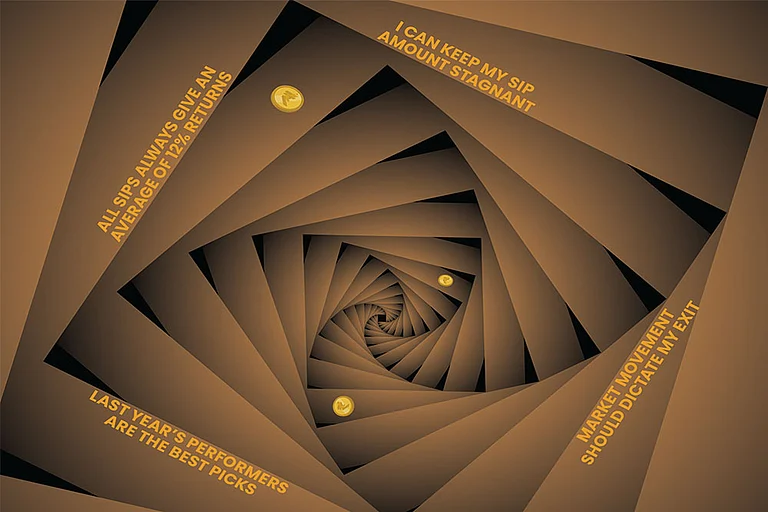

Losing Money in SIP/Mutual Funds: When mutual fund investors want higher returns, they invest in equity mutual funds. In equity mutual funds, investors' money is invested in the stock market. Equity funds are linked to the equity market, so there is risk in them. By the way, if investors invest in mutual funds through SIP with a long-term goal, then there are more chances of getting high returns. But in some cases, investors are also likely to incur losses in mutual funds.

When the SIP portfolio in a mutual fund starts causing losses to investors, many times, especially new investors get nervous and start selling their units or withdraw their entire investment. But this step can spoil the financial planning of those investors and they fall behind their goals. Instead of panicking and selling units or taking the wrong decision, experts talk about focusing on such measures in such cases, which first brings your returns back on track and then the target set by them can also be achieved.

1. Be patient and keep calm

The first step to successful investment is to keep a calm mind and maintain patience even in the face of challenges. Fluctuations in the stock market are a common occurrence, which is seen from time to time. But if we look at the long-term history, the markets perform well. In the short term, the price goes up and down due to volatility. While in the short term, there is a loss in mutual funds due to volatility, if you look at the long term, positive returns are seen only after 3-4 years of holding.

2. Do not sell in a hurry

You may incur short-term losses on mutual funds in a falling market. But this means that you should redeem your investment. Equity mutual funds attract an exit load of 1% in most cases if redeemed before one year of investment.

Some investors believe that when the value of a mutual fund goes down, they can withdraw their money from it, but this does not give good results. SIP frees you from the hassle of timing the market. It also takes advantage of rupee cost averaging for you to buy more units when the market is down.

3. Compare your fund's performance with other funds

In case of negative returns, compare your mutual fund scheme with other mutual fund schemes in the same category and in other categories. If you find that your mutual fund is performing only slightly worse than the best-rated funds, then switching may not be necessary. If there is a huge difference in performance, then consult an advisor before switching.

4. Identify the market trend

If we talk about equities, the fluctuations in the stock price are due to the general trend of the market. Compounding works for you when you are on the right side of the trend, whether it is a rising market or a falling market. So, the first step is to assess the correct trend of the market, you have to identify whether the market is in a bull trend or a bear trend. Then invest in the same trend.

5. Diversity

Diversity is also very important for successful investment. That is why while investing in mutual funds, one should always focus on diversifying the portfolio. For this, you can consider different categories of funds. You can also consider keeping multi-cap and flexi-cap in the portfolio.

6. Research

If you invest in a sector or investment option just by looking at the returns it will give, then this is not the right way. An option that gives high returns for some time can also give negative returns in the next few days. Therefore, first, you should research which companies' shares are in the portfolio of the fund in which you are investing. Do those companies have the ability to stay ahead in the market for a long time with high growth or not? After that, you should compare the fund's past performance, outlook and expense ratio.

7. Consult

It is suggested that you consult a financial advisor before investing in SIPs or mutual funds. Discuss your current financial position and future goals. Talk about your risk appetite or lack of it. A professional will guide you through the process and help you make an informed investment decision.