. It also means, when you get an assurance or guarantee, there will be a cost to pay.

Will this cost get transferred to the investor to some extent?

Yes, to some extent. But having borne that cost, the pension fund will need to provide some stability as well as maintain a reasonably attractive return to ensure that it gets traction. This will, of course, come as an additional product.

NPS allows investors to withdraw only 60 per cent of the corpus as lump sum, and the rest is annuitised. But the problem with annuities is that the returns are very low, which go down further when inflation and taxation are considered. At any point, would NPS think of bringing its own annuity product that is more efficient?

At present, the returns from annuities for joint life products is around 8.5 per cent. While that's not bad, it needs to improve. Annuity depends on several factors, such as longevity, and the existing and anticipated interest rates.

Annuities are under the purview of the Insurance Regulatory and Development Authority of India (Irdai), and we have taken up with them to consider variability and flexibility in how annuity products are bought. So, one could consider the option of switching from one annuity product to another, which may be more favourable.

As far as solutions within NPS are concerned, considering that annuity products apparently give lower returns, people may want to stick to pension funds that give higher returns in comparison.

For such people, we can have the option of a systematic withdrawal plan (SWP), but as of now there are restrictions. So, we have also asked for an amendment to the statute concerned so that we have an additional pension product which allows SWP after retirement. In a way, it can become a competing product to annuities.

As of now, we have the flexibility to play with the lump sum part. So, the 60 per cent corpus that is supposed to be withdrawn as a lump sum may have the SWP facility. We are in the process of exploring that.

Through the SWP function on the 60 per cent lump sum, there can be an option to get regular income.

Then there is the option to stay in NPS till 75 years of age, wherein you are letting the product reinvest your money for you.

Over the years, NPS has started providing a lot of tax benefits, including the additional benefit of Rs 50,000 under Section 80CCD (1B). But with the government moving towards the new tax regime, which does not offer most deductions, will the uptake of NPS get affected?

We do notice a seasonality in NPS subscriber data, as there’s a pick-up in the last quarter, as some people come in purely due to tax considerations. Last time, we saw a dip in the numbers during that time. However, if you look at the annual figures, there were a million new NPS subscribers (individuals and corporates) compared to 9.7 lakh in the previous year.

I don’t see the new tax regime as a negative for NPS. That’s because all other tax-saving instruments will be affected by it. Once people start looking at products for their merit, people will choose NPS. A retirement product is essential for everyone and considering the returns and flexibility, NPS will win.

So, despite the initial dip, NPS will grow on its own merit.

What’s the way forward for NPS?

There is a lot of potential for NPS to grow. First, it is available for everyone, whether they are in the formal or informal sectors. As of now, there may not be enough women under NPS, partly because there are fewer women in the formal sector, so that’s an area for growth. Women can buy NPS on their own, or spouses can buy it for them.

One retirement plan for the head of the family may not be enough, so one can buy for the spouse and even for children or parents.

NPS also needs to target the professionals and the self-employed. For instance, those engaged in agriculture, where income streams can be uncertain.

Also, as India transitions from a middle-income to a high-income country, greater demand will be created for NPS going forward.

The importance of pension products will only go up, as previously, joint families used to provide a safety cushion, but that has changed now.

nidhi@outlookindia.com