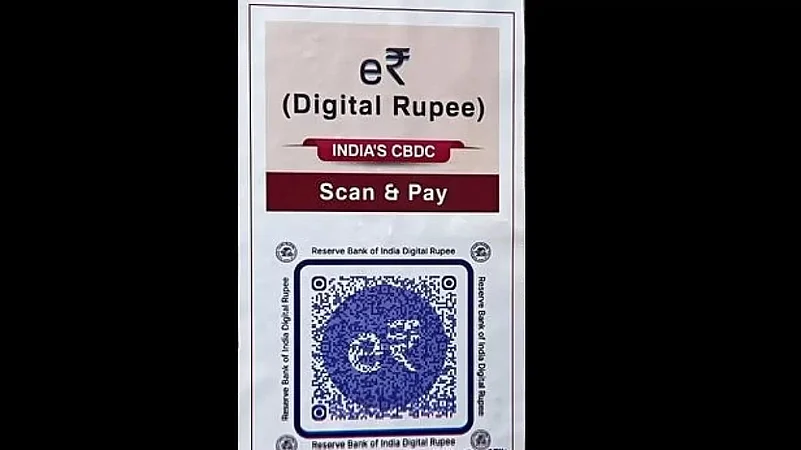

The Reserve Bank of India (RBI) on Thursday, December 1, 2022, began the much-awaited trial run of India’s first retail central bank digital currency (CBDC) or ‘e-rupee' in four cities—Mumbai, Delhi, Bengaluru, and Bhubaneswar—through eight participating banks.

CBDC is not expected to replace India’s premier instant payment solution, Unified Payment Interface (UPI), instead, it is touted to replace physical cash.

So, what is CBDC and how is it different from UPI?

What Is CBDC?

Every Indian banknote reads: “I promise to pay the bearer the sum of…” So, each banknote is a liability of RBI or the central bank.

Rahul Advani, policy director of the APAC region at Ripple, a Blockchain-based payment solution company, says, “CBDCs represent a liability of the central bank, and can be either retail (the digital equivalent of cash for use by households and businesses) or wholesale (accessed only by financial institutions, similar to existing central bank settlement accounts).”

CBDC Vs UPI

CBDC Won’t Replace UPI But Will Enhance Its Applicability

Rajashekara V. Maiya, VP and global head of business consulting, Infosys Finacle, the fintech subsidiary of IT company Infosys, said CBDCs “will act as cash in digital form for retail payment systems such as UPI. CBDCs and UPI are different in applications, and one cannot replace the other.”

“They will co-exist, and their utilities will differ. With the world evolving towards more digital than physical, CBDCs can serve as digital banknotes in the future digital economies,” Rajashekara V. Maiya further added.

Unlike UPI, CBDC Is Tokenised With Use Cases Beyond Payments

Says Muzammil Patel, global head of strategy and corporate finance at Acies, a technology consulting services company, people should not limit the use case of CBDC as only a payment solution, for that UPI is already there. Instead, CBDC is a tokenized digital currency that may replace all the paperwork formalities done before actual payment.

For example, suppose when two people enter into a payment contract for lease rental discounting of a house, a lot of paperwork is involved, like creating e-nach mandates for setting up a collection mechanism, physical contract, trust account, etc. So when the parties approach a bank for this purpose, they go through an entire process, like proving the contract is real, validating the transaction, and others.

“So CBDC as a digital currency has far more utility than just a payment mechanism. Since it is using the distributed ledger technology (blockchain) as its underlying technology, the scope of it evolving to a larger use case is there,” Patel further added.

CBDC Eliminates Payment Frauds

Maiya says, "It is important to secure such usage at the retail level; hence tokenization is planned to ensure that there are no duplicate or fraudulent payments."

According to Shams Tabrej, founder and CEO of Ezeepay, an Uttar Pradesh-based payment services company, CBDC will allow people to access the central bank directly. CBDC's debut aims to authenticate the entire payment process by simplifying it and placing it under RBI. The difference between UPI and CBDC is that while UPI transactions are fully backed by a physical currency, the CBDC, or the digital rupee, is a legal tender and not supported by a physical currency.

"International money transfers to obtain paper money from banks become hassle-free with the introduction of the Indian digital currency," added Tabrej.

CBDC Does Not Require A Bank Account While UPI Needs One

Says Supratik Nag, vice president, product management, Maveric Systems, a banking technology service provider company, "These CBDC vouchers can be redeemed through one-time seamless payment mechanism without using any card or bank accounts via CBDC UPI payment gateway. In regular UPI payments, users need bank accounts to transfer funds and use services. In CBDC, a user doesn’t need a bank account."

"UPI and CBDC both have distinct uses. Since there will not be any requirement for bank accounts, using these CBDC vouchers, public services can reach all the corners of the country and, the allocation/distribution of funds can be monitored centrally," Nag further added.

CBDC Is More Anonymous Than UPI

In an interview with Business Standard, V. Vaidyanathan, MD & CEO of IDFC First Bank, said that “CBDC is more anonymous than traditional digital transactions.”

He added that in the CBDC, the core banking system would have a one-time debit entry for currency purchases, but subsequent transactions will all move from wallet to wallet. This will be more convenient than carrying physical cash, as a physical wallet can only hold a limited quantity of cash when compared to a digital currency wallet.