If fear of missing out (FOMO), the much-celebrated and somewhat over-used moniker that investors are bombarded with, ever finds a distant cousin, it would surely be pleasure of missing out (POMO). Whether we perceive it clearly or not, the rough-and-tumble world of retirement planning constantly exhibits many forms of POMO. Retirees and soon-to-be retirees sometimes delay gratification and wait for the right signals to arrive on the horizon before they zero in on allocations.

In the retail investments space, POMO has a particularly large following. ‘Missing Out’ is a strategic move that seasoned participants practise with regard to initial offers of all sorts—initial public offerings (IPOs) and new fund offers (NFOs) are prime examples. But not all primary issuances tempt them right at the beginning. Over-arching valuations, for instance, often keep the retirement-minded away from such offerings. Participation is also determined by principles of asset allocation. If one’s risk profile does not permit a certain kind of investment, one needs to stay away from it, at least temporarily.

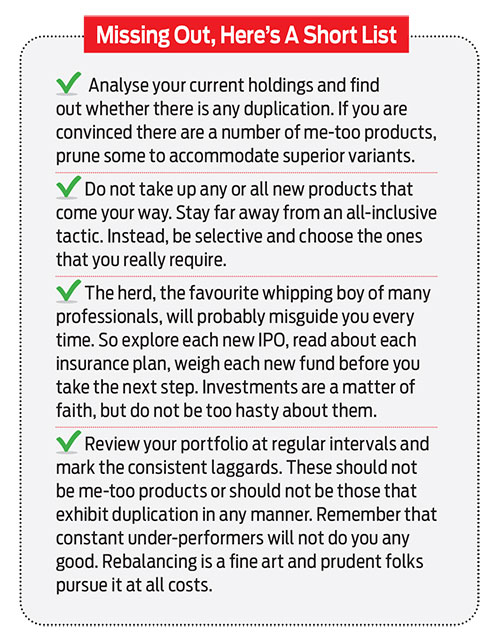

All practitioners of POMO have a common raison d’etre. They want to stay out of harm’s way. ‘Harm’ here refers to the damage that some investments are most likely to usher in, leading to lower returns or, worse, probable losses. It keeps them safe and sound, stops them from owning me-too products, and generally helps them avoid exposure to toxic assets. The key to success, therefore, lies in the right fit. It is the responsibility of the retiree to choose the most appropriate products in keeping with their risk-bearing capacity. A wrong insurance plan or mutual fund is practically a misfit, capable of delivering little value. There are countless instances of such products—effectively, deadwood—that are lying inactive in portfolios for years.

What do retirees want from their portfolio? The answer will hold important clues for those who wish to delve deeper into the issue. Most of us are primed by the need for capital appreciation. Many underscore the significance of income generation and liquidity. They act as basic drivers for retirement planners everywhere. The sway of the markets often appears to the average individual as a chimera. That’s why so many of us end up exposing ourselves to risky propositions. This is the reason why we must consciously miss out on some of the perceived opportunities.

Retiree, Know Yourself

Self-knowledge is as critical as it gets in today’s investment world, especially in the context of the recent multiplicity of products and services. The ordinary retiree has a large and sometimes puzzling variety to choose from. A diversified portfolio comprising a sprinkling of equity, fixed-income, commodity, insurance and real estate will, more often than not, mean the convergence of me-too products. This happens typically with insurance and mutual funds, which prompt even the most conservative of us to acquire “duplicates”—that is, repeat our acquisitions.

The counter-argument, incidentally, is worth noting, too. An influential section of the market, especially asset management outfits and sundry product sellers, will speak vehemently in favour of multiple funds, insurance, portfolio management services and the like. They will argue that an average individual must try out a variety of intermediaries (such as professional fund managers) within the same basket of products. Why should a participant stay restricted to merely one or two professional houses? Why should they not consider others in order to fortify the holdings?

The fact is that diversification is as necessary as sunlight. A retirement plan enthusiast who is not sufficiently diversified will face problems with returns; in other words, depending on a handful of asset classes is likely to spoil the party. A broad-based basket is ideally the most optimal choice for an individual. As all personal finance gurus will tell, there are several ways in which the fundamental principles of diversification can be implemented.

A common example stems from the equity market. A portfolio made up of, say, just infotech stocks will simply not work in the investor’s favour when the sector declines. I refer to infotech as readers will find it instantly relatable. Stocks of major IT companies have indeed taken a backseat in recent times. A casual glance at the price charts will tell you how well-known and popular names in technology have decelerated. If you have faith only in tech stocks, you will surely pay a high price when the sector itself faces great challenges.

Do The Significant Other

The significant other in this case appears in the shape of a well-balanced portfolio, not over-diversified or under-diversified in any manner. This, of course, is certainly not as easy to achieve as it sounds. The “perfect blend” is very nearly an impossible concept; a gap between the ideal and the reaility can easily persist over decades. Such a gap can widen if the retiree fails to change stance—the composition of the portfolio—in keeping with changes in life stages. Indeed, life-stage planning is a unique, irreplacable concept.

Few people are able to folllow it consistently, and in the practical world in which we live, it is one of the most difficult pursuits. Yet a simple, easy-to-appreciate version can be worked out to suit the most basic portfolio. An individual must change strategy when the life-stage gets modified. Modifications are warranted in a variety of contexts, such as, job change, child birth, divorce, death in the family and superannuation.

The retirement seeker must ensure that the preliminary requirements are not compromised with.

If, for example, the need is for regular income after a sudden (that is, unplanned) lay-off at work, the assets need to be tweaked accordingly. If a family member passes away and the responsibility to take care of others shifts too, the portfolio must be changed. There will now be a greater compulsion to generate long-term wealth, which will probably trigger a bigger allocation to market-linked assets.

Each individual investor is uniquely different, so no two strategies will be alike. While optimal alignment can be ruled out, participants can draw lessons from a few common principles.

The author is Director, Wishlist Capital