About 34 per cent of Indian women taxpayers below the age of 26 years have filed their income tax return (ITR), a survey by Clear, formerly known as ClearTax has revealed.

Besides, about 49 per cent of senior citizens did not use their Section 80C deduction limit, and even a larger 68 per cent of them did not use their Section 80D health insurance deduction limits, the survey by the fintech tax filing assistance company has revealed.

Here are the trends observed by the survey.

More Than A Third Of Young Women Filed ITR

Women below the age of 26 years represented 34 per cent of all women who filed income tax returns, the survey revealed, followed by 35 per cent of 26-30 year olds, and above 50 year olds.

Table showing percentage distribution of women who filed ITRs by age. Source: Clear

46 per cent Women Exhausted Their 80C Limit

It was found out that about 46 per cent of all women who filed their ITRs fully exhausted their Section 80C deduction limit, which was the highest among women. Only 11 per cent women did not use this deduction.

Table showing percentage wise distribution of women who used their 80C deduction limit. Source: Clear.

49% Senior Citizens Did Not Utilise 80C Limit, 68% Did Not Fully Use 80D Limit

It was found out that most people aged 60-plus did not fully use their income tax deduction limits under both sections 80C and 80D of the Income-tax Act, 1961.

About 34 per cent seniors fully exhausted their 80C deduction limits, and about 7 per cent exhausted their 80D limits. About 49 per cent did not use the 80C limit and 68 per cent did not use 80D, the survey revealed.

Table Showing Percentage of People Using 80C and 80D deduction limits. Source: Clear

Section 80D of the Income-tax Act, 1961 allows a taxpayer to claim deduction for health insurance premium and expenses incurred towards preventive health check for self, spouse, dependent children and parents.

Section 80C of the Income-tax Act, 1961 allows taxpayers to reduce their taxable income by making certain specified tax-saving investments, such as tax-saving fixed deposits, equity-linked savings schemes (ELSS), and others.

Middle Aged People Were Highest Age Group For Filing ITR

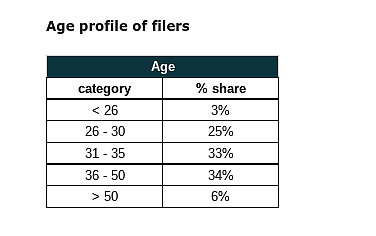

People below 26 years of age and those above 50 years of age comprised about 3 and 6 per cent respectively, in the demography representing people who were filing their ITRs.

The majority portion of people who were filing ITR were in the age group of 36-50 years, followed by those aged 31-35 years, the survey revealed.

Table showing the distribution of people who were filing ITRs by age group. Source: Clear