The consequences of sucking up cash from the system cannot be comprehended easily and in a short time. Yes, there are benefits of reducing cash in the system and increasing the usage of digital money. One thing is clear though, there will be an impact on our finances and definitely so with our investments. The no cash-only credit scenario will impact the economy in the near term, which is why you should sit up and take note of sectors that will get impacted to play your investments accordingly.

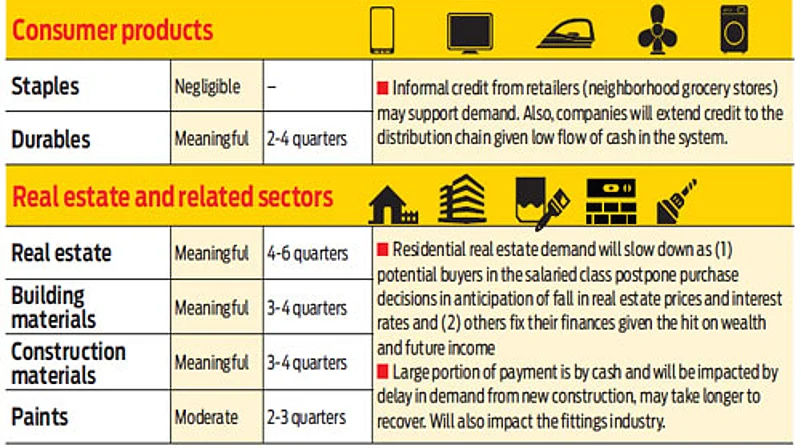

The impact on the markets can be attributed to multiple factors-the US election results, the approaching year end as well as the currency demonetisation drive. The sector which is likely to be most impacted is real estate, which is already facing difficulties due to the downward economic cycle. The impact will not be just on the construction and construction material segment, it will also be on Housing Finance Companies (HFCs).

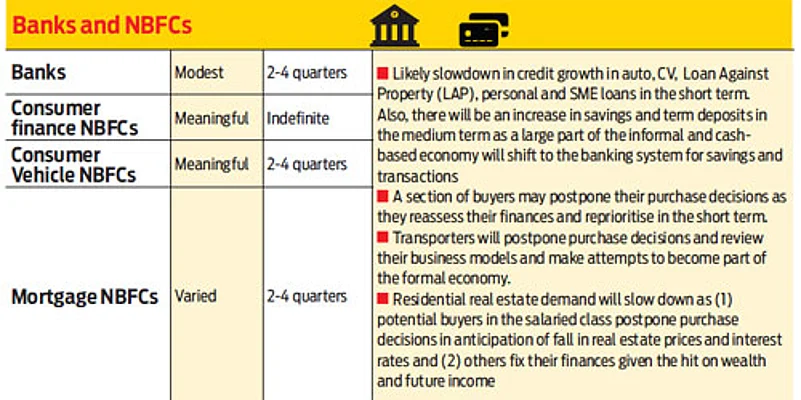

Another sector which will be impacted adversely is the jewellery segment, though jewellers welcomed the move as reduction in cash will create a demand for gold, which is favourable to them. The NBFC sector too will face the heat, as it is the lifeline for small and medium businesses. There could be default in repayment of loans, especially in cases of loans against property, which is popular among the MSME segment of borrowers. At the same time, banking stocks are likely to do better with the increase in deposits.

As an investor, you should not make any irrational move by shifting your investments in haste because of the impact of the demonetisation. As money is generally deployed keeping a few years timeframe in mind, one should give some time before taking any drastic steps. Be clued into the changes around you and track the market movements more regularly to understand the changes as they occur.