The 53rd GST Council Meeting addressed several pivotal issues concerning the Goods and Services Tax (GST) regime, aiming to streamline processes and provide clearer guidelines. One significant clarification that emerged from the meeting pertains to the valuation of the supply of import of services by a related person when the recipient is eligible for a full input tax credit. This clarification is expected to simplify compliance and provide much-needed certainty to businesses engaged in cross-border transactions within related entities.

I.Background

In the context of GST, the valuation of goods and services is crucial for determining the tax liability. However, complexities arise when dealing with related party transactions, especially in cross-border services, where the value declared on the invoice may not always reflect the true market value. The issue becomes more intricate when the recipient of such services is eligible for a full input tax credit (ITC). In such cases, the concern shifts from the actual payment of tax to the accurate declaration of the value of services.

GST authorities have been issuing notices under Section 150 of the CGST Act to companies for discrepancies in input tax credit claims, prompting scrutiny of annual returns against monthly filings. Although businesses clarified that some notices lack verification, imposing undue compliance burdens the officials maintained that mismatches cannot be overlooked.

Moreover, there have been concerns against some registered persons, seeking tax on a reverse charge basis for certain activities performed by their related persons based outside India. These activities are being considered as import of services despite no consideration being involved. There has been a long-standing demand that the same treatment that is given to domestic related parties or distinct persons, as clarified in Circular No. 199/11/2023-GST dated 17.07.2023, should also be given to a foreign entity providing services to its related party in India, particularly when the recipient in India is eligible for full ITC. Vide the Circular No. 199/11/2023-GST dated 17.07.2023, only the inter-state transactions between the distinct persons under Section 25 of the CGST Act. The Circular had clarified that the value of supply of services between the head office and brand office should be determined as per the open market value under Rule 28(1), and in cases where full input tax credit is available to the Branch officer, the value declared in the invoice by the head officer is deemed to be the open market value.

However, there remained ambiguity regarding services provided to an Indian branch office from their foreign head office.

II.The Clarification

The Council recommended clarification that in cases where a foreign affiliate provides services to a related domestic entity, and the domestic entity is eligible for full input tax credit, the value of such services declared in the invoice by the related domestic entity may be deemed as the open market value. This recommendation aligns with the second proviso to rule 28(1) of the Central Goods and Services Tax (CGST) Rules, which deals with the valuation of transactions between related persons. for instance, a foreign affiliate provides IT services to its related domestic entity in India. The domestic entity declares the value of these services as ₹10,00,000 on the invoice. Hence, the declared value of ₹10,00,000 is deemed to be the open market value. The domestic entity pays GST on ₹10,00,000 and claims the same as input tax credit, resulting in no net tax liability.

Council further recommended that when the related domestic entity issues no invoice for services provided by the foreign affiliate these services' value may be declared as Nil. For instance, when a foreign affiliate provides consultancy services to its related domestic entity in India and no invoice is issued by the domestic entity for these services then the value of these services is deemed to be Nil. The domestic entity pays no GST on this transaction and no input tax credit is claimed.

In line with the GST Council recommendations, the CBIC vide the clarificatory Circular No.210/4/2024-GST dated 26.06.2024 clarified that earlier Circular No. 199/11/2023-GST dated 17.07.2023 regarding the supplies of services between distinct persons in cases where full ITC is available to the recipient, is equally applicable for the import of services between related persons.

III.Implications of the Clarification

This clarification has several important implications for businesses and tax authorities:

1.Simplification of Compliance: The clarification simplifies the compliance requirements for businesses engaged in related party transactions involving import of services. By deeming the invoice value as the open market value, businesses can avoid the complexities of justifying the valuation to tax authorities, thus reducing administrative burdens.

2.Certainty and Predictability: Providing a clear guideline on the valuation of such transactions offers businesses greater certainty and predictability in their tax planning and reporting. This helps in avoiding disputes and potential litigations related to the valuation of services.

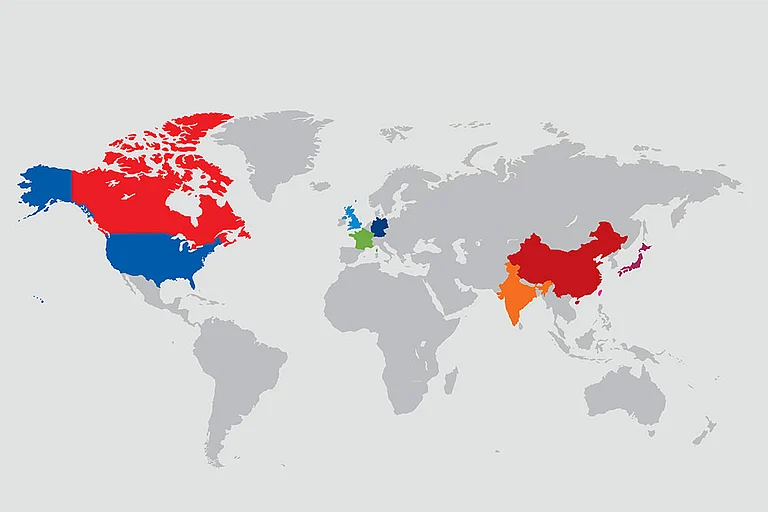

3.Alignment with International Practices: The approach of deeming the invoice value or Nil value as the open market value aligns with international practices where related party transactions are often subject to simplified valuation rules. This alignment enhances India's attractiveness as a business destination by reducing the compliance burden on multinational corporations.

4.Focus on Substance Over Form: The clarification emphasizes the substance of the transaction over its form. By considering the availability of full input tax credit, the Council acknowledges that the actual tax paid does not impact the recipient's final tax liability. This pragmatic approach ensures that the tax system does not penalize businesses for formal compliance issues when there is no revenue loss to the exchequer.

IV.Conclusion

The clarification regarding the valuation of the supply of import of services by a related person where the recipient is eligible for full input tax credit marks a significant step towards simplifying GST compliance for related party transactions. By deeming the declared or Nil value as the open market value, the GST Council and the clarificatory Circular No.210/4/2024-GST dated 26.08.2024 has provided businesses with a clear and pragmatic approach to valuation. This reduces the administrative burden and aligns with international best practices, fostering a more business-friendly environment in India. Additionally, it will also be beneficial for the taxpayers who may have missed out on issuing invoices on service imports from foreign related parties. Going forward as well the companies may review the position on taxability and valuation towards import of services from foreign affiliates considering these clarifications.. As businesses adapt to these clarified rules, they can look forward to greater certainty, reduced disputes, and a more streamlined compliance process under the GST regime.