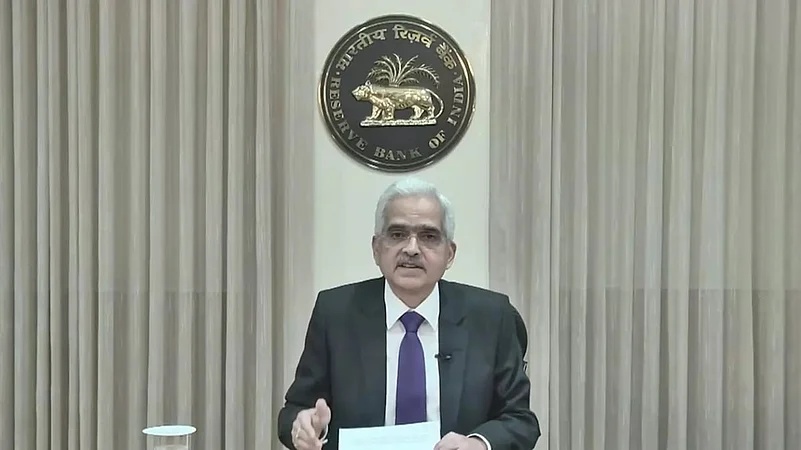

The Reserve Bank of India (RBI) on December 7, 2022 announced various developments for industry stakeholders, consumers, and India’s financial markets, in its last monetary policy committee (MPC) meeting for 2022.

The RBI decided to gradually move towards normal liquidity operations and restore market hours from 9 am till 5 pm. Apart from this development, the RBI has now also permitted resident Indians to hedge their gold portfolio in eligible and recognised exchanges situated in the International Financial Services Centre (IFSC). At present, IFSC is a designated area in Gandhinagar, Gujarat.

Here are some of the market-related developments announced at the MPC meeting.

Bond/Money Market Timing Is Back To Normal

The RBI said that as part of a gradual move towards normal liquidity operations, it has now been decided to restore market hours as previously, i.e., from 9am till 5 pm. It is to be noted that this market hours is specifically for call/notice/term money, commercial paper, certificates of deposit, repo in the corporate bond segment of the money market, as well as rupee interest rate derivatives.

“Although the Reserve Bank remains in absorption mode, we are ready to conduct liquidity adjustment facility (LAF) operations that inject liquidity as may be needed through our main operations,” the RBI said.

Justifying this development of restoring the market timing, RBI said that the overall system liquidity “remains in surplus”. During the period from October 2022 till November 2022, the average total absorption under LAF was Rs 1.4 lakh crore.

The absorption figure for October-November period was lower than the August-September period, which was Rs 2.2 lakh crore on an average.

RBI said that in the period ahead, liquidity conditions are likely to improve due to several factors, which would include moderation in currency in circulation in the post-festival period, pick-up in government expenditure in the last few months of the financial year, and higher forex inflows due to the return of portfolio investors.

“The Reserve Bank remains committed to flexibility and two-sidedness in liquidity operations, but market participants must wean themselves away from the overhang of liquidity surpluses,” the RBI said.

According to Venkatakrishnan Srinivasan, founder and managing partner, Rockfort Fincap, a debt advisory firm, restoring market hours from 9 am upto 5 p.m. should help the traders to get into full fledged trading activity in a phased manner and they will have ample time now to borrow and lend funds in call and term money markets.

"Trading activities of Commercial paper, certificates of deposit will increase further and subsequently leads to deepen the liquidity of these instruments," Srinivasan further added.

Indian Residents Can Now Use IFSC To Hedge Against Gold Price Volatility

In order to provide more flexibility to Indian resident entities who want to hedge their gold’s value, the RBI has now allowed them to use recognised exchanges located in the International Financial Services Centre (IFSC).

Sandeep Bagla, CEO, Trust Mutual Fund, said, "Till now resident entities could not hedge gold price risk in overseas markets. In the GIFT city, there are a number of exchanges which can enable resident entities to hedge their gold risk. It could be beneficial for select entities like jewellers who hold a large inventory of gold at any point of time."