As living and working patterns continue to evolve, a lot of people in the mass affluent segment prefer greater flexibility in their living spaces that not only makes them more comfortable, but also more functional in their day-to-day life.

A slick and premium look, availability of high-end amenities and latest technology, and a perfect view of green spaces and open landscapes have become common asks for those who can afford to pay for them.

To cater to this demand—though only among a select group of clientele—developers are now coming up with more luxury home projects.

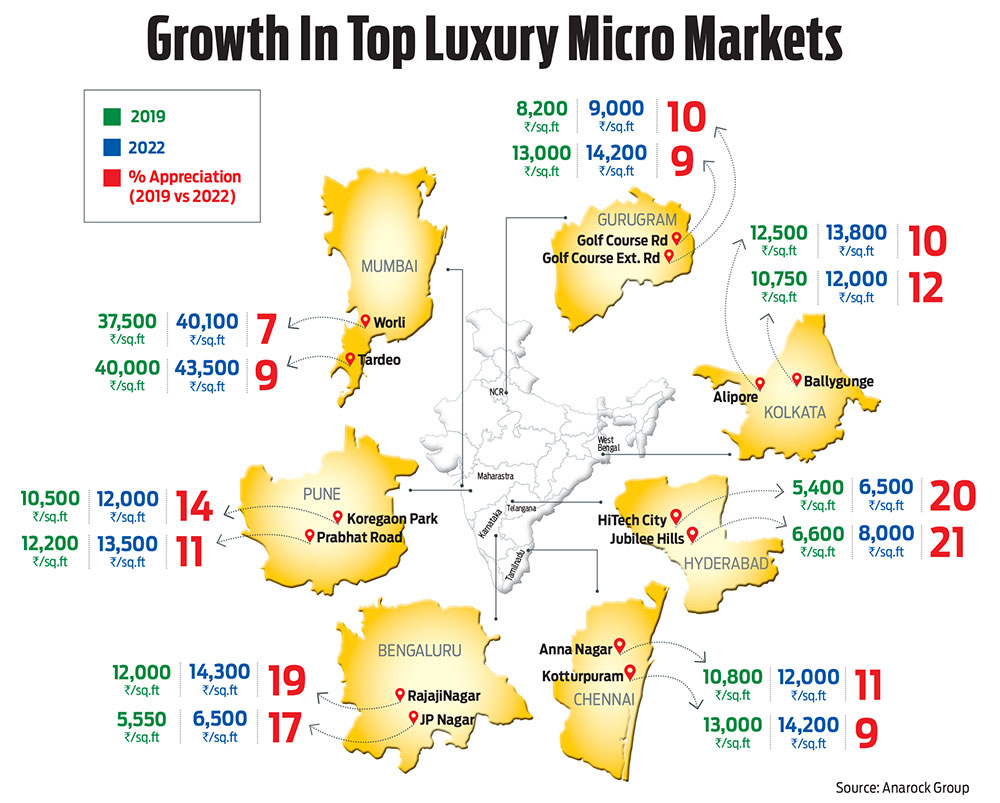

Says Vivek Rathi, director, research, Knight Frank India, a real estate consultancy firm: “The segment above Rs 5 crore can be referred to as luxury housing, and it is currently witnessing increased activity in terms of both sales and launches. Mumbai, Delhi NCR and Bengaluru are among the key markets for such new projects.”

Though there is palpable optimism and luxury projects promise a lot, being cautious is important in the Indian real estate market, given past experiences.

What’s Driving The Demand?

Among the major reasons that have given a leg-up to the segment were the learnings from the Covid pandemic. It had a positive impact on the luxury residential market as people recognised the importance of having larger and less crowded homes. With the rise of work-from-home and e-schooling, individuals required more spacious homes with additional rooms to create a dedicated workspace or study area.

“The transformation in the luxury real estate market is greatly influenced by learnings imbibed through the pandemic, which underscored the significance of living in a healthy environment. The successive lockdowns made it necessary for developers to reimagine the overall design to incorporate outdoor spaces in residential plans, and making living spaces more functional and comfortable,” says Cyrus Mody, managing partner, Viceroy Properties, a premium real estate developer based in Mumbai.

Also, the segment was economically least impacted by the pandemic, says Anuj Puri, chairman, Anarock Group, a real estate services company. “After Covid, luxury housing saw increased demand from homebuyers. Buoyed by this demand, developers also increased new supply in this category,” he adds.

In terms of new launches, data from Anarock Group indicates that as many as 25,770 units were launched in the luxury category (priced above Rs 1.5 crore) in the pre-covid year of 2019, which is about 10 per cent of the overall new supply (of approximately 237,000 units) launched in the year.

In 2022, the top-seven cities saw new supply of 60,250 units in the luxury category, which is nearly 17 per cent of the total new supply added in the top-seven cities, according to the data.

In luxury housing, safety, security and wellness aspects also play key roles. So buyers give a thumbs up to green and open spaces. Also, having health amenities within the complex helps save time and offers convenience.

“People have realised the need for homes with better amenities and wellness facilities. Housing societies with good social infrastructure allow residents to get all of these within the precincts, without them having to step out of the complex,” says Samantak Das, chief economist and head of research, JLL India, a real estate services company.

A new regulation in Budget 2023-24 states that if an individual sells a property or other assets, including equities, and the capital gains exceed Rs 10 crore, the maximum benefit they can receive when reinvesting it in another property will be limited to Rs 10 crore. Any capital gains over Rs 10 crore will be subject to taxes, starting April 2023.

This will directly affect the high-priced luxury housing segment. In fact, high net-worth individuals (HNIs) across top cities, including Mumbai, reportedly rushed to close luxury housing deals before the financial year ended in March 2023.

This will surely come as a setback for the ultra-luxury housing sector since there was no such restriction. Previously, HNIs and ultra HNIs used to reinvest most of their capital gains in ultra-luxury properties to save on taxes. But with that option limited now, some investors might feel discouraged to buy properties for investment purposes.

“However, to say that it will have a major impact on this segment is also not entirely true. The end-user demand may not be entirely impacted by this move; it may be felt more by the investment demand. Also, more than the primary market, I think the impact could be on the secondary market sales of the luxury and ultra-luxury homes,” says Puri.

What Should You Expect?

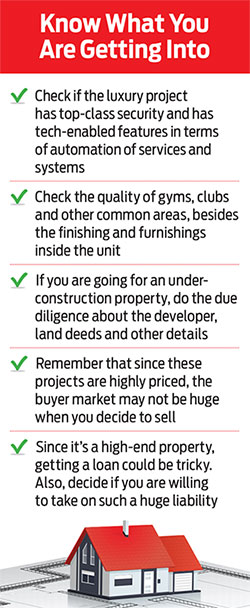

Just because an apartment complex has the tag “luxury” in its name, it does not mean it will have all the facilities that a typical luxury project will offer. It’s not uncommon to get hoodwinked by fraudulent operators. Here are some of the things you should watch out for.

Smart Homes And Security: When you are paying a high price, you can expect security to be top-notch. “The high-end real estate launches include advanced home automation systems that allow residents to control lighting, heating, and security systems from their smartphones along with advanced security systems, such as CCTV cameras, 24-hour security guards, and secure parking facilities, high-end amenities,” says Mody.

High-End Amenities: Luxury homes come with a range of high-end amenities, such as gymnasiums, high-speed elevators, high-ceiling construction, sky decks, and private gardens. “The major offerings include landscaped gardens, temperature-controlled pools, a premium clubhouse operated by a branded service provider, golf cart services, concierge services, valet, and professional housekeeping services,” says Das.

Premium Finishes And Furnishings: Luxury houses are usually constructed using premium building materials, such as marble, granite, and hardwood flooring. They also boast of bespoke kitchen and bathroom designs, reflecting a high degree of customisation and attention to detail.

Sustainable Homes: Consumers are increasingly getting drawn to sustainable and environmentally friendly spaces. Not surprisingly, “luxury real estate launches are increasingly incorporating green features, such as solar panels, rainwater harvesting, and energy-efficient lighting and appliances, with a greater emphasis on environmental sustainability,” says Mody.

Risks To Be Sure Of

The luxury housing market may be booming, but it is a big-ticket item, and it is important that you do your due diligence and look at the risks before buying into it.

Construction Risk: In the past, there have been cases when due to lack of funds or other reasons, the luxury segments of certain projects got stalled, even as the affordable ones were completed and sold out. Also, there have been instances where luxury housing projects have remained stuck for years.

For instance, Arohan, a luxury residential project on Golf Course Road, Gurgaon, launched in 2016, was stuck for four years owing to lack of funds, leaving many buyers with an uncertain future, before another developer stepped in to complete it. Two stalled luxury housing projects of Jaiprakash Associates Ltd (JAL) in Noida were also taken over by a new developer after being stalled for some years.

“One must buy from a branded developer, because not only does its value go up when re-selling, but also because construction-linked risks can be mitigated. Moreover, the location of the property also plays a key role here,” says Puri. Do your own diligence too, as even well-known developers have faced issues in the past.

Resale Risk: The other issue with luxury housing is that it may take longer to sell it in the secondary market. “As the market is flooded with options, new and first-entry units attract buyers more than resale units. Majority of the new projects being launched come up with new themes and better amenities, thus attracting potential buyers towards newer projects over older ones.

People are ready to move to the upcoming corridors in order to buy a fresh unit over a resale unit of the same value,” says Das.

Difficulty In Getting A Loan: Home loans for luxury housing projects are not easy to get. During the pandemic, the Reserve Bank of India (RBI) had reduced the risk weight for loans above Rs 75 lakh to 35 per cent from 50 per cent. There was an extension till 31 March, 2023.

A higher risk weight means that banks need to keep higher capital reserves when they lend, which may lead to a higher rate of interest for big-ticket housing loans.

Also, such loans have a loan-to-value (LTV) ratio of 75 per cent, which means that one needs to fork out 25 per cent of the property value as down payment.

“Luxury properties come with high price tags, and investing in them requires significant capital. This means that investors must have a substantial amount of money to invest. They should make sure that buying it will not put a strain on their finances,” says Amit Goyal, managing director, India Sotheby’s International Realty.

To sum up, be sure of your cash flows and assess all the risks before you choose to invest in a luxury project. Also assess the investment potential in light of new developments if that’s the purpose.

meghna@outlookindia.com