The Multi Commodity Exchange of India recently launched Gold Mini Options Contract with Gold Mini (100 grams) Futures as the underlying. Investors, jewellers, traders and other key stakeholders welcomed this move, as was evident from the launch day (April 25, 2022) turnover of Rs 66.1 crore and the second day turnover of Rs 95.41 crore.

Click here to read the exclusive Interaction with Shivanshu Mehta, head – bullion, MCX, about the launch of gold mini options with gold mini futures as underlying.

So what makes this newly-launched option an attractive investment, and how can you too use this for earning money. Read on to find out.

What Is Gold Mini Options Contract With Gold Mini (100 grams) Futures As Underlying?

There are four types of gold contracts – namely Gold, Gold Mini, Gold Guinea, and Gold Petal. The newly-launched gold mini option will use the gold mini future (100 grams) as its underlying contract instead of the regular gold contract, which is denominated in 1 Kg.

“The newly-launched gold mini option will use the gold mini future (100 gms) instead of the regular gold contract’s 1 kg denomination. The option will use the gold mini futures price as the underlying asset instead of the spot. This means the basis (premium or discount to spot) will determine the option price rather than the absolute spot price,” says Vijay L Bhambwani, head of research, behavioural technical analysis, Equitymaster.

How Does This Benefit You?

MCX designed the gold mini contract taking into account feedback received from market participants and other stakeholders. Hence, it proves a comprehensive benefit to almost all buyers, including retail, jewellers, small traders, institutions, and others.

Benefits To Retail

1. Lower Capital: The gold mini options contract with the gold mini (100 grams) future as its underlying contract will be quoted in Rs per 10 grams. For example, Gold mini future contract as of 2pm is quoted on MCX at Rs 51,282. The gold mini call option (51,200 CE) is trading at Rs 1,008, for which you need Rs 1,008*10=Rs 10,080.

“The biggest advantage of the gold mini options is that they require a much lower cash outlay, compared to a standard option. The gold mini options are a good investment tool for those with limited capital, such as small investors, to trade very high-priced commodities like gold right now,” says Sriram Iyer, senior research analyst at Reliance Securities.

2. Trade Opportunity: The future contract price of any asset mostly trades above its spot price, since a lot of factors, such as time value of money, overnight interest rate, cost of capital and others, are factored in.

“A future contract price will mostly be higher than the cash spot market, since the future price is calculated by taking into factor various aspects like time value of money, risk free interest rate, cost of capital, and the number of days left till its expiry, and other factors. Hence, this difference in spot cash price and its future price can be attributed to spot – future parity,” says SP Tosniwal, founder and CEO, ProStocks, a stock broking and financial services company.

Since the gold mini options uses the gold mini (100 grams) futures as its underlying, it opens up trade opportunities arising due to price differential.

“There is a possibility that the spot price is steady, but the future falls (basis contracts), then the call options premium will rise, and put options will fall. In a routine market, there should’ve been no change,” adds Bhambwani.

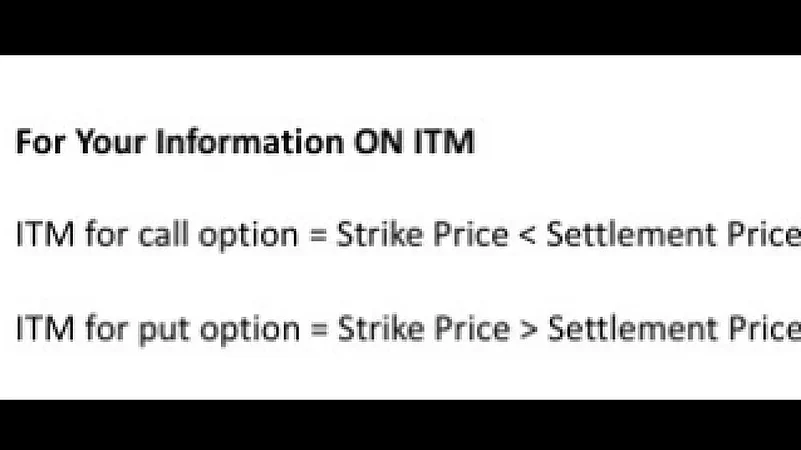

2. Settlement Into Future: You might be interested in buying a gold mini (100 grams) future contract, but you fear that the prices are volatile, at present. To eliminate this, you can buy the gold mini option contract since all open In The Money options (ITM) and deep ITM option contracts will be devolved into futures positions, and all such devolved futures positions shall be opened at the strike price of the exercised options. This is only possible unless you have given not to exercise instruction.

“All In The Money options (ITM), including deep ITM options will eventually convert into the respective underlying futures contract unless ‘contrary instruction’ has been given by long position holders of such contracts for not doing so. The rest Out Of Money (OTM), Close To Money (CTM) and At The Money (ATM) will be either cash settled, or expire worthless as per the situation and price at time of expiry,” says Megh Mody, commodities and currencies research analyst at Prabhudas Lilladher.

3. Losses Limited: If you are a buyer of option contracts, then the maximum loss that you could face is the amount of premium paid and nothing beyond that. But the amount of profit that you could earn is technically limitless.

Benefits To Institutions

1. Cost of Capital: Since a lot less capital is blocked in the gold mini option trade, the intrinsic cost of capital i.e., opportunity interest cost is lower.

“Opportunity cost is the cost which arises when a given alternative is chosen over the next available alternative. Suppose, for buying the future contract you need Rs 1 lakh capital, but for buying the option contract based on the same future contract, you need Rs 15,000, so Rs 85,000 can be saved and invested in other assets to generate income,” says SP Tosniwal.

2. Customisable Hedging Benefit: Using the respective option and future contract, institutions can simultaneously go long or short on the respective gold mini option or future contract as per their market expectations, and as per their required lot size.

“Institutions can use gold futures as trading, but gold options can be used to hedge, especially for importers or the ones who take physical delivery of gold. Since the lot size and initial margin of gold mini options is also lower, they can benefit from it by customising the positional trade according to their requirement,” adds Mody.