The Life Insurance Corporation (LIC) of India has cautioned policyholders in a public notice about a fake information being circulated on various social media channels that claims that the life insurer will penalise policyholders if they fail to update their KYC details.

The fake message says that LIC is charging customers a penalty for failing to update their ‘know your customer’ (KYC) details. The fraudsters reportedly approached the customers to give them their KYC documents adding that they will get the details included in the LIC policy .

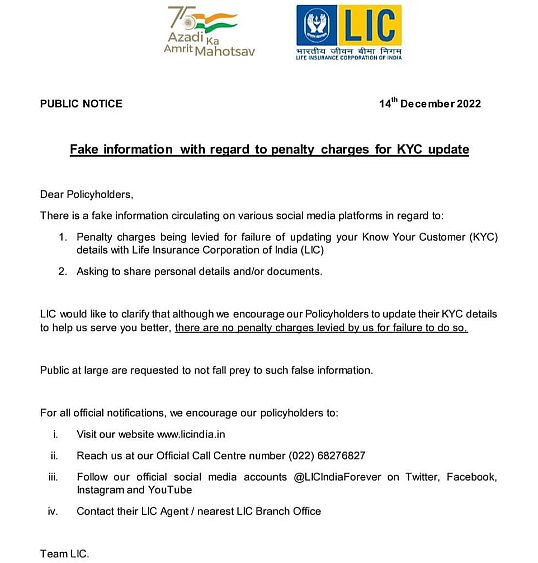

LIC has now issued an advisory squashing such fraudulently spread rumours about KYC.

It said in the advisory: “LIC would like to clarify that although we encourage our policyholders to update their KYC details to help us serve you better, there are no penalty charges levied by us for failure to do so.”

LIC also mentioned the official ways in which customers could reach out for any clarification related to their policies.

Customers could reach out to them on the official website, www.licidia.in, through phone on (022) 6827 6827, on the official social media handle LICIndiaForever on Twitter, Facebook, Instagram, and YouTube, and through any designated LIC agent or branch.

According to Pinakin Dave, country manager, India and SAARC, OneSpan Inc, a Chicago based cyber security company, "Financial institutions and banks will never ask for money from their customers in this manner. Even if you get such a call, visit the bank/ financial institution’s official website and call the number mentioned there to verify. Besides, some of the ways to stay safe online is to always update your anti-virus software and your computer/ mobile systems. Using passwordless authentication is another way to ensure security. Multi-factor Authentication (MFA) system is also another way of ensuring security while transacting online."

According to Aayush Choudhury, CEO & co-founder, Scrut Automation, a compliance automation company , "Over the last few years, and particularly as the world has become more digital during and after COVID-19, people - both as individuals and employers have become attack paths for several cyber criminals. While companies still conduct phishing training for their employees, individuals and consumers are still vulnerable. There is a need for concerted effort from banks and financials institutions to train their customers continuously on ever evolving phishing tactics."

How To Know If The Person Approaching You For KYC Documents Is Genuine Or Fake?

LIC said that the official website ends with .in and not .com or .org. Likewise, LIC’s social media handles are the same across channels – the ‘I’ and ‘F’ are in caps, while the rest of the word excluding LIC is in small in the username LICIndiaForever.

Manoj Shastrula, CEO & founder, SOCLY.io, a cyber security compliance company, said that one should not trust any social media post which is not backed by any official source. Circular by LIC is welcome but always verifying the source to double check in several ways is advisable. LIC won't be asking for any confidential details over a phone or any other communication.

"Thus never to rely on a single communication method. Always try to back check from your end. Also, being vigilant at all times when it comes to unsolicited communication, whether via email, social media chats, or even text message is also a necessity. You should never click on a link or attachment unless you’re sure it’s safe. Always keep a safe copy of your documents. This could help you recover your information if you are a victim of phishing, in addition to ensuring you can find them in case you lose your devices or they are stolen," Shastrula further added.

KYC is an important part of buying or transacting with any financial, insurance, banking, or other products. This is because KYC checks make sure that the investments, insurance policies, and others are authentic and the ultimate maturity benefit reaches the correct person.

Also, under the Prevention of Money Laundering Act, 2002, KYC is a mandatory document, since it will help eliminate the chances of black money.

On April 24, 2020, the Insurance Regulatory and Development Authority of India (IRDAI ) said in a release that insurance companies can now use Aadhaar authentication method for KYC purposes. This move could help people comply with the KYC regulations from the comfort of their home.

Source: LIC Twitter Handle