After being panned by tax-payers for the inefficient online mechanism to link Aadhaar and PAN, the Central Board of Direct Taxes (CBDT) on Thursday launched a simpler facility for the purpose.

The CBDT’s move comes in the backdrop of widespread complaints from tax-payers regarding linking failure due to mismatch of names in both databases. While the facility was introduced in 2015, many tax-payers used it for the first time this year as the central government has made Aadhaar-PAN linking mandatory for filing returns.

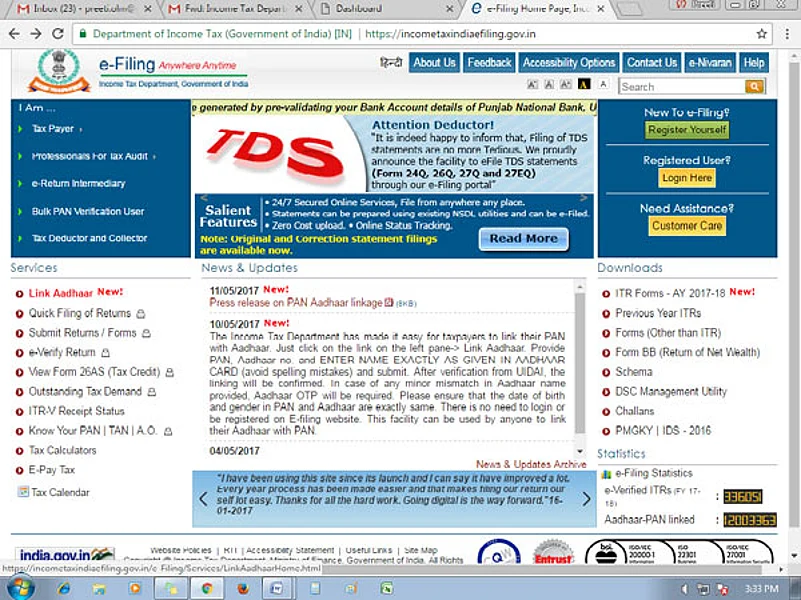

As per the new mechanism, you can complete the process without registering and logging on to www.incometaxindiaefiling.gov.in, the official e-filing portal by following a few simple steps.

Quick fix procedure

Visit the e-filing portal and click on the ‘Link Aadhaar’ link on the left pane. You need to enter your PAN, Aadhaar and your name as it appears on your Aadhaar card and click ‘Submit’. Once the information is verified with the UIDAI, the linking will be a success. You can also choose to execute the process after registering and logging in. Go to ‘Profile Settings’ and select Aadhaar linking. In this case, the information as per PAN will be pre-populated. Rest of the steps will remain the same.

Dealing with failure

However, if the linking fails due to mismatch in names on both systems, a one-time password will be sent to your mobile number registered with UIDAI. “Taxpayers should ensure that the date of birth and gender in PAN and Aadhaar are exactly the same,” CBDT cautioned in its official release.

Rectifying errors

If the names in the two databases are completely different, then the process will be stalled. You will then be prompted to make the necessary modifications either in Aadhaar or PAN database.