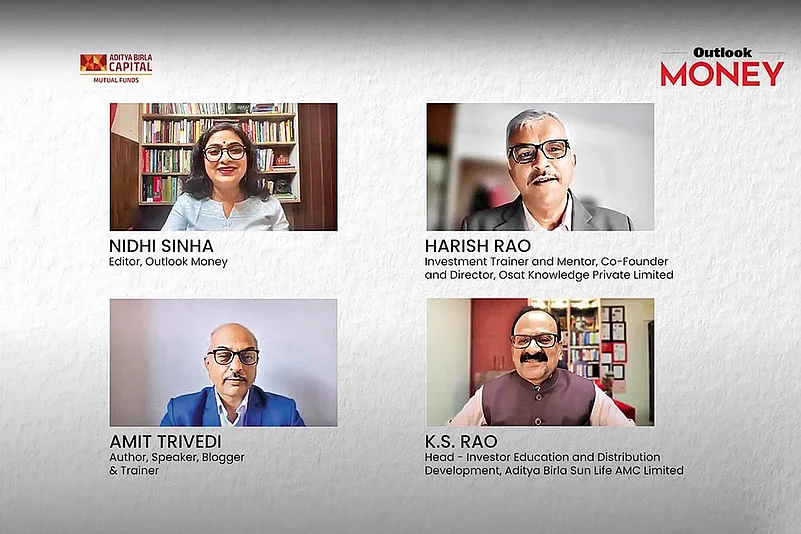

Delayed gratification, understanding the impact of inflation, the power of compounding, recognising risks, and humility are essential to financial success, said experts during a financial literacy webinar organised by Outlook Money in collaboration with Aditya Birla Sun Life Mutual Fund. The session, part of an investor education initiative on September 5, 2024, was moderated by Nidhi Sinha, Editor of Outlook Money. It featured financial experts K.S. Rao, head of Investor Education at Aditya Birla Sun Life AMC Limited, Amit Trivedi, author and trainer, and Harish Rao, investment trainer and co-founder of Osat Knowledge Private Limited. Sinha highlighted how lessons from financial legends can guide personal finance journeys.

Learning from the Legends

Rao shared his insights inspired by Warren Buffett, emphasising long-term focus, value investing, and the power of compounding. He remarked, “Success in investing comes from patience and continuous learning. Buffett’s ability to stay true to his principles through market fluctuations is a model for all investors.” Rao also admired Buffett’s simplicity, adding, “Buffett’s frugality and the Snowball Effect of compounding are powerful lessons for lifetime security.”

Harish Rao offered a personal take, crediting his early financial lessons to his mother. “Opening a savings account at age 10 taught me the power of compounding,” he said, adding that John Bogle’s approach to low-cost, long-term investing is another vital influence. He likened Bogle’s model to the Amul cooperative structure, empowering investors by keeping them central to financial decisions.

Amit Trivedi brought a unique perspective, drawing lessons from cricketer Sunil Gavaskar’s advice to “stay on the wicket,” urging investors not to abandon long-term investments hastily. He also related the classic Indian film Anand to personal finance, encouraging investors to focus on small successes and not fret over short-term losses.

Financial Education: A Lifelong Journey

The experts highlighted the need for continuous financial education. Rao emphasised that informed investors are the most protected, noting, “In 2014, mutual funds were seen as risky, but today, thanks to awareness campaigns, we have reached over 50 million investors.” Harish stressed that financial education often begins at home, advocating for lessons on delayed gratification and discipline, while Trivedi cited Benjamin Graham, noting that self-awareness and discipline are crucial in overcoming emotional biases in investment decisions.

Key Takeaways

Rao summarised his financial mantra with DIP: “Delayed gratification, understanding the Impact of inflation, and the Power of compounding.” Trivedi stressed the importance of humbleness and recognising risks, while Harish urged the audience to focus on building intellectual, social, and emotional capital for long-term financial success.