Earlier this year, online food delivery platform, Zomato’s 10-minute delivery plan faced flak from netizens and politicians. They slammed the move alleging that it would put the lives of their delivery partners in danger, as they will rush to meet their target.

Zomato, on the other hand, stressed that it would not pressurise the gig workers. Politicians, too, appealed to the government to regulate the gig economy.

In June 2022, Niti Aayog released a report named 'India’s Booming Gig and Platform Economy' after studying and giving recommendations on improving gig work and the gig work platform in India.

Now, Karma Life, a fintech start-up providing solutions to gig economy workers’ financial problems has come out with a report, titled GigPulse, on the back of a detailed survey on gig workers in India that throws interesting insight on the industry and the lives of the workers.

But what exactly is gig economy, and who are gig workers?

Who Are Gig Workers?

A gig worker is an individual who is engaged in livelihoods outside of the traditional employer-employee arrangement, both in the formal as well as the informal sector. These workers can be broadly classified into platform and non-platform-based workers.

Platform workers are those whose work is based on online software apps or digital platforms, while non-platform gig workers are generally casual wage workers and own-account workers in the conventional sectors, working part-time or full time.

What Is A Gig Economy?

The rapidly burgeoning economy is bringing forth a new economic revolution, globally. The gig economy includes self-employed individuals, freelancers, on-call workers, and other temporary employees.

After the covid-19 outbreak, the gig economy continued to create millions of employment and maintain community connections.

For the survey, Karma Life collaborated with LEAD, KREA University.

The report classified gig workers into three categories. They are:

1. Constrained Earner: Primary earners who support their families and choose gig work as the only resort.

2. Millennial Spender: Young dependents with no-to-low family obligations for whom gig work is a means to earn extra cash.

3. Ambitious Achiever: Ambitious financial planners who earn with other household members and tend to see gig work as a stepping stone to bigger opportunities.

Is A Gig Worker The Primary Earner In The Household?

The survey revealed that 61 per cent gig workers are not the primary earners of their families. “But 71 per cent constrained earners are primary earners,” the report mentioned.

Notably, the average earnings of gig workers is Rs. 18,000. The mean monthly household income reported is Rs. 40,000. On average, the ratio of a gig worker’s income to the total household income is 0.61.

What Do Gig Workers Spend On?

On the expenditure side, it was found that most gig workers reported a hand-to-mouth existence. A significant portion of their salary was spent on essential expenses, such as rent, education, household and medical expenses. Rent, education and household expenses were the recurring expenses, whereas medical fell under non-recurring expenses.

The gig workers also spent a portion of their earnings on work-related expenses. Expenses on fuel and mobile recharge were recurring ones, while vehicle repair came under non-recurring expenses. Fuel expense prevalence was lower than expected, because several delivery platforms and e-commerce sites provided fuel allowances.

Other than these expenses, gig workers also spent some amount on entertainment, personal travel, and clothes and grooming.

When asked whether they lived in rented houses or own housing, 62 per cent gig workers mentioned having their own houses, 36 per cent workers lived in rented places, and 2 per cent were living with friends and family. A median amount, Rs. 3,000 (20 per cent), was regularly sent home.

Surplus Or Deficit?

Gig workers across segments reported a mix of deficits and surpluses in any given month, indicating they could benefit from access to flexible liquidity, as well as liquid savings solutions.

Over 15 per cent of gig workers faced a financial deficit of Rs 5,000 on average.

Over 32 per cent constrained earners faced a deficit of Rs 5,750.

Over 14 per cent millennial spenders faced a deficit of Rs 4,400.

Over 10 per cent ambitious achievers faced a deficit of Rs 4,800 deficit.

Says Rohit Rathi, co-founder and CEO, KarmaLife: “The survey asked questions about finance/income in almost real-time (hence no annual average). Thus, this could be due to financial volatility, too; some months they have more, some months less. Our study shows that there is a relationship between gig worker’s financial behaviour and them having positive or negative income surplus. Workers who save regularly or never save have less negative surplus compared to workers who aspire to save, but never could. Workers who never save might use that money to meet expenses, and hence, less negative surplus. Similarly, workers who maintain a budget and track their expenses have less negative surplus compared to workers who don’t budget their expenses.”

Are Gig Workers Good Money Managers?

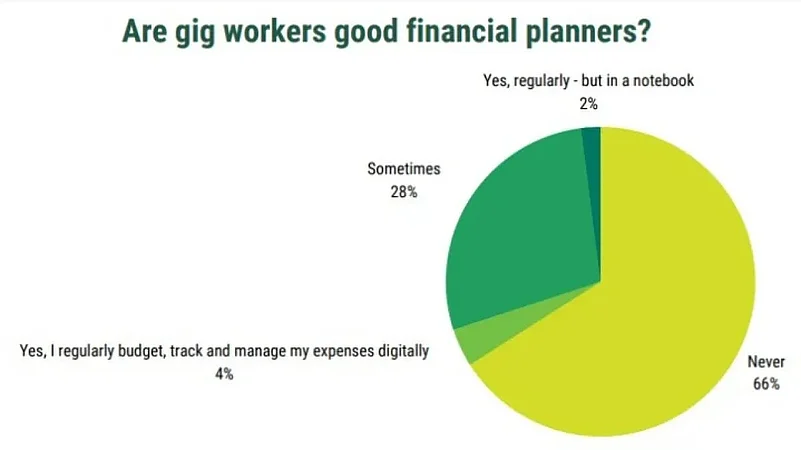

Based on the survey, 66 per cent workers were found to have never managed their finances. About 28 per cent workers said that they sometimes managed their finances, and only 6 per cent gig workers tracked their finances either digitally or in notebooks.

Two-thirds of the gig workers never tracked their expenses. There is an opportunity to improve financial literacy and education, the survey revealed.

Notably, only 18 per cent of the gig workers had credit card facilities. Around 55 per cent of them used it every few months. About 51.1 per cent gig workers always wanted to have a credit card, but never applied for one, while 34.4 per cent workers stated that they never found a need for having a credit card, while the rest mentioned that they were declined by the credit card company.

Do Gig Workers Save?

According to the survey, only a quarter were able to save, while two-thirds didn’t even try. A significant percentage of gig workers, 66.2 per cent, said that they didn’t save money, while 25.6 per cent of workers disclosed that they saved regularly, and 8.2 per cent workers still aspired to save money one day.

“Overall, gig workers in the sample report have poor financial management, as reflected by 66 per cent who don’t maintain any record or track their expenses. Hence, lack of planning is one key factor. There are also key differences among life stages. Constrained earners are generally older and take on gig work as almost a last resort, as they have high family responsibilities and several pressing financial obligations. Among the younger gig workers, a portion use this as pocket money/supplemental income, and hence it finances their consumption needs, and so they have no savings. There are also among the younger gig workers who have some family responsibility, but are more ambitious, and they tend to have a higher proportion towards saving,” adds Rathi.

Category-wise, the survey revealed that 31 per cent ambitious achievers reported saving every month, 23 per cent constrained earners aspired to save, but were unable to do so, and 73 per cent millennial spenders never saved money.

The top factors for their savings were children’s education, money for an emergency fund, wishing to start their own business, buying aspirational goods, or towards retirement, the survey added.