K Siva Kumar, 40, from Amaravati in Andhra Pradesh, bought an electric scooter in April 2022. Just a day after the purchase, when he put its detachable battery for charging, it exploded causing a fire in his bedroom. Kumar died and his wife and children suffered injuries.

There have been various instances of the electric vehicle (EV) battery bursting into flames and causing injury or worse. Ever wondered if such incidents are covered under motor insurance?

Current Availability

The EV insurance space in India is evolving. Since third-party vehicle insurance is mandatory in India, all EVs above a certain capacity have to be insured. Currently, traditional motor insurance policies meant for internal combustion engine (ICE) i.e., petrol and diesel vehicles, are being issued for electric cars and scooters as well.

Broadly, two types of policies are being used for EVs as of now. First, traditional comprehensive insurance policies that include own-damage (also known as accidental damage) and third-party insurance. Second, asset insurance policies for low-capacity EVs that don’t fall under the motor insurance category. These cover accidental damage but are not mandatory. “Third-party insurance is mandatory for all EVs that can ply above the speed limit of 25 km per hour. Own-damage cover is optional. For EVs below the 25 km per hour speed limit, even third-party insurance is not mandatory. However, we recommend owners of such vehicles to get adequate insurance cover to protect their vehicle,” says Adarsh Agarwal, chief distribution officer, Digit Insurance.

Missing Parts

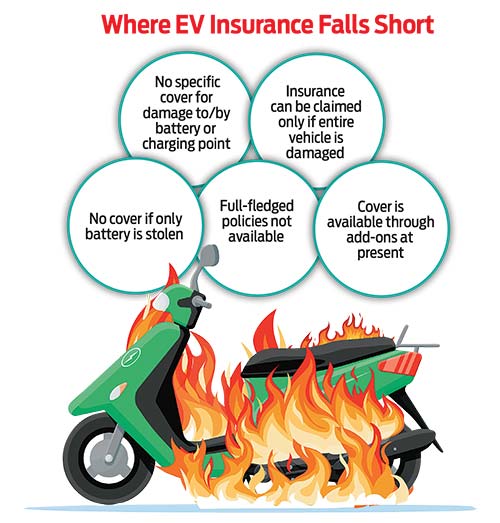

Having an insurance policy, however, does not mean that the vehicle is completely protected. This is especially true for EVs, which are built differently from ICE vehicles. For instance, the battery component by itself comprises over 40 per cent of the vehicle cost.

“Currently, the EV volumes are low. One cannot analyse unless there are mass volumes. Once we get enough data and claims experience, only then would we be able to design a bespoke policy,” says T.A. Ramalingam, chief technical officer, Bajaj Allianz General Insurance.

Keeping the differences and the growing use of EVs in mind, insurers are looking at a broader coverage for EVs or putting forward bespoke policies. However, not much progress has been made so far. For example, Tata AIG General Insurance had announced some time back that it was designing a specific EV policy—Auto Secure eVehicle Comprehensive Policy—that would cover own-damage as well as damage caused due to the electric car’s battery burning while charging. The insurance company is, however, yet to bring the policy into the market.

Industry insiders say the insurance regulator has directed insurers to file EV-linked add-on covers instead of full-fledged policies. “We are soon going to file our EV add-on policy for two-wheelers,” a Tata AIG spokesperson told Outlook Money.

The Battery Conundrum

A major flaw in the available EV covers is that instances where the battery alone gets affected are not covered. Only when the entire vehicle gets damaged do insurers agree to settle the claim. “This is because component failure in itself is not covered in motor insurance policies. Traditional policies cover loss or damage to the vehicle insured and/or its accessories due to accidental external means such as burglary, theft, housebreaking, riot and strike and acts of God such as flood,” says N. Bojarajan, practice leader–renewable energy and e-Mobility, Gallagher Insurance Brokers.

Similarly, if the battery alone is stolen, the claim may not be accepted. “If a battery gets stolen from a vehicle, there is a due process after which a claim is admitted. But in EVs, due to battery swapping options, the risk exposure is wider and not always limited to theft from vehicle,” says Bojarajan.

Many feel that given the importance of a battery in an EV, there should be battery-specific covers. “Most underwriters feel that a traditional policy is sufficient. However, we feel that there is a need to have tailor-made policies for batteries and charging equipment. This is because risks associated with EV charging infrastructure can also cause damage to EVs, and not just accidents,” says Borjarajan.

Say, a battery is being charged and a short circuit leads to an instant fire that damages the battery and the charging connector. A traditional policy will not accept the claim unless the vehicle and the battery both catch fire. This is why an EV-specific policy that covers batteries and charging connectors are needed,” he says.

To start with, a sandbox approach can be taken. Till about a year back, hardly any insurer or broker had a separate e-mobility practice. Things are different now. Some are trying to design a battery cover within the regulatory framework under special conditions. “There are all-risk and special contingency policy formats that can be used when traditional policies are not adequate. Underwriters, in the public and private sectors, have come forward to design such tailor-made policies to align with the evolving EV ecosystem. We are trying to offer battery cover within this framework,” says Bojarajan.

What You Can Do

While the insurers develop more products to catch up with the market demand, it is recommended that EV users buy a comprehensive motor insurance policy that covers not only third-party damage but also own-damage. Consider adding relevant riders, which will widen the coverage of the base policy.

“Add-ons such as depreciation cover, gap value cover and roadside assistance are recommended for EV owners as these provide adequate protection against the major risks,” says Udayan Joshi, president-underwriting and reinsurance at Liberty General Insurance, adding that the insurer has designed new add-ons for EVs. “These will be launched shortly in the market.”

Which are the most useful riders for EVs? Return to invoice rider, suggests Ashwini Dubey, head-motor renewals, Policybazaar.com, an insurance aggregator. This rider ensures that you receive a claim amount equal to the car’s original value (on invoice). “The claim applies when a car is stolen or is beyond repair. A fire that results in total damage to the car will get covered under this rider,” says Dubey.

As with any motor insurance, some things are not covered. So, ask about the deductibles and consumables before buying a policy. “You must know all exclusions to avoid any shocks at the time of claim,” says Agarwal.

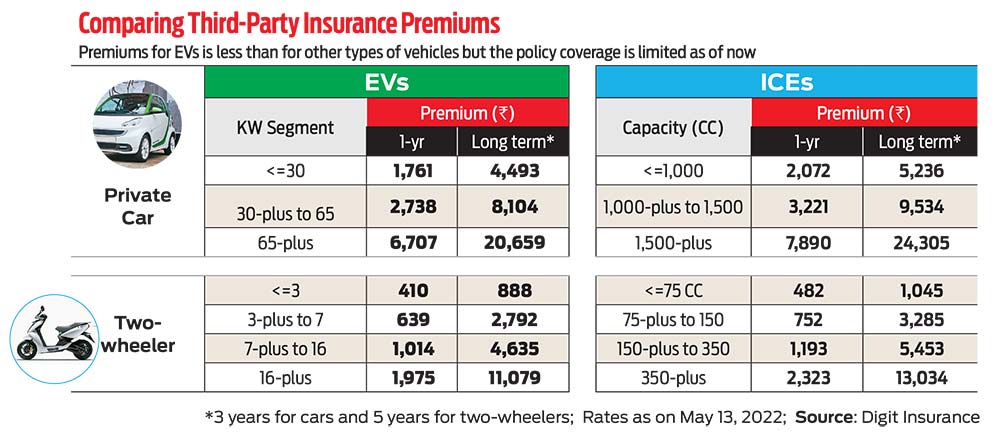

Premium On EV Insurance

Contrary to perception, the premiums for EVs are not higher than that for ICE vehicles. While the Insurance Regulatory and Development Authority of India (Irdai) has already defined the range of premiums for third-party cover, which is the same across insurers, the third-party insurance premium for EVs is usually about 15 per cent lower than for ICE vehicles. “Broadly, we observe EVs enjoying a differential in the range of 5-20 per cent in the overall premium for comprehensive coverage compared to ICE cars or bikes,” says Joshi. The differential is only in own-damage cover.

Data from Digit Insurance shows that the one-year third-party premium for a private electric car not exceeding 30 KW is Rs 1,761. In comparison, an ICE vehicle not exceeding 1,000 CC will have a one-year third-party premium of Rs 2,072.

“Premiums for EVs depend on the insurer’s pricing philosophy. Rating factors such as the EV’s make and model, battery capacity, location, age of vehicle, etc., are considered for pricing,” says Joshi, adding that as insurers get more experience with EV claims, the pricing will get fine-tuned.

As the demand for EVs increases, it’s time the insurance regulator identifies the particular risks in EVs and allows the insurers to come out with appropriate products. A push from the regulator will go a long way in ensuring wider coverage.

The author is a financial journalist

letters@outlookmoney.com