When you are sending or remitting money overseas, under the liberalized remittance scheme (LRS), all resident individuals, including minors, are allowed to freely remit up to $2,50,000 per financial year. However, the tax implications vary when you are remitting money for different purposes. Read on to know more.

Tax Implications On Foreign Remittances: Here are the instances in which the new rate of tax collected at source (TCS) is applicable when sending money abroad.

Foreign tour packages

Online shopping from a foreign website

Investing in a foreign asset or instrument

Giving loans or doling out gifts to relatives living overseas.

Buying stocks of foreign companies

Purchasing property abroad

Immigrants remitting funds to their foreign bank account

Exemptions: “There is an exemption from TCS up to a maximum of Rs 7 lakh if you are sending money overseas to cover educational expenses. For transactions above this threshold, TCS charges of 0.5 per cent will be applicable if the funds are being provided via a loan financed by a financial institution,” says Manikandan S, tax expert, Cleartax.

If these expenses are being met via any other income source, five per cent TCS is applicable for transactions exceeding the maximum threshold. Moreover, in case the person remitting the money cannot prove that the purpose for sending it is education, the TCS rate would be 20 per cent.

“In case the person remitting funds does not submit his/her PAN card, the TCS rate will increase. In this case, for foreign money transfers funded by education loans above the maximum cap, the TCS rate will increase to five per cent, and in the case of normal income sources, it will increase to 10 per cent,” adds Manikandan S.

In addition, foreign remittances up to Rs 7 lakh for covering medical expenses will come under exemptions. A TCS rate of 0.5 per cent is applicable for transaction values exceeding this amount, only if it is from the loan amount sanctioned by a financial institution.

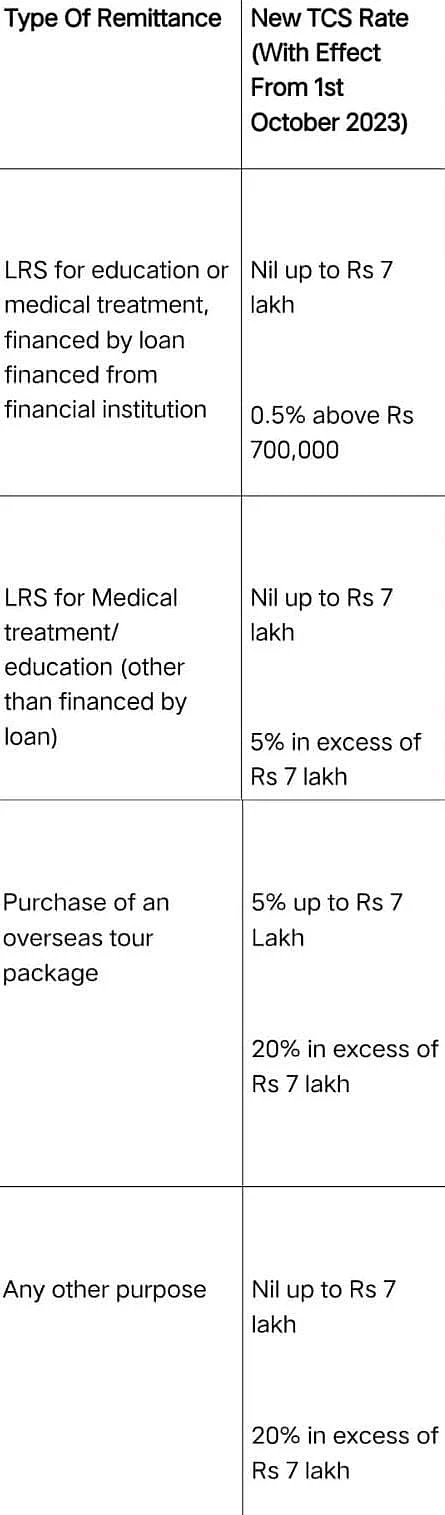

The table here shows the new and old foreign remittance TCS rates for different types of remittances:

Remember You Can Claim A TCS Refund

It is important to remember that TCS paid is not an additional tax. If you have paid more TCS than the actual tax liability in a financial year, you can claim a refund when filing your taxes.