ICICI Prudential Mutual Fund has launched ICICI Prudential Passive Multi-Asset Fund of Funds. The offering aims to provide returns that closely correspond to the total return of the benchmark CRISIL Hybrid 50+50- Moderate Index (80% weightage) + S&P Global 1200 Index (15% weightage) + Domestic Gold Price (5% weightage) subject to tracking errors. S Naren, ED & CIO, ICICI Prudential Mutual Fund believes over the last decade easy liquidity conditions and rate cuts by global central banks created a conducive environment for equity markets to perform.

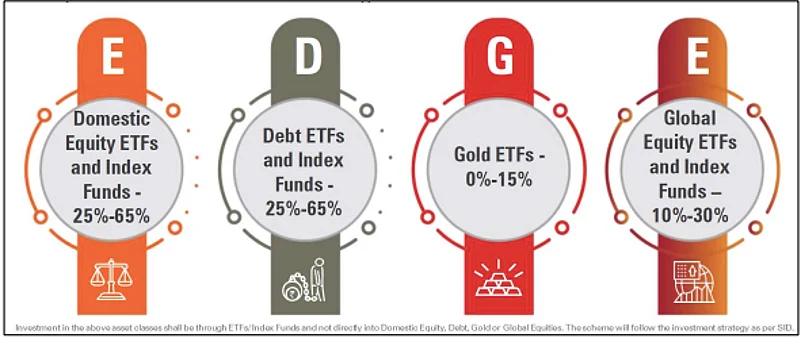

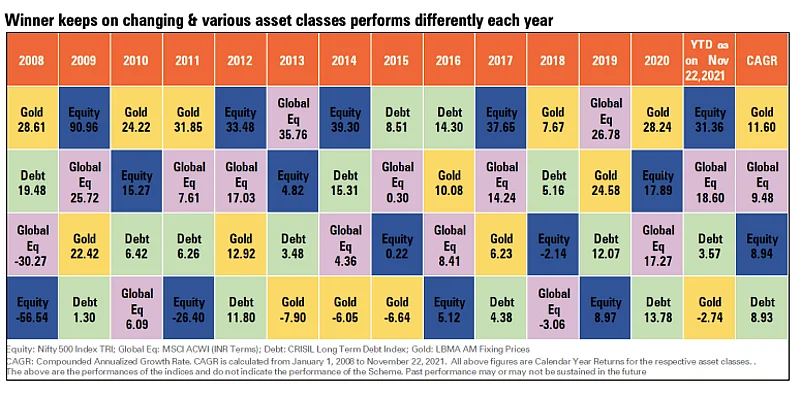

Now with the withdrawal of stimulus measures, multi-asset philosophy is likely to provide better outcomes in the near term. Speaking on the launch of the product, Mr. Chintan Haria, Head – Product Development & Strategy, ICICI Prudential Mutual Fund said, “We believe this product is a simple solution for an investor looking for multi-asset allocation through the passive route. Apart from allocation to domestic equities ETFs/Index, debt ETFs/Index, and gold ETFs, an investor will also have exposure to ETFs/Index investing in global companies as well through this product, thus bringing in geographical diversification as well.” ICICI Prudential Passive Multi-Asset Fund of Funds aims to be a simple solution for multiple problems. The Scheme provides a blend of all asset classes and follows the approach below.

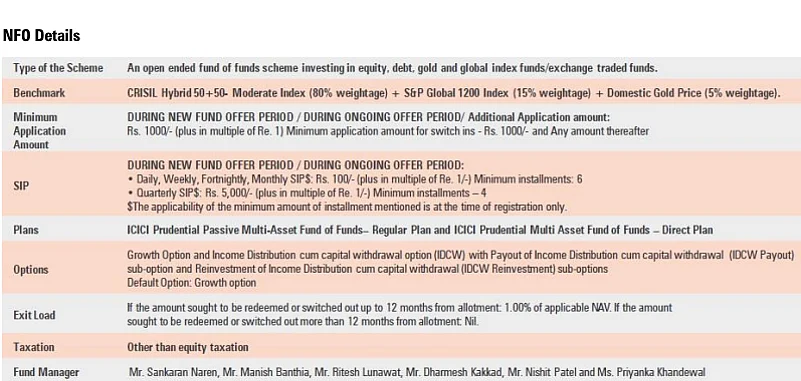

The minimum application amount at the time of NFO is Rs. 1000. An investor can also opt for either Daily, Weekly, Fortnightly or Monthly SIP starting at Rs. 100. Why should investors consider ICICI Prudential Passive Multi-Asset Fund of Funds?

- Provides investors the opportunity to take exposure to an offering which is well-diversified across asset classes

- Monitored regularly by experts to mitigate potential risks and provides tactical allocation to a particular sector

- Active involvement in identifying asset class mix including exposure to select and innovative range of global ETFs

- The offering is both cost and tax efficient as the investor will not attract any tax incidence when the FoF is rebalanced

- Expertise in managing various philosophies that have mandate to invest across asset class or themes