Children’s Day has been celebrated since 1964 to honour the love and affection Jawaharlal Nehru, India’s first Prime Minister, had for children. The day is observed every year on his birth anniversary, November 14.

Children are the future of any nation, and this day serves as a reminder for adults to take responsibility for creating a bright future for them by providing opportunities to thrive and grow into responsible and knowledgeable citizens.

Beyond the importance of nutritious food for a healthy mind and body, quality education is vital in shaping children into self-reliant and purposeful individuals. The foundation for a happy and fulfilling life, be it health, education, social connections, a sense of purpose, or financial independence, begins at home.

Childhood And Financial Literacy

Does money matter? Yes, it does, but it is often not discussed with children. However, several researches highlight that financial literacy is crucial for a person's overall well-being. Lessons in finance learned early in life pave the way for prudent decision-making and a stable, secure financial future.

Financial literacy is a fundamental skill, and those who possess it are less likely to fall victim to risky investments, gambling, or fraud due to ignorance.

Starting early is the key, as children have a remarkable ability to grasp concepts quickly. But the question remains; how early is not too early?

When Is The Right Time To Start Teaching Financial Literacy To Children?

Rakesh Gupta, assistant professor at SCERT, Delhi, who teaches finance in college and has previously worked in schools with young children, says, “Finance is not just about complex numbers and is not exclusively for adults.”

Financial acumen, he says, can be developed in children from an early age, say 4-5 years. “There is no need to teach numbers first before introducing financial concepts. It can begin with simple ideas like distinguishing between needs and wants, which can shape their spending behaviour. It helps them differentiate essential expenses from non-essential ones, introducing the basics of budgeting.”

Shweta Jain, founder of Investography, an investment firm, says, “Financial prudence and literacy can be introduced as early as age 3. It can begin right from the concept of ‘buy what is needed only’ or ‘what's on the grocery list only’. It can evolve as the child grows older to giving them pocket money or money to spend when travelling to a new place.”

A Study of Several Financial Literacy Teaching Methods for Children published in 2021 in the International Journal of Ethno-Sciences and Education Research, mentions, “The way to introduce financial problems to children is not by directly introducing them to financial products, but more fundamentally by explaining what money is. After they understand the function of money, parents can teach them how to manage finances. The simplest thing parents can do is provide an introduction to the concept of money to children.”

Also Read: What Is Ayushman Bharat Yojana?

How To Impart Financial Literacy To Children

Schools can play a significant role in financial education once a child has acquired basic numeracy skills. However, building financial acumen can begin much earlier at home. Research indicates that fostering habits, such as savings, providing pocket money to encourage independent spending decisions, involving children in shopping, and gradually introducing concepts, such as compounding, budgeting, investing, and the value of money can have a lasting impact. Teaching children that earning money requires effort instils an early appreciation for financial responsibility.

Jain suggests, “Talking to them (children) about how one can earn money to how can invest is important. Leading by example is the best way. Next is to discuss and then let them do it themselves. Some games like Monopoly might also help.”

Sharing her personal life example, she adds, “I did these with my child and he (aged 8 then) did write a book ‘London Here I Come’ about money in 2020, which got published also. He recently went to Japan on a school trip and did his currency calculations on his own.”

Gupta says, “I didn’t consciously dedicate time to formally teach my daughter financial concepts, but open discussions at home helped develop a basic financial understanding in her, such as knowing what to demand and what to avoid.

He adds, “I noticed impulsive behaviour in her when she was younger, but as she entered her teenage years, she became more thoughtful about her spending and never put me in a difficult situation. She now saves her allowance for weeks to buy a desired toy/book instead of spending on small treats which is showing budgeting skills and delayed gratification.”

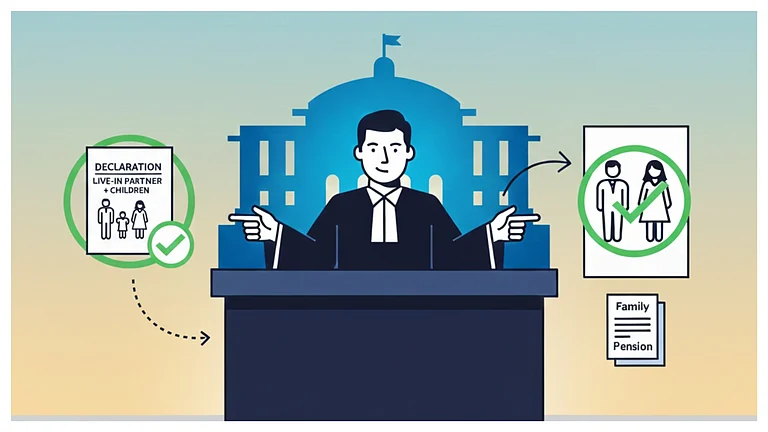

As family structures evolve and nuclear families become more common, with fewer people to depend on, it is crucial to instil financial knowledge in children. This will empower them to navigate their lives successfully, without financial struggles or depending on others.