“As India's leading digital banking fintech startup, our primary focus is on easing and enhancing customer experience, and the launch of NiyoX is a testament to our commitment to the digital transformation of the banking space," says Vinay Bagri, Co-founder and CEO at Niyo.

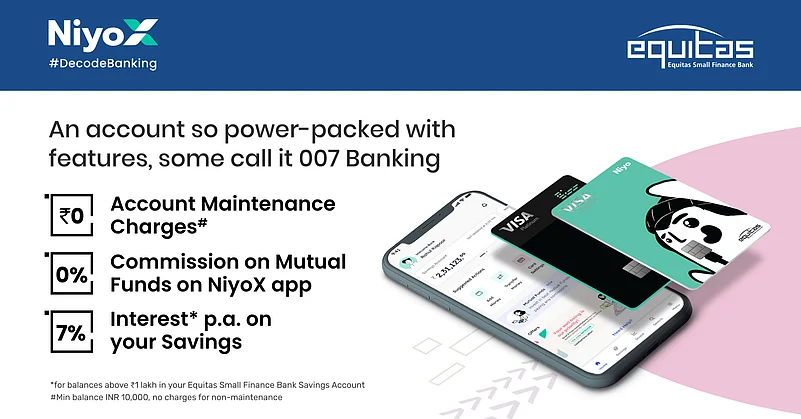

Powered by Niyo Money, the wealth management suite is a one-stop shop that provides zero commission mutual funds, helps users track their investments, and rounds up expenses and invests the change. The launch of domestic and international stocks on this platform is also in the pipeline.

The need for NiyoX was realized after Niyo surveyed 8,000 millennials living in metro and non-metro cities. 55 per cent respondents said that they would switch banks for better rewards and offers and 45 per cent would switch banks for better interest rates.

To address such demands, NiyoX will also bring in a multilayer reward system comprising referral incentives, rewards points and scratch card-based cashback topped up with more exclusive offers for the users.

NiyoX also offers a VISA Platinum Debit Card, an industry-high 7 per cent per annum interest rate on account balance and a promise of “zero non-maintenance fee”.