The recent hike in interest rates globally and in India along with the rise in construction costs notwithstanding, the realty sector in India is looking to positive days ahead.

Earlier, concerns had been raised over the sustainability of residential demand, as well as the potential impact on developers’ operating margins due to rising input costs, higher interest rates and the overall economic scenario.

Now, ICICI Securities has come out with an update on the residential real market sentiment in India in a report titled Real Estate – Residential: Shaken, Not Stirred

It said that the situation is gradually improving to the pre-pandemic levels, and unsold inventory is also on a decrease, thereby signifying a rise in buyer demand, which had been severely hit because of the Covid-19 pandemic.

“While these concerns are justified, we are of the view that developers in our listed coverage universe have already anticipated these concerns based on past cycles and are now pursuing a path of calibrated growth, while keeping balance sheets healthy. Hence, we believe that listed developers may be ‘shaken, not stirred,” the report said.

According to the report, the bullishness is based on the following four factors:

Listed developers’ debt levels have declined by 45 per cent post covid: The report said that on an aggregate basis, listed developers in the coverage universe (ex-REITs) have been able to bring down their consolidated net debt down by 45 per cent to Rs 23,900 crore (ex-DCCDL) between the fourth quarter of FY20 to fourth quarter of FY22 (March 20 to March 22).

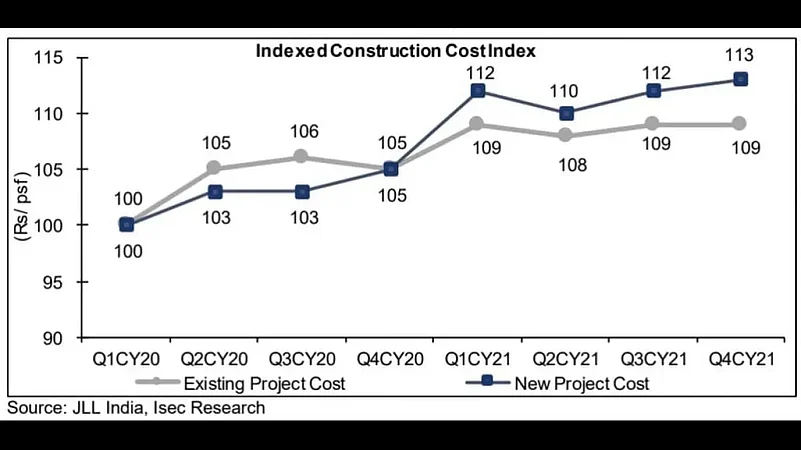

Construction cost increase to be mitigated by price hikes: Post January 22, global macro factors have led to a further escalation in costs, especially in commodities, such as cement and steel, leading to a further rise of 7-8 per cent in costs for new projects in the last quarter of FY22. Most leading developers have accordingly taken price hikes of 3-8 per cent across projects to mitigate cost push inflation in March-April ’22, the report said.

Affordability of residential homes remains favourable: Recent rate hike actions globally and in India led to large lenders increasing home loan mortgage rates by 90-100 basis points (bps) from 6.7 per cent to 7.6 -7.7 per cent. This translates to a 7- 8 per cent higher equated monthly instalment (EMI) outgo for new homebuyers over a 20-year loan tenure, which may not significantly impact demand, as wage inflation should keep pace with the increase in EMIs, especially in the IT/ITeS sector across India’s tier-I cities, the report added.

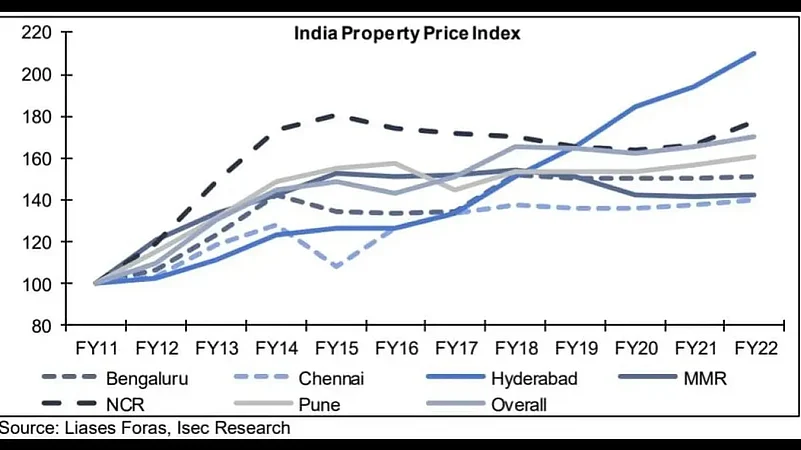

Listed developers to see continued market share gains: Overall, FY22 sales volumes across India’s eight tier-I cities grew by 41 per cent year-on-year (y-o-y) to approximately 269,400 units, which is at par with FY20 sales volumes along with unsold inventory months across cities declining from 46 months as of March 2020 to 36 months as of Mar 2022.

Despite a second covid wave in April 2021, which impacted sales volumes in the first quarter of FY22, residential sales for the remainder of FY22 have been on an upward trajectory since the second quarter of FY22, according to Liases Foras.

The report further said that the overall industry volumes in FY22 had recovered to FY20 levels, and the residential market share of listed coverage universe had risen from 16 per cent in FY20 to 25 per cent in FY22 at a pan-India level.