Finance Minister, Nirmala Sitharaman announced on Tuesday that salaried employees under the new tax regime to save up to Rs 17,500 annually in taxes due to the changes proposed in Budget 2025.

According to experts, the common man or the taxpayer had a lot of expectations from Budget 2024. The budget did provide some tax relief, but perhaps not in the way it was expected.

“In a major relief for the taxpayers, Budget 2024 revised the tax slabs under the new tax regime and also increased the standard deduction from Rs 50,000 to Rs 75,000,” says Abhishek Soni, CEO, Tax2Win, an income tax portal.

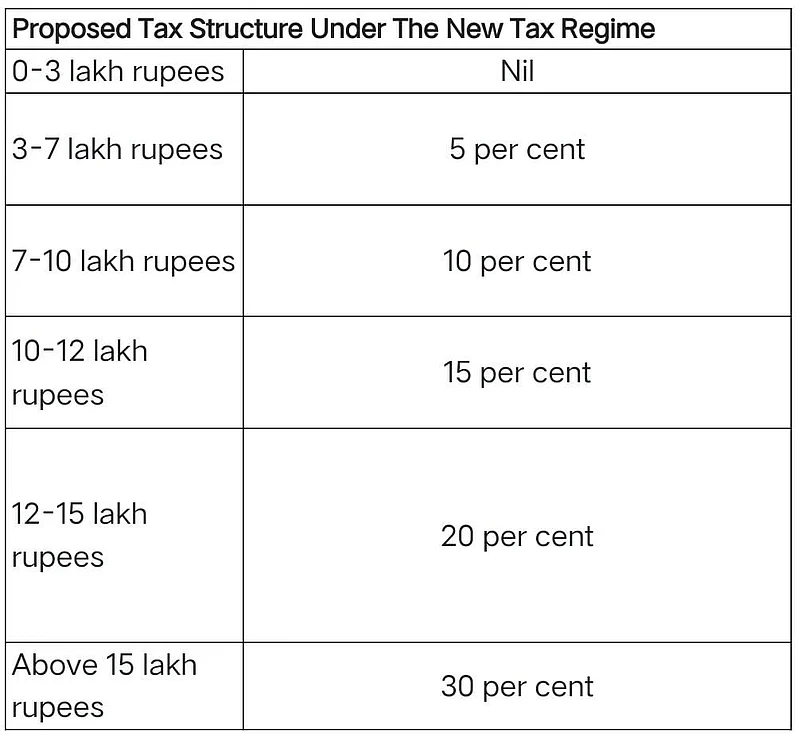

According to the budget speech, the tax rate structure is proposed to be revised, as follows:

Proposed Tax Structure Under The New Tax Regime Comes Here

Also, according to the budget speech “As a result of these changes, a salaried employee in the new tax regime stands to save up to Rs 17,500 in income tax.”

We explain how the proposed changes in the new tax regime result in a tax saving of Rs 17,500.

“Increase in five per cent slab from Rs 6 lakh to Rs 7 lakh - Rs 1 lakh was first taxable at 10 per cent now at five per cent so the net benefit is Rs 5,000,” says Divya Baweja, Partner, Deloitte India.

An increase in the 10 per cent income slab from Rs 9 lakh to Rs 10 lakh-Rs 1 lakh was first taxable at 15 per cent and now at 10 per cent so the net benefit is Rs 5,000.

The total benefit from the slab is Rs 10,000(5,000+5,000)

The increase in the standard deduction is Rs 25,000. So net benefit from standard deduction at the maximum rate is Rs 7,500(25,000*30 per cent)

The total slab benefit plus standard deduction benefit is Rs 17,500 (10,000 plus 7,500).

How You Can Save Rs 17,500 Under The New Tax Regime Comes Here

How You Can Save Rs 17,500 Under The New Tax Regime

A Shift To The New Tax Regime

It is to be noted that the new tax regime was introduced in Budget 2020. Ity had a simplified tax structure but did not have the most popular deductions like Section 80C, Section 80D, and home loan interest rate deductions under Section 24B, which is why it did not find many takers.

The government has since provided incentives to make the new tax regime more attractive. In budget 2023, it was made the default tax regime. This means that if someone wants to choose the old tax regime, they have to opt for it.

The 80C deduction limit was increased from Rs 1 lakh to Rs 1.5 lakh in Budget 2014-15. Since then, it has not been increased and over the years it has been expected that the 80C deduction limit would be increased. However, that has not happened. Going by the last few budgets, it seems that the government wants to incentivize people to shift to the new tax regime. Going ahead, experts think that the government may scrap the old tax regime altogether.