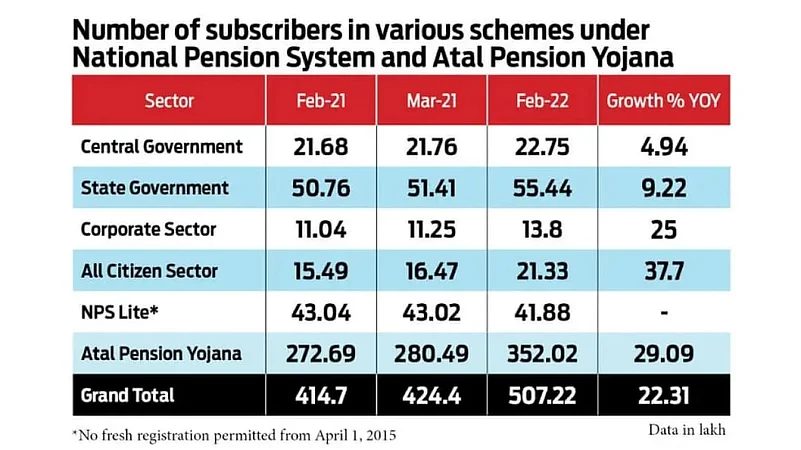

The number of subscribers in various pension schemes under the Pension Fund Regulatory and Development Authority (PFRDA) has risen to 50.72 million by the end-February 2022 from 41.47 million the same month a year ago.

According to PFRDA data, this represents a healthy year-on-year (YoY) increase of 22.31 per cent.

This is despite the fact that the National Pension System (NPS) has lost some ground as the Rajasthan and Chhattisgarh governments have decided to implement the Old Pension System in its place.

To read more about the difference between the NPS and the Old Pension Scheme, click here: https://www.

The 22.31 per cent rise includes the increase in Atal Pension Yojana accounts, which have gone up to 35.20 million from 27.27 million in February 2022, a YoY increase of 29 per cent.

The corporate and "all citizen" subscribers (financially independent, self-employed, or professionals) have also increased.

In a single year, corporate subscribers increased by 25% to 1.38 million in February 2022.

In comparison, the growth in the central and state government sectors has been muted at 2.27 million (4.94 per cent) and 5.54 million (9.22 per cent), respectively.

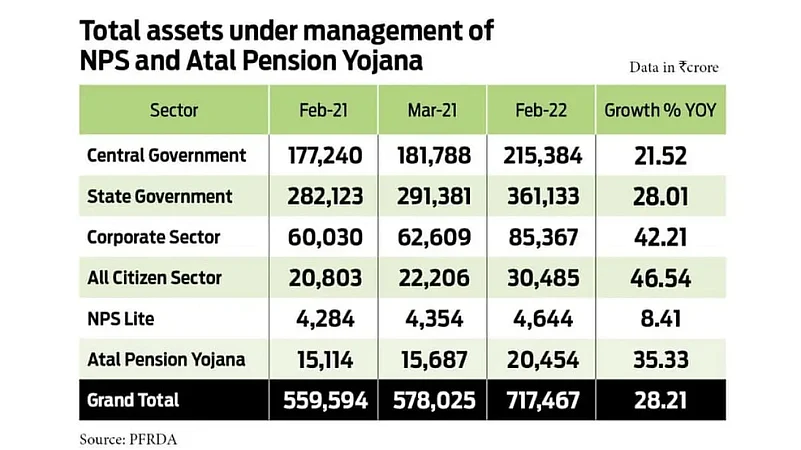

In addition to the increase in the number of subscribers to NPS and Atal Pension Yojana, the assets under management (AUM) have also risen.

While the overall amount has gone up by 28 per cent in a year, the maximum increase was seen in the all-citizen segment at 46.54 per cent.

The AUM in this category went up from Rs 20,803 crore in February 2021 to Rs 30,485 crore in February 2022.

The second category to have seen the most increase in AUM is Atal Pension Yojana, at 35.33 per cent. The funds managed under the scheme increased from Rs 15,114 crore to Rs 20,454 crore in February 2022.

Investments coming in from corporate employees also saw a healthy growth of 42.21 per cent, from Rs 60,030 crore to Rs 85,367 crore in February 2022.

In comparison, the contributions from central and state government employees were lower -- while investments from central government employees increased from Rs 1,77,240 crore to Rs 2,15,384 crore, those from state government employees went up more—from Rs 2,82,123 crore to Rs 3,61,133 crore in February 2022.

The NPS Lite model saw the most modest increase, with investments increasing by only about 8%, from Rs 4,284 crore to Rs 4,644 crore.

However, this is despite the fact that the NPS Lite model saw a decrease in the number of subscribers from 4.3 million in February 2021 to 4.18 million in February 2022.