Priyanka Nair (30) lives in Jalgaon, Maharashtra with her husband Sreejit, who is also 30, their 2-year-old twin daughters and her in-laws, both 60 years of age.

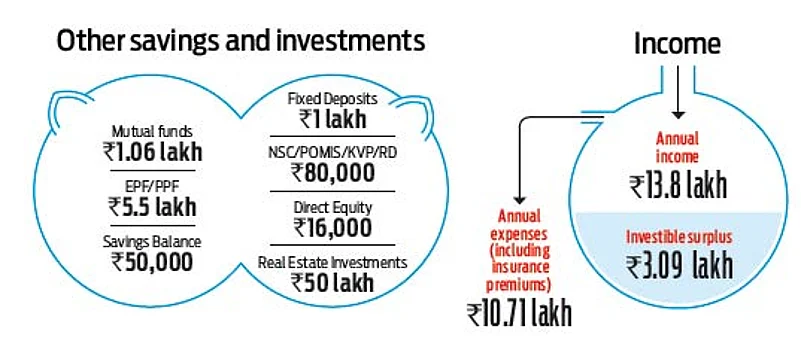

Priyanka works for a multinational company as a brand manager while her husband works in the quality assurance industry. The annual take home salary of the couple is Rs 12.5 lakh, with Priyanka contributing Rs 6.5 lakh into it and her husband contributing the remaining sum.

The couple has made sound investments over the years and have also bought a house on loan whose EMI they are paying currently.

They are also aware of the need for a good insurance cover and have taken up both life and health insurance. Keeping a few necessary things in mind will help them sail through their financial goals.

Insurance

Priyanka and her family have a health insurance coverage of Rs 10 lakh and are paying Rs 34,000 as premium.

They should look for alternatives where they can get the same coverage for lesser cost. Priyanka has a life insurance coverage of Rs 52 lakh while Sreejit has for Rs 17 lakh. Both of them should top up their life insurance coverage to Rs 1 crore each at least by way of term insurance.

The combined cost of individual term plans for the couple will range from Rs 17,000 to Rs 20,000. They should also individually buy accident cover of Rs 25 lakh each.

Children’s education

Avnika and Ananya are twins, so their higher education is also going to happen together. Assuming today's higher education cost of Rs 10 lakh each, the amount that will be required for both after 16 year will be Rs 92 lakh, assuming inflation at 10 per cent.

The traditional life insurance policies that have been bought for them by their parents will mature around 2030, the time when they will be puRs uing their higher education. The expected maturity proceeds from the policies will be Rs 30 lakh.

The balance can be achieved with an SIP of Rs 10,000 in balanced funds assuming an annual return of 12 per cent.

Retirement

The couple’s expenses at the age of 60 will come to be around Rs 1.25 lakh per month.

Assuming life expectancy of 85 yeaRs , they will need a corpus of Rs 3.70 crore to lead a stress free retirement life.

Assuming that they don’t make any withdrawals from their EPF, they will get around Rs 1.25 crore collectively.

To fund the balance amount they need to start and SIP of Rs 7,000 each for next 30 years to reach the magic figure