Indian taxpayers were expecting some big bang measures in Budget 2024-25 that would reduce their tax outgo, and Union Minister of Finance Nirmala Sitharaman did not disappoint them, when she announced the revised tax structure under the new tax regime.

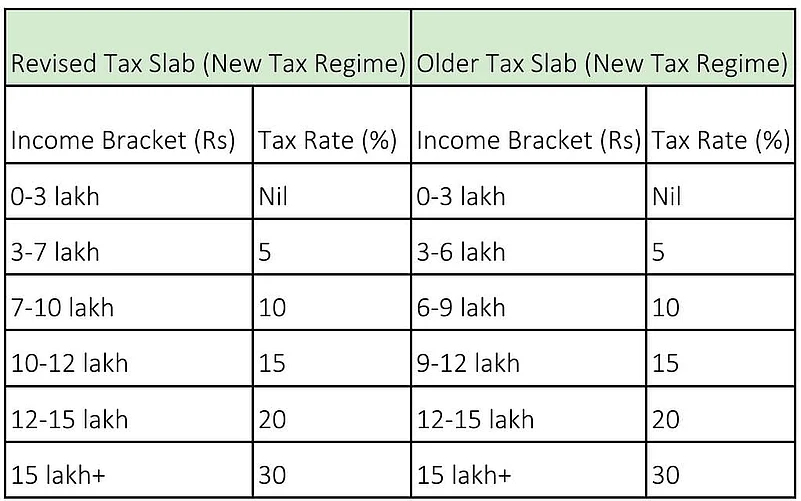

Here is how the tax slabs have changed.

Comparison Of Tax Slabs (2024-25 vs. 2023-24)

The new tax regime was introduced in Budget 2020, but even though it brought in a simplified tax regime, major tax deductions under sections 80C and 80D were not available. Hence, it did not find many takers.

Says Naveen Wadhwa, vice president, research and advisory, Taxmann, a tax and corporate law firm: “In the past couple of years, we have seen the government’s evident efforts in promoting the new default tax regime by offering attractive benefits, such as favourable slab rates, and Standard Deduction for salaried employees.”

With Budget amendments, the Standard Deduction limit has been increased to Rs 75,000 for employees who choose to remain in the new tax regime under Section 115BAC. On the other hand, salaried employees who opt to pay tax as per the old regime will get the Standard Deduction of Rs 50,000.

“With the changes in slab rates and the increased standard deduction, a salaried employee in the new tax regime can save up to Rs 17,500 in income tax,” says Wadhwa.

The old tax regime thus remains unchanged, aligning with expectations,0 since the new tax regime was made the default last year. Now, if you need to specifically opt for the old tax regime in case you want to choose it.

Says Abhishek Soni, CEO, Tax2Win, an income tax portal: “These reforms aim to simplify and streamline taxation, making it more appealing to the younger generation, while broadening the taxpayer base.”

However, it needs to be noted that some of the other Budget expectations like increasing the limit of Section 80C deductions under the old tax regime were not met, confirming the fact that the government wants more and more taxpayers to opt for the new tax regime.