The annual tax-saving season is here again. The months of January, February and March usually see frenzied activity on this front, with salaried employees struggling to file investment declarations ahead of the deadlines. The last date for making tax-saving investments, March 31, is also drawing closer, adding to the anxiety.

However, you can avoid this annual rigmarole and plan tax-related investments in a manner that not only enhances your financial planning strategy but also reduces year-end pressure on cash flows. You can achieve your goals by aligning your financials and tax planning roadmaps.

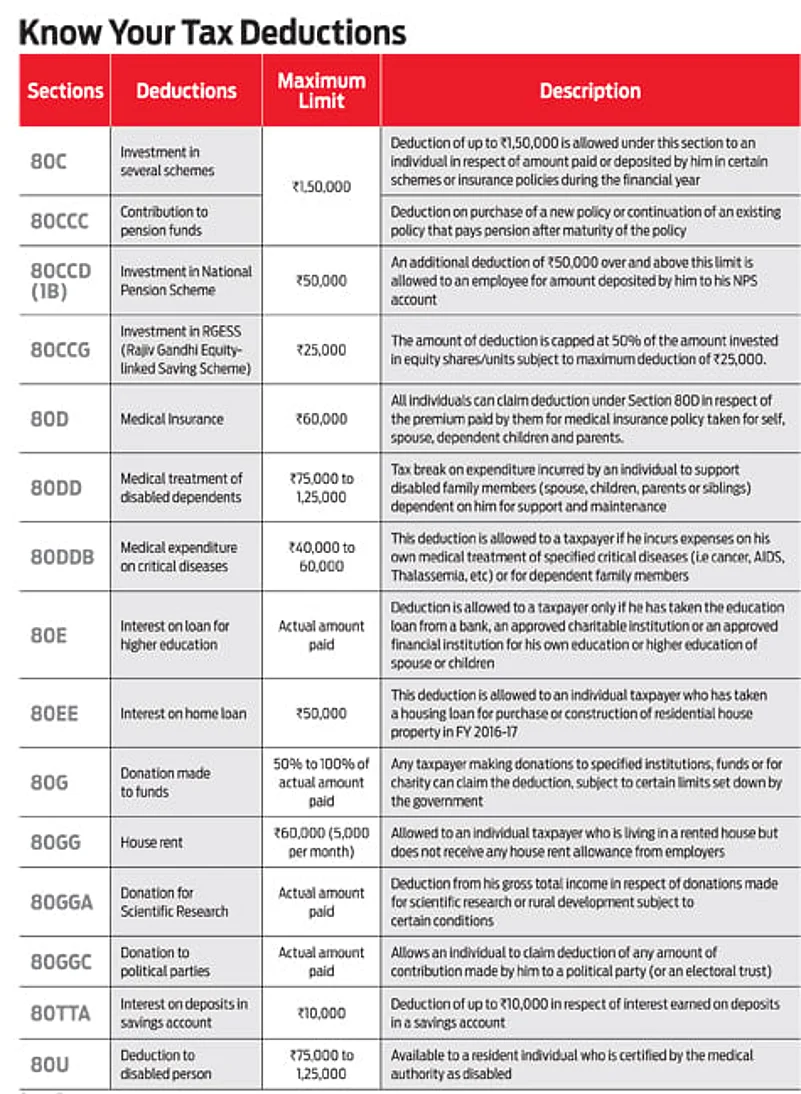

If you have delayed the process, understand the provisions under the Income Tax Act, 1961, that lists tax concessions to individuals before going ahead with tax-saver investments. Read on to learn more about efficient tax-saving.

1.

Section 80C: Look before you invest

Instead of blindly squeezing out `1.5 lakh from your savings to be locked away in an equity-linked savings scheme (ELSS) or a life insurance policy for three and five years respectively, you should look at other deductions that Section 80C offers. For instance, tuition fee paid as part of children’s school fees is a relatively lesser-known tax benefit, but even fewer tax payers are aware of the change introduced in 2015. “Pre-nursery, play school and nursery fees are also eligible for deduction under Section 80C,” points out Vaibhav Sankla, managing director, H&R Block.

Evaluate all tax benefits to know if you actually need to set funds aside for tax-saving. “Add Employees’ Provident Fund (EPF) contribution, school fees, principal repayment of housing loan and other tax-saving expenses made to compute the total deduction already available,” says Archit Gupta, founder and CEO, Cleartax, a tax returns filing portal. Simply put, you might need to make little or no tax-saving investments if your EPF contribution, housing loan principal repayment and existing life insurance policies’ premium make up `1.5 lakh—the annual deduction limit under Section 80C.

2. Section 80C: Prepay housing loan

If you haven’t exhausted the deductions under Section 80C, you can consider prepaying a part of your home loan after evaluating all the alternatives at hand. “Before making prepayment, compare the opportunity cost of your investment against your interest cost,” advises Sankla. In other words, carry out a cost-benefit analysis taking into account the interest paid on your loan and returns the tax-saving investments are likely to generate. “It is important to plan the number of installments in order to see how much interest can be saved by prepaying the loan. If principal repayments are done in one go, it can result in loss of tax benefits as the assessee can avail of deduction only under 80C and for that specific year in which payment is made,” says Amit Maheshwari, partner, Ashok Maheshwary & Associates LLP.

3. Section 80GG: Claim HRA benefits without allowance

Do not despair if your salary structure does not feature house rent allowance (HRA) or if you are self-employed. “You can still claim a deduction for rent paid under section 80GG, subject to specified limits. The maximum amount of rent qualifying for deduction is `5,000 per month,” says Amarpal Chadha, tax partner and India mobility leader, EY. The deduction is allowed for individuals who neither own residential property, nor receive HRA, and yet have to shell out rent to their landlords. “The deduction allowed is the least of rent paid minus 10 per cent of the total income before allowing the deduction or 25 per cent of the total income before allowing deduction, or `5,000 per month,” explains Suresh Surana, founder, RSM Astute Consulting.

4. Section 10: Pay rent to parents

Tax benefits related to HRA form a key component of a salaried individual’s remuneration package. It is a huge source of comfort for those living in rented apartments. However, even those who live with their parents can avail of this benefit by paying rent to them, particularly if the latter fall in lower tax brackets. “Your parents, in turn, can claim a standard deduction of 30 per cent of the rent amount, the deduction for housing loan interest and the deduction for proportionate municipal taxes. As a result, the entire family can save on taxes,” explains Sankla.

5. Section 24: Beyond home loan interest deduction

Section 24 is popularly known as the provision that allows tax breaks of up to `2 lakh on home loan interest paid. This limit is not confined to interest paid on loan from banks or housing finance companies. “You can claim deduction on loan processing fees, foreclosure charges and other fees related to your home loan. Interest includes service fees, brokerage, commission and prepayment charges,” points out Sankla. Similarly, you can avail of benefits if your house purchase entails loan from parents, family members or friends. “However, in this case, you should collect a certificate from the lender,” adds Sankla. The deduction is allowed irrespective of whether it is a housing loan or personal loan from an individual or institution. The only condition is that the loan amount should be used for the acquisition of a house.

6. Section 80C: Get your PPF investments right

Tax-saving benefits of public provident fund (PPF) contribution are well-known. However, a proactive approach can help you gain from the scheme under Section 80C. “In order to get a higher return, it is advised to invest just when the financial year commences, since the PPF account follows the April-to-March year cycle,” says Akhil Chandna, director, Grant Thornton India.

The earlier you invest, the higher will be the interest your PPF account accumulates during the year. Do not wait until March. If you have been a long-term PPF depositor, you could restructure your PPF contribution such that you can take advantage of PPF withdrawal rules—starting from the seventh year of your investment in PPF account, you can make partial withdrawals every year, subject to ceilings “You can withdraw and reinvest the permissible amount in the PPF account to claim deductions without the burden of making any fresh investment,” according to Sankla.

7. Section 80D: Utilise non-insurance health deductions

Although introduced in Union Budget 2012, awareness of the `5,000 tax relief on preventive health check-ups is still low. Available under Section 80D, it has received scant attention in comparison to the more prominent deductions it offers on health insurance premium paid for self, spouse, children and parents. “If your Section 80D limit is under-utilised, you can consider a preventive health check-up. Do remember to preserve your bills safely,” says Gupta of Cleartax.

This apart, you are entitled to tax breaks in case you take care of uninsured elderly parents’ medical expenses. “You can claim a deduction of up to `30,000 for the expenses incurred on medical treatment of parents who are over 80 years of age,” says Sankla. However, both these benefits have to adhere to the section 80D limit.

8. Section 80D: Optimise group health benefits

Since the total deduction on health insurance premium can go up to `60,000—`25,000 for self, spouse and children and `30,000 if parents happen to be senior citizens—distributors often exhort tax payers to buy higher value covers. Instead, you can look at a less-taxing alternative: premium paid on group health cover.

Employees consider group health insurance to be a critical component of the remuneration structure. Since several such plans also cover elderly parents, depending on the company’s policy, it acts as a cushion against hospitalisation expenses. Moreover, pre-existing illnesses too are covered and the claim settlement is hassle-free, prompting many individuals to opt for it even if they have to fund the premiums. Such employees can file for tax relief on their group policies instead. If you have bought a group health insurance policy for your spouse, children or your parents through your employer and the premium for such a policy is borne by you, then you can claim deduction for the same under Section 80D, if it has not been accounted for in your Form 16, informs Sankla.

9. Section 24: Cut losses on let-out properties

For years, those who owned more than one house, funded through home loans, enjoyed a distinct advantage. They could claim as deduction the entire interest paid on home loans linked to their houses where they did not reside. This was in addition to the tax break of Rs 2 lakh on home loan interest for their self-occupied house. The interest on let-out properties would be treated as a loss. It could then be set off against income from other heads like salary or business income. The 2017 Union Budget, however, put an end to this practice by capping such losses, or interest paid, at `2 lakh - the same as deduction on interest paid on self-occupied property. “Any further loss will need to be carried forward for the next eight years to be set off against future income from a house property,” says Chadha, explaining the implications of the changes under Section 24 read with Section 71. If you’re holding back prepayment only to maximise tax breaks on interest paid, you can reconsider your options. “Look at pre-payment to avoid higher interest cost if you have surplus cash and if you are unable to set off the carried forward house property losses against property income in future,” adds Chadha.

10. Section 80G: Make the most of charity

Any donation made to non-governmental organisations (NGO) or government relief fund is eligible for a tax break under Section 80G. The donation amount can be claimed as a deduction, which will either be 50 or 100 per cent of the actual money transferred. This will depend on the entity to which a donation is made.

Most non-governmental charitable institutions fall in the 50 per cent category. “It is important to choose the recipient of your donation carefully. Further, in order to claim the deduction, the assessee must ensure that he preserves the proper receipt issued by the trust as a confirmation of the donation made by him,” says Maheshwari. Most organisations do not factor in 80G deductions in the investment declaration forms. As a result, tax-payers have to claim this deduction at the time of filing tax returns.

While you must retain the receipts, do not attach them to your ITR-V, or the verification form, if you plan to send it across to the I-T department’s centre in Bengaluru by post.

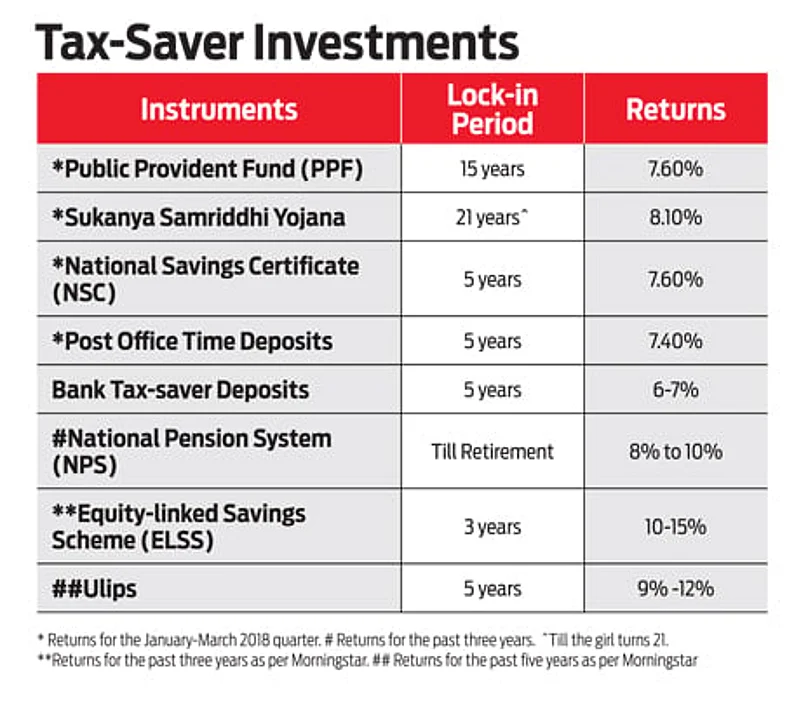

For efficient tax planning, start the exercise in April every year. If you’ve put it off until the deadline hour, ensure that you don’t take decisions in haste. First, exhaust the available concessions before parking your money in tax-saving instruments. Lastly, try to identify products that suit your risk appetite and come with minimal lock-in period.