The government has extended the time for non-residents (NRs) to file Form 10F online, which offers benefits under the Double Taxation Avoidance Agreement (DTAA), until March 2023.

NRs require an income tax account to submit Form 10F digitally. Those without a permanent account number (PAN) or who don’t need one may find it hard to open an income tax account.

Considering these hurdles, the Central Board of Direct Taxes (CBDT) has given more time to NRs for submitting Form 10F, mandatory to claim benefits under DTAA.

Until CBDT finds a way for NRs to file Form 10F electronically without a PAN or Income Tax account, the old way of submitting a physical form will continue, say experts.

The Income Tax Act of 1961 allows NR taxpayers to file for tax benefits. However, they must submit a Tax Residency Certificate (TRC) and Form 10F to avail of DTAA benefits.

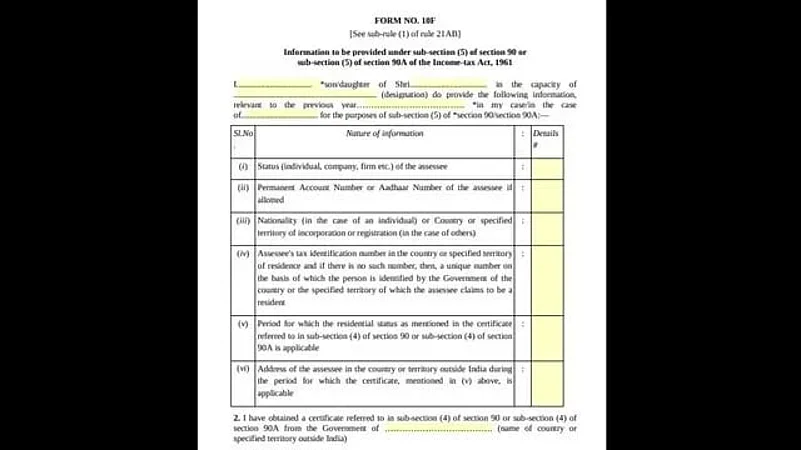

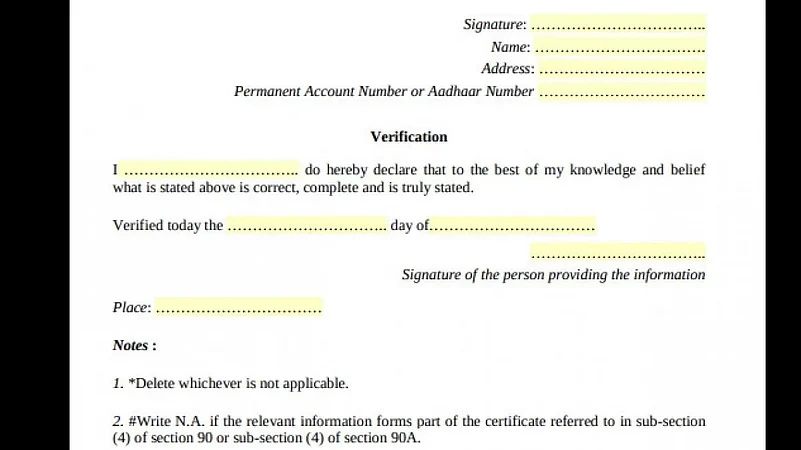

Amarpal Chadha, tax partner and India mobility leader at EY, said they must furnish Form 10F, mentioning their name, address, status, nationality, tax identification number in the foreign country, TRC validity, others., in case TRC is not in a prescribed format.

What Is Form 10F?

According to sub-section 4 and sub-section 5 of section 90 of the Income Tax Act, a non-resident (NR) taxpayer must submit Form 10F, TRC, and other information if they wish to claim DTAA benefits which India and the country where they reside entered into.

The IT department usually asks for six pieces of information from an NR in form 10F. But CBDT, in a circular on July 16, 2022, mandated some forms, including 10F, to be filed electronically on the income tax portal.

Abhishek Y. Bhavsar, an Ahmedabad-based chartered accountant, said it created a lot of difficulties for NRIs. “For e-filing of any form online, the filer must possess a permanent account number. So it was difficult for NRs as they do not have any taxable income in India,” Bhavsar added.

Chadha said that in the absence of a digital facility for filling Form 10F, NRs could not avail of the Treaty benefits. Earlier (before July 2022 circular), NRI taxpayers used to file 10F in a physical form.

However, TRC and form 10F are not required for filing tax returns. Instead, they will need to produce it when the tax authority requests to see one during a tax audit or during a scrutiny.

Mihir Tanna, associate director, SK Patodia and Associates, a Mumbai-based CA firm, said that earlier, to avail the benefit of tax treaty, form 10F was signed physically by the non-resident (NR) payees and furnished along with the Tax Residency Certificate (TRC) to the Indian Resident payers at the time of remittance of money so that withholding of tax can be done properly in a complied manner.

What Does The Notification Mean For NRs?

Gaurav Makhijani, a chartered account and senior tax advisor at Roedl & Partner, a Pune-based audit firm, said NRs faced additional compliance burden for e-filing Form 10F. They must obtain a PAN card in India and a digital signature certificate (DSC), which has to be renewed periodically.

With this partial relief, NRI taxpayers who do not have a PAN card can still use the physical method of filing Form 10F.

According to Makhijani, "Substantiating that a non-resident taxpayer who does not have a PAN card and the one that doesn't require to obtain one in India for "claiming this relaxation could again be complex."

Bhavsar said, "to mitigate the hardship permanently post-March 31, 2023, non-resident taxpayers should be allowed to furnish the form electronically using their Tax Identification Number (TIN) issued by concerned overseas tax authorities."

According to Mudit Vijayvergiya, founder of SBNRI, a Haryana-based NRI-focussed financial services company, "A better approach could be to shift the responsibility of filing form 10F on the resident payer. It helps to ensure that all data is collected digitally without creating an unnecessary compliance burden on the NRI community."

According to Tanna, "With the relaxation of submitting Form 10F electronically till March 31, 2023, certain commercial transactions with non-residents will be carried out without any additional compliance burden on Non Resident (NR) Payees. However, it is important to note that relaxation is only for those non-residents who are not required to obtain PAN in India."

So, until the CBDT figures out a way to get NRs to file Form 10F electronically without a PAN or Income Tax account, the old physical form submission process will be the way to go.