Has the bear tightened its grip on the market or is it just a correction in the bull market? That’s the question everyone’s asking on the street. The global markets have been on a roller coaster ride since the beginning of the year, largely due to the geopolitical tension between Russia and Ukraine. Macroeconomic changes due to higher inflation worldwide caused by oil and commodities prices added fuel to the fire.

In addition to that, the interest rate hike announcement by the US Federal Reserve gave ample reason to foreign portfolio investors (FPIs) to flee from emerging markets. Since the beginning of the year, FPIs have pulled out Rs 1.58 lakh crore from the Indian markets across equity, debt and hybrid assets.

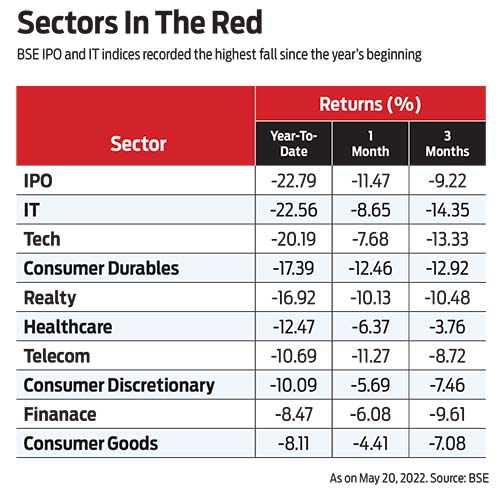

With the global markets hitting new lows, emerging markets like India have also been facing headwinds. The broadly tracked indices, the BSE Sensex and Nifty, are down by over 7 per cent in the last six months. If we look at this number from the peak in October 2021, Sensex has fallen over 14.52 per cent. Small- and mid-cap indices, which are considered more volatile than large-cap indices, have seen slightly higher corrections. The BSE Mid Cap and BSE Small Cap indices have corrected 18.11 per cent and 17.15 per cent, respectively, from the peaks. Some of the sectors such as IT and technology, which were darlings of the market until a few months ago, are now floundering.

The healthcare sector is keeping ill, while real estate is not offering any reason to invest.

Typically, a bear phase begins when the markets fall by about 20-25 per cent. At present, the market is close to that level. Many bluechip stocks such as Maruti, TCS, Bajaj Finance and others have corrected over 25-30 per cent from their peaks.

Where Is The Market Headed?

Even if the market is not in a bear phase, it is definitely highly volatile. And there’s no denying the fact that high volatility in the market rattles investors. Experts are of the opinion that the journey will not be as smooth as it was in 2021. “Expect the journey to be volatile. This is a year when policy direction is changing and liquidity is being reduced, and interest rates are being hiked globally,” says Prateek Agrawal, business head and chief investment officer, ASK Investment Managers.

Others echo the view. They believe that the time and quantum of interest rate hikes will decide the market direction. “We expect market volatility to continue. The key concern for markets will be the extent and speed of interest rate hikes as central banks will attempt to control inflation and inflation expectations,” says Ruchit Mehta, head of research, SBI Mutual Fund. “At present, economic growth momentum seems to be sustaining, albeit the pace is likely to slow down. There are risks of earnings coming under pressure from higher costs and higher interest rates,” he adds.

The Reserve Bank of India (RBI) surprised the market when it increased the repo rate by 40 basis points (bps) to 4.4 per cent and the Cash Reserve Ratio by 50 bps, in an unscheduled announcement on May 4, 2022. One basis point is one-hundredth of a percentage point.

But that doesn’t seem to be the end of rate action. Given the elevated level of inflation, it is likely that RBI will hike rates further and at a faster pace. “We expect the MPC (monetary policy committee) to hike the repo rate by a further 40 bps in the June review and by 35 bps in the August review. That will take the repo rate to the pre-pandemic level and help prevent inflationary expectations from getting unanchored. After that we expect a pause to see the impact of the rate hikes on economic growth. We foresee a terminal rate of 5.5 per cent by mid-2023,” says Aditi Nayar, chief economist, ICRA.

Will The Markets Fall Further?

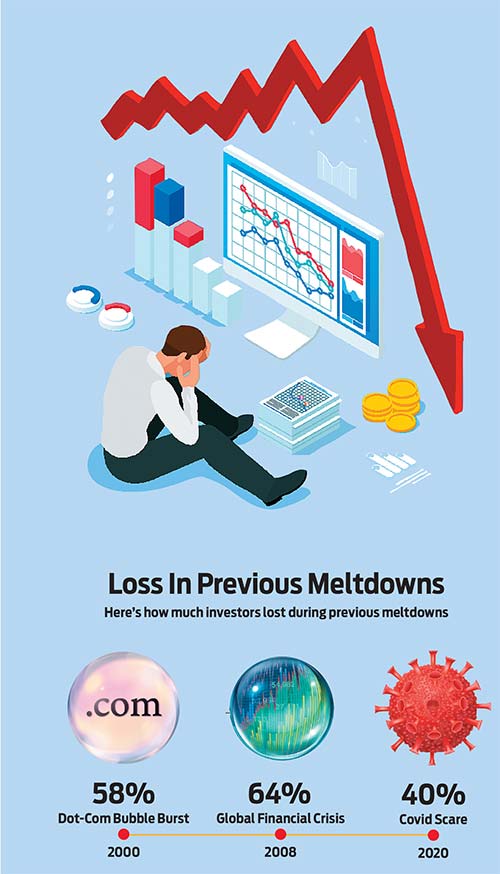

The answer to this question is not simple. If we take the last three meltdowns—in 2000, 2008 and 2020—the minimum that investors lost was about 40 per cent.

After the 2000 bull run, when the dot-com bubble burst, the Indian market eroded by about 58 per cent. The global financial crisis of 2008, which came after a mega bull run between 2003 and 2008, erased over 63.70 per cent gains. Recently, in 2020, when Covid hit the country, the market claimed about 40 per cent of investors’ gains.

According to the Bank of America Global Fund Manager Survey, fund managers are sitting at the highest cash levels since 9/11; global growth optimism is at an all-time low; and the fear of stagflation is the highest since August 2008. Generally, fund managers sit on higher cash as a way to protect their downside when they believe that the markets will fall further. Considering this thesis, it is likely that the market will go down further.

If we compare Indian markets with global peers, Indian equity markets were among the least affected till the end of April 2022, driven primarily by better growth prospects, resilient domestic investor flows and a relatively dovish monetary policy till that point and a stable currency. However, that seems to have changed in May 2022 post the surprise 40 bps-rate hike by the central bank.

There has been a sharp fall in equity, driven by accelerated FPI outflows even though domestic institutional investors (DIIs) are trying to absorb the FPI selling. Even after the recent depreciation, the rupee remains among the best performing currencies.

“We believe India should remain the fastest growing among major economies, making India one of the most attractive investment destinations for global investors,” says Alok Agarwala, head of research, Bajaj Capital. He, however, adds that financial markets can show a disconnect with the real economy in the short term as they are driven more by capital flows. Hence, we may continue to see heightened volatility in Indian equities, till the time the global situation stabilises and commodity prices start cooling off.

Is It An Opportunity For Investors?

Some sectors have corrected significantly in the last few months and offer good investment opportunities for investors. “After the recent drop, the market is valued fairly,” says Agrawal. He believes that investors should expect the direction of the market to be positive on account of fairly strong earnings momentum expected from corporate India. “We see an opportunity in retail lenders. The lending business has turned around and NPAs (non-performing assets) are lower. The growth in assets under management (AUM) and NIMs (net interest margins) should be stronger going forward, while mark-to-market treasury losses would be encountered. The dip in stock prices while fundamentals are improving presents an interesting opportunity,” says Agrawal.

Businesses in the chemical space are benefitting from the move away from China and the growth story can sustain for several years. These businesses have embarked on strong capex to capture the opportunity. Speciality chemicals is likely to see lower competition and should, therefore, be in focus.

“From a medium-term perspective, we like the financial services, consumer discretionary and infrastructure (capital goods, constructions, industrial) sectors,” says Mehta.

Investors can also direct their focus towards high-quality stocks of companies with strong balance sheet and low leverage. Typically, these companies sustain during volatile times like the one at present. “This is a year of high volatility. At the same time, valuations are now fair. Investors should buy high-quality, high-growth-focused portfolios in a staggered manner utilising the dips in the market to their advantage,” says Agrawal.

It is better to be patient than pressing the panic button. “Volatility leads to emotional excitement, and when emotions are invested in the market, the impact can be adverse. Thus, be patient and let the market fluctuations subside,” says Anup Bansal, chief investment officer, Scripbox, a wealth management firm.

Over a period of nearly three decades, from 1993 to 2022, Sensex returns have compounded at about 12 per cent. While the returns may have moved differently over shorter periods during the phase, they do tend to converge over time and the same could be the case going forward.

Markets recover and continue their upward journey in the long term. However, as an investor, you should have the liquidity to let averaging play out and the holding power to not exit in panic.

kundan@outlookindia.com