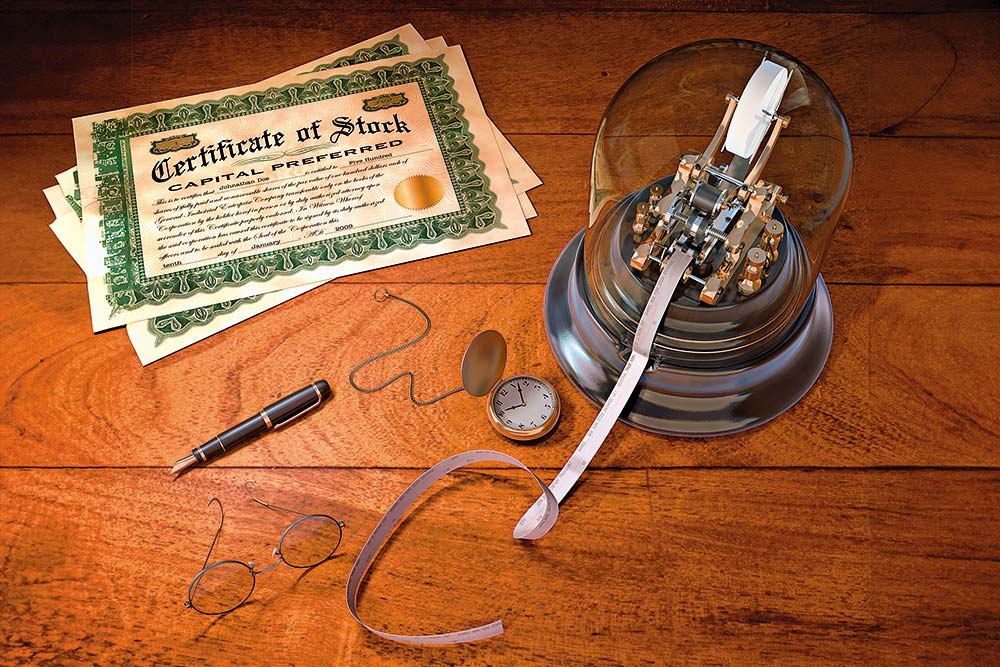

After the recent demise of my father, I found out that he had some stock certificates in physical format. How do I go about dematerialising them?

You need to connect with the registrar and transfer agency (RTA) to update the name in the company records to dematerialise physical shares inherited from a deceased person.

Once the details get updated at the RTA, you (the client) can get in touch with the demat desk of the respective depository participant (DP) to find out about the process and documentation needed for dematerialisation.

My money has doubled in the stock market over the last few years. Should I withdraw the money now or wait for further gains? I do not need the money now, and I think I can lock my gains into a guaranteed product. What should I do?

If you have invested in stocks, we would suggest to ascertain their earning potential and expected return before taking an exit call. In case, you have invested in mutual funds, time spent in the market is more important than timing the market. For the past two to three decades, markets have given around 12 per cent annualised returns. Since you do not need the money in the near term, I would suggest holding on to your portfolio. You can plan your exit six months to one year before any planned liquidity requirement and switch to arbitrage funds, which are tax-efficient products with near similar return expectations like a fixed-income instrument.

Answers by: Bharat Pareek, Head – Product & Segment, Private Wealth Management of ICICI Direct

Disclaimer

ICICI Securities Ltd. ( I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. Investments in securities market are subject to market risks, read all the related documents carefully before investing.