When it comes to building a strong investment portfolio, diversification across different asset classes is essential. Just like a reliable Wi-Fi connection needs all three signal bars for optimal performance, your investments need to be spread across multiple asset types for your portfolio to achieve solid, consistent returns. Multi-asset allocation funds offer investors an opportunity to balance their investments across various categories, helping to reduce risk and potentially increase returns over time.

Asset allocation refers to how you distribute your investments among different asset classes, such as equities, debt, and commodities like gold and silver. This strategy is the cornerstone of successful investing, as it ensures that your investments are not concentrated in one area. The key to long-term success is a balanced, well-structured portfolio that can perform well in different market conditions.

Key Components of a Multi-Asset Allocation Portfolio

For optimal portfolio performance, a multi-asset allocation strategy typically includes three main asset classes: equity, debt, and gold or silver.

Equity, or stocks, play the role of a wealth creator in your portfolio. By investing in shares of companies, you are participating in their growth and success. Equities have the potential for higher returns over time but can also be volatile in the short term. The key to successful equity investing is patience and the ability to ride out market ups and downs.

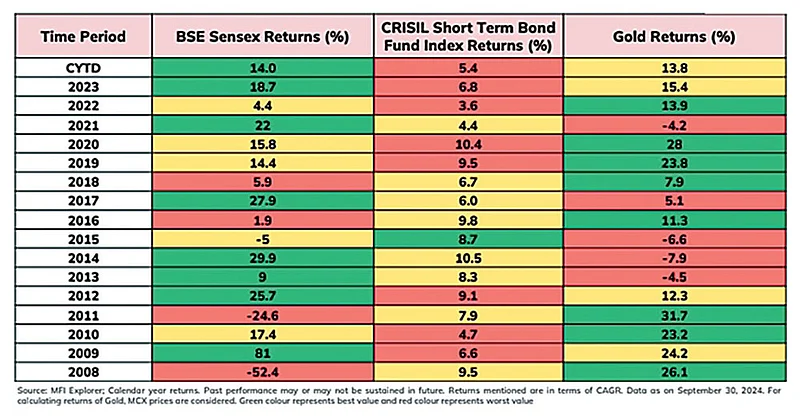

Debt instruments bring stability to your portfolio. While equities are focused on capital appreciation, debt investments provide consistent returns over a longer period. If you refer to the table above, debt has not had a single year with negative returns. Thus, it helps to reduce the overall risk in your portfolio.

Commodities like gold and silver act as a hedge against inflation and provide protection against global uncertainties. Historically, gold has performed well in spurts, as it requires certain conditions when it performs, for example, between 2013 and 2019, gold had a consolidation phase with almost no growth, but from 2019 to 2023, it delivered a CAGR of 14.5%. This illustrates the role that gold and silver can play in protecting your wealth when other asset classes are under pressure.

Why Choose a Multi-Asset Allocation Fund?

Instead of managing separate investments across different asset classes, these funds automatically balance your investments between equities, debt, and commodities. This provides a hassle-free way to ensure that your portfolio remains diversified, reducing the risks associated with market volatility.

Additionally, multi-asset allocation funds can be tax-efficient, offering investors a way to minimize tax liabilities while maintaining exposure to a broad range of asset classes. For example, if you make separate investments between equity, debt and gold, then for rebalancing can result in short-term or long-term capital gains tax. Whereas, if the same is being reblanced at the fund level, then there is no capital gains tax for the investor. This tax-friendly structure can enhance returns.

In today’s complex financial environment, having a well-diversified, balanced portfolio is essential for achieving long-term success. By investing across multiple asset classes, you reduce risk and ensure that your investments can weather any storm. Just like having a strong Wi-Fi signal ensures uninterrupted connectivity, a strong multi-asset allocation ensures consistent portfolio performance across all market conditions.

Disclaimer: The Views are Personal and not a part of the Outlook Money Editorial Feature