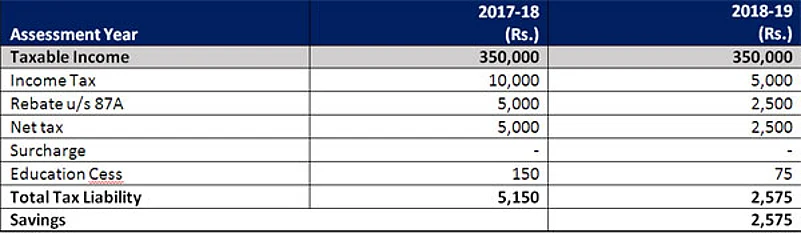

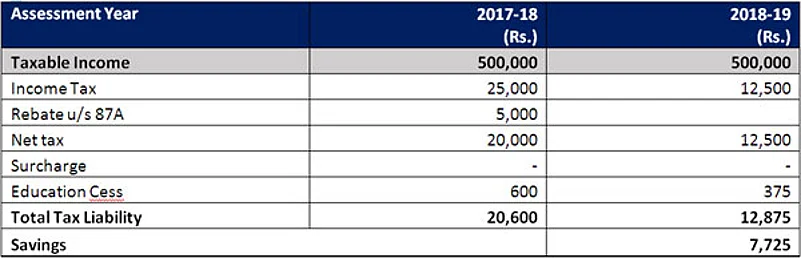

The Union Budget 2017 proposals have finally been announced, putting to rest the widespread expectations, contemplation and conjecture regarding the income tax for individual tax payers. The Finance Minister did heed the plea of the lower income group and the salaried tax payers to reduce their tax burden, especially in the aftermath of demonetization and the hardships they faced, and reduced the tax rate for the lower income level i.e the income slab of Rs. 2.5 lakh to Rs. 5 lakh from 10% to 5%. With this reduction, a person earning an income of up to RS. 3 lakh will not have to pay any tax while a tax payer earning an income between Rs. 3 lakh to Rs. 5 lakh will find that his tax has been reduced substantially. The Tables below indicate how the tax will change for an individual taxpayer less than 60 years of age having table income of Rs. 3.5 and Rs. 5 lakh:

There is some reason to cheer for taxpayers with taxable income up to Rs. 50 lakh as well. These tax payers will also benefit from the reduction in the tax rate for the Rs. 2.5 lakh to Rs. 5 lakh tax slab from 10% to 5%, translating into a reduction in the annual tax by Rs. 12,875 or an increase in the monthly take home pay by Rs. 1073. Refer to the table below to see how the tax will change for a taxpayer less than 60 years of age with a taxable income of Rs. 40 lakh.

The reduction in the tax rate is expected to result in a loss of revenue to the exchequer to the extent of Rs. 15,500 Crores. However, the nominal tax rate of 5% for the lowest income slab is expected to encourage many more people who were hitherto not paying taxes, to pay tax and start to be compliant with the tax laws. Other measures, such as the simplified one page tax return form for taxpayers with gross total income up to Rs. 5 lakhs (not applicable for individuals with business income) and no scrutiny in respect of first time return filers for the first year (provided no contrary information is available) are also further expected to boost compliance and enhance the tax base.

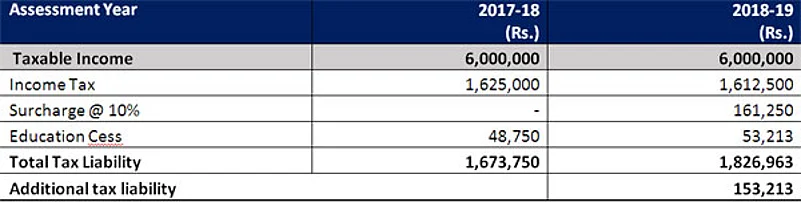

With a view to balancing the loss in the revenue on account of the reduced tax for smaller tax payers, the tax burden on the Rs. 50 lakh plus to Rs. 1 Crore income group has been increased with the introduction of a surcharge of 10% of the tax. As a result, the maximum marginal tax rate for this group will increase from 30.9% to 33.99%. For this group, the benefit of the reduction in lowest tax rate from 10% to 5% will be wiped out by the additional income tax payable in the form of the surcharge (subject to the marginal relief). The table below illustrates how the tax outgo will increase for a taxpayer (less than 60 years of age) with a taxable income of Rs.60 lakh:

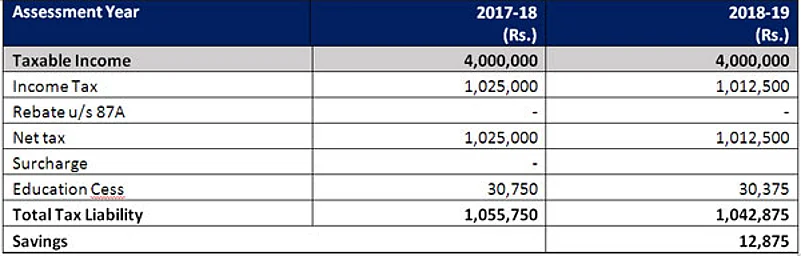

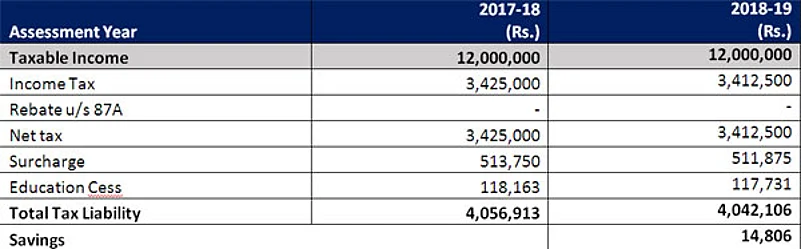

The ‘Super rich’ tax payers, i.e the tax payers with income exceeding Rs. 1 Crore will continue to pay the 15% surcharge as they did last year. However, they will also benefit from the reduction in the tax rate from 10% to 5% for the lowest income slab. This is evident from the table below:

Thus it can be seen that while the taxpayers that fall in the more than Rs. 50 lakh to Rs. 1 Crore tax slab will witness a hike in their taxes, all other tax payers will see a slight reduction in the tax.

By Mr. Homi Mistry – Partner; and Ms. Mousami Nagarsenkar - Director with Deloitte Haskins & Sells LLP